FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

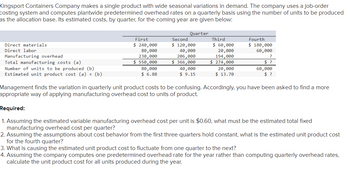

Transcribed Image Text:Kingsport Containers Company makes a single product with wide seasonal variations in demand. The company uses a job-order

costing system and computes plantwide predetermined overhead rates on a quarterly basis using the number of units to be produced

as the allocation base. Its estimated costs, by quarter, for the coming year are given below:

Direct materials

Direct labor

Manufacturing overhead

Total manufacturing costs (a)

Number of units to be produced (b)

Estimated unit product cost (a) (b)

First

$ 240,000

80,000

230,000

$ 550,000

80,000

$6.88

Quarter

Second

$ 120,000

40,000

206,000

$366,000

40,000

$ 9.15

Third

$ 60,000

20,000

194,000

$274,000

20,000

$ 13.70

Fourth

$ 180,000

60,000

?

$ ?

60,000

$ ?

Management finds the variation in quarterly unit product costs to be confusing. Accordingly, you have been asked to find a more

appropriate way of applying manufacturing overhead cost to units of product.

Required:

1. Assuming the estimated variable manufacturing overhead cost per unit is $0.60, what must be the estimated total fixed

manufacturing overhead cost per quarter?

2. Assuming the assumptions about cost behavior from the first three quarters hold constant, what is the estimated unit product cost

for the fourth quarter?

3. What is causing the estimated unit product cost to fluctuate from one quarter to the next?

4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates,

calculate the unit product cost for all units produced during the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Academy allocates support dept costs to production departments befoe establishing predetermined overhead rates for use in product costing. Assembly uses machine hours as a base and expects to use 90,000 MH this year. Testing uses direct labor hours and expects to use 160,000 DLH this year. Academy allocates support dept. costs to Assembly and Testing before their pre-determined rate. Support costs are allocated to productive depts. based on time of service while IT costs are allocated based on IT hours. Dept EngSupport IT Assembly Testing Total Dept Overhead $ 2,000,000 $ 1,000,000 $ 3,000,000 $ 2,000,000 $ 8,000,000 Time of Service 40 50 700 450 1,240 IT Hours 1,000 2,000 9,000 11,000 23,000 A. Complete a cost allocation table using the step method.…arrow_forwardLehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $25 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehighton's first two years of operation is as follows: Sales (in units) Production (in units) Production costs: Variable manufacturing costs Fixed manufacturing overhead Selling and administrative costs: Variable Fixed Based on absorption costing Finished-goods inventory Retained earnings Year 1 2,600 3,100 $15,500 18,600 Based on variable costing Finished-goods inventory Retained earnings LEHIGHTON CHALK COMPANY Selected Balance Sheet Information End of Year 1 10,400 9,400 $ 5,500 11,100 Selected information…arrow_forwardKoontz Company manufactures two models of industrial components-a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars): Basic Advanced Total Number of units produced and sold 20,000 10,000 30,000 $ 5,000,000 3,650,000 1,350,000 1,200,000 $3,000,000 $2,000,000 1,350,000 650,000 480,000 Sales Cost of goods sold Gross margin Selling and administrative expenses 2,300,000 700,000 720,000 (20,000) Net operating income (loss) $4 $4 170,000 150,000 Direct laborers are paid $20 per hour. Direct materials cost $40 per unit for the Basic model and $60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental…arrow_forward

- Greenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 7. Which of the four activities is a batch-level activity? multiple choice Machining activity General…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 Required: 1. What is the company’s plantwide overhead rate? (Round your answer to 2 decimal places.) PLEASE ROUND TO…arrow_forwardKingsport Containers Company makes a single product that is subject to wide seasonal variations in demand. The company uses a job-order costing system and computes plantwide predetermined overhead rates on a quarterly basis using the number of units to be produced as the allocation base. Its estimated costs, by quarter, for the coming year are given below: Quarter First Second Third Fourth Direct materials $ 200,000 $ 100,000 $ 50,000 $ 150,000 Direct labor 120,000 60,000 30,000 90,000 Manufacturing overhead 240,000 216,000 204,000 ? Total manufacturing costs (a) $ 560,000 $ 376,000 $ 284,000 $ ? Number of units to be produced (b) 120,000 60,000 30,000 90,000 Estimated unit product cost (a) ÷ (b) $ 4.67 $ 6.27 $ 9.47 $ ? Management finds the variation in quarterly unit product costs to be confusing. It has been suggested that the problem lies with manufacturing overhead because it is the largest element of total manufacturing cost. Accordingly, you have…arrow_forward

- Greenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 231,000 11,000 MHs Machine setups Number of setups $ 180,000 300 setups Production design Number of products $ 94,000 2 products General factory Direct labor-hours $ 260,000 10,000 DLHs Activity Measure Product Y Product Z Machining 9,000 2,000 Number of setups 60 240 Number of products 1 1 Direct labor-hours 9,000 1,000 5. What is the activity rate for the Product Design activity cost pool?arrow_forwardDelph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forwardRardin Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Direct materials 7.4 ounces Direct labor 0.3 hours Variable overhead 0.3 hours The company reported the following results concerning this product in July. Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost y applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. Required: a. Compute the materials quantity variance. Do not indicate whether Favorabled or Unfavorable. $8.00 per ounce $16.00 per hour $7.00 per hour 2,200 units 16,420 ounces 17,900 ounces 720 hours $141,410 $12,528 $5,112 T h m a narrow_forward

- Feldpausch Corporation has provided the following data from its activity-based costing system: Activity Cost Pool Total Cost Total Activity Assembly $ 1,398,250 65,800 machine-hours Processing orders $ 69,451 2,520 orders Inspection $ 184,800 2,400 inspection-hours The company makes 920 units of product W26B a year, requiring a total of 1,290 machine-hours, 61 orders, and 40 inspection-hours per year. The product's direct materials cost is $57.55 per unit and its direct labor cost is $13.56 per unit. The product sells for $123.50 per unit. According to the activity-based costing system, the product margin for product W26B is: (Round your intermediate calculations and final answers to 2 decimal places.)arrow_forwardAngle Max Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Multiple Choice Assume that the Assembly Department allocates overhead using a plantwide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 2 direct labor hour and 3.30 machine hours in the Assembly Department, and 4.50 direct labor hours and 0.4 machine hours in the Finishing Department? O$17.60. Assembly 180,000 DLH 380,000 MH $380,000 $20.40. Finishing 148,000 DLH 91, 200 MH $562, 400arrow_forwardRardin Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Direct materials 7.4 ounces Direct labor 0.3 hours Variable overhead 0.3 hours The company reported the following results concerning this product in July. Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. Required: b. Compute the materials price variance. Do not indicate whether Favorable or Unfavorable. $8.00 per ounce $16.00 per hour $7.00 per hour 2,200 units 16,420 ounces 17,900 ounces 720 hours $141,410 $12,528 $5,112arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education