FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

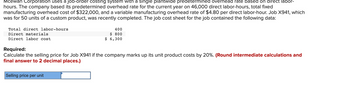

Transcribed Image Text:Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-

hours. The company based its predetermined overhead rate for the current year on 46,000 direct labor-hours, total fixed

manufacturing overhead cost of $322,000, and a variable manufacturing overhead rate of $4.80 per direct labor-hour. Job X941, which

was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Total direct labor-hours

Direct materials

Direct labor cost

400

$ 800

$ 6,300

Required:

Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and

final answer to 2 decimal places.)

Selling price per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information pertains to this job: Direct materials Direct labor cost Machine-hours used $ 390 $ 240 34 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 60 units, what is its unit product cost? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it establish for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the plantwide predetermined overhead rate.…arrow_forwardPlease help me solve the total manufacturing cost for Job D-70 & Job C-200arrow_forwardLupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours 30,000 $ 252,000 $ 2.10 Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job T687 was completed with the following characteristics: Number of units in the job 10 Total machine-hours 30 $ 675 $ 1,050 Direct materials Direct labor cost The of overhead applied to Job T687 is closest to: your intermediate calculations decimal places.) Multiple Choice $315 $252 $378 $63arrow_forward

- Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed: Number of units in the job Total machine-hours Direct materials Direct labor cost 20 80 $ 500 $ 2,160 If the company marks up its unit product costs by 40% then the selling price for a unit in Job A496 is closest to: Note: Round your intermediate calculations to 2 decimal places.arrow_forwardThe Oliver Company manufactures products in two departments: Mixing and Packaging. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $748,000, and estimated direct labor hours are 340,000. In October, the company incurred 30,000 direct labor hours. Read the requirements. Requirement 1. Compute the predetermined overhead allocation rate. Round to two decimal places. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate. (Abbreviation used; qty = Requirement 2. Determine the amount of overhead allocated in October. Predetermined OH allocation rate Begin by selecting the formula to allocate overhead costs. (Abbreviation used; qty = quantity.) Allocated mfg. = overhead costs The overhead allocated in October is quantity.)arrow_forwardGarza Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department’s predetermined overhead rate is based on machine-hours and the Customizing Department’s predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Casting Customizing Machine-hours 23,000 15,000 Direct labor-hours 7,000 7,000 Total fixed manufacturing overhead cost $ 82,800 $ 30,100 Variable manufacturing overhead per machine-hour $ 1.40 Variable manufacturing overhead per direct labor-hour $ 4.70 The estimated total manufacturing overhead for the Customizing Department is closest to:arrow_forward

- Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to estimate that it would incur $4,354,800 in manufacturing overhead cost at an activity level of 573,000 machine-hours. The company spent the entire month of January working on a large order for 12,600 custom-made machined parts. The company had no work in process at the beginning of January. Cost data relating to January follow: a. Raw materials purchased on account, $310,000. b. Raw materials used in production, $267.000 (80% direct materials and 20% indirect materials). c. Labor cost accrued in the factory, $177,000 (one-third direct labor and two-thirds indirect labor). d. Depreciation recorded on factory equipment, $63,600. e. Other manufacturing overhead costs incurred on account, $85,400 1. Manufacturing overhead cost was applied…arrow_forwardGitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). Its predetermined overhead rate was based on a cost formula that estimated $129,000 of manufacturing overhead for an estimated allocation base of $86,000 direct material dollars to be used in production. The company has provided the following data for the just completed year: Purchase of raw materials $ 140,000 Direct labor cost $ 82,000 Manufacturing overhead costs: Indirect labor $ 148,100 Property taxes $ 8,600 Depreciation of equipment $ 18,000 Maintenance $ 12,000 Insurance $ 7,700 Rent, building $ 38,000 Beginning Ending Raw Materials $ 22,000 $ 10,000 Work in Process $ 47,000 $ 36,000 Finished Goods $ 70,000 $ 60,000 Required: 1. Compute the predetermined overhead rate for the year. 2. Compute the amount of underapplied or overapplied…arrow_forwardXYZ has two production departments, Forming and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Forming Finishing Machine-hours 18,000 14,000 Direct labor-hours 2,000 8,000 Total fixed manufacturing overhead cost OMR 99,000 OMR 70,400 Variable manufacturing overhead per machine-hour OMR 2.10 Variable manufacturing overhead per direct labor-hour OMR 3.90 During the current month the company started and finished Job PS5. The following data were recorded for this job: Job PS5: Forming Finishing Machine-hours 90 20 Direct labor-hours 30 60 Direct materials OMR 940 OMR 350 Direct labor cost OMR 960 OMR 1920 The total job cost for Job PS5 is closest to: a. None…arrow_forward

- MNO Corporation uses a job-order costing system with a predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data: Total estimated direct labor-hours 50,000 Total estimated fixed manufacturing $285,000 overhead cost Estimated variable manufacturing overhead per direct labor-hour 3.80 $ Recently, Job P123 was completed with the following characteristics: Total actual direct labor-hours 20 $ 710 $ 500 Direct materials Direct labor cost The total job cost for Job P123 is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $1,210 $1,400 $690 $900arrow_forwardLupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job T687 was completed with the following characteristics: Number of units in the job Total machine-hours Direct materials Direct labor cost Multiple Choice If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: Note: Round your intermediate calculations to 2 decimal places. O O $113.60 $754.00 $397.60 10 30 $ 690 $ 1,370 $288.40 30,500 $ 610,000 $ 6.00arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education