Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

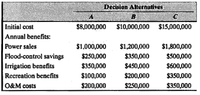

The federal government is planning a hydroelectric project for a river basin. In

addition to producing electric power, this project will provide flood control, irrigation, and recreational benefits. The estimated benefits and costs expected to be derived from the three alternatives under consideration are listed as follows:

The interest rate is 10%, and the life of each project is estimated to be 50 years.

(a) Find the benefit-cost ratio for each alternative.

(b) Select the best alternative, according to BC(i).

Transcribed Image Text:Decision Alternatives

B

Initial cost

$8,000,000 $10,000,000 $15,000,000

Annual benefits:

Power sales

$1,000,000

$1,200,000

$1,800,000

Flood-control savings

Irrigation benefits

Recreation benefits

O&M costs

$250,000

$350,000

$500,000

$350,000

$450,000

$600,000

$100,000

$200,000

$350,000

$200,000

$250,000

$350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forward1arrow_forwardAn electronic circuit board manufacturer is considering six mutually exclusive cost-reduction projects for its PC-board manufacturing plant. All have lives of 10 years and zero salvage value. The required investment, the estimated after-tax reduction in annual disbursements, and the gross rate of return arc given for each alternative in the following table: llte rate of return on incremental investments is given for each project as follows: Which project would you select according to the rate of return on incremental investment if it is stated that the MARR is 15%?arrow_forward

- 3. Using both Payback and NPV results, which projects, if any, would yourecommend McGloire should fund? Justify your answer and include a criticalassessment of two nonfinancial qualitative factors that could affect the investmentarrow_forwardThe general city population is set to benefit in travel-time savings from a municipal road project amounting to $80,000. The local government will incur an initial spending of $2,500,000 and an operating and maintenance cost of $30,000 per year. This new road will reduce accidents, representing medical savings of $135,000. Consider a 15- year period and an interest rate of 5%. What is the modified benefit-cost ratio of this project?arrow_forwardA regional municipality is studying a water supply plan for its tri-city and surrounding area to the end of year 2070.To satisfy the water demand, one suggestion is to construct a pipeline from a major lake some distance away. Construction would start at the beginning of 2030 and take fivefive years at a cost of $15 million per year. The cost of maintenance and repairs starts after completion of construction and for the first year is $2 million, increasing by 1 percent per year thereafter. At an interest rate of 6 percent, what is the present worth of this project? Assume all cash flows take place at year-end. Consider the present to be the end of 2025/beginning of 2026. Assume there is no salvage value at the end of year 2070. The present worth of this project is how many million. (2 decimal places)arrow_forward

- Project A and Project B are independent projects. Investment life of Project A is 4 years and investment life of Project B is 17 years. Project A's NPV is $375 and Project B's NPV is $1,743. EANPV of project A is $102 and EANPV of project B is $96. Which of the following decision is correct? O a. Select both projects because both have positive NPVs. O b. Select Project A because it has a shorter investment life O c. Select Project B because it has a longer investment life Od. Select Project A because it has a higher EANPV O e. Select Project B because it has a higher NPVarrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forward

- The conventional B/C ratio for a flood control project along the Mississippi River was calculated to be 1.3. The benefits were $500,000 per year and the maintenance costs were $200,000 per year. What was the initial cost of the project if a discount rate of 7% per year was used and the project was assumed to have a 50-year life?arrow_forwardPlease make sure you have the right answer! I have asked this question too many times and all the answers were wrong!!!arrow_forwardThe Egyptian government is considering three projects to overcome the drought due to (sad EINahda) project. Project A is a dam. The dam will have irrigation and recreation benefits in addition to the water control benefits. Projects B and C consist of permanent dikes along the Nile River near Nagaa Hammadi. Data for these projects are shown in the following table. Using a MARR of 0.11 and considering the project life to be 30 years, use incremental annual worth benefit-cost analysis to choose the best project. Project A Project BProject C First Cost (millions of $) Annual Benefits (millions of $) 45.8 30.8 22 4.6 3.4 Annual Op, and Maint. Costs (millions of $) 0.4 0.2 0.2 Benefit to Cost Ratio AW(C) = Benefit to Cost Ratio AW(B) = Benefit to Cost Ratio AW(A) = Benefit to Cost Ratio AW(B-C) = Benefit to Cost Ratio AW(A-B) = Select 1 for Project A 2 for Project B 3 for Project Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education