Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

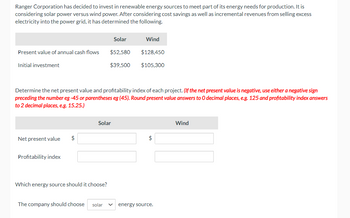

Transcribed Image Text:Ranger Corporation has decided to invest in renewable energy sources to meet part of its energy needs for production. It is

considering solar power versus wind power. After considering cost savings as well as incremental revenues from selling excess

electricity into the power grid, it has determined the following.

Present value of annual cash flows

Initial investment

Net present value $

Profitability index

Determine the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign

preceding the number eg -45 or parentheses eg (45). Round present value answers to O decimal places, e.g. 125 and profitability index answers

to 2 decimal places, e.g. 15.25.)

Solar

$52,580

$39,500

Solar

Which energy source should it choose?

The company should choose solar

Wind

$128,450

$105,300

$

energy source.

Wind

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Carmen, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, net present value, and profitability index for each of the projects are as follows: Project A Project B Project C Present value of future cash flows $450,100 $313,100 $405,000 Initial investment 200,000 155,000 190, еее Net present value $250, 100 $158,100 $215,000 Profitability index 2.25 2.02 2.13 In what order should Carmen prioritize investment in the projects? Multiple Cholce С, В, А O A, B, C А, С, В C, A, Barrow_forwardGalaxy Corp. has to choose between two mutually exclusive projects. If it chooses project A, Galaxy Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 11%? Project A Year 0: Year 1: Year 2: Year 3: O $15,077 O $21,538 $12,923 O $14,000 O $19,384 Cash Flow -$12,500 8,000 14,000 13,000 Project B Year 0: Year 1: Year 2: Year 3: Year 4: Year 5: Year 6: -$40,000 9,000 13,000 12,000 11,000 10,000 9,000arrow_forwardNet present values for three alternative Investment projects follow. (a) If the company accepts all positive net present value Investments, which of these projects will it accept? (b) If the company can choose only one project, which will it choose? Potential Projects Net present value Project A $1,400 Project B $(12,100) Project C $15,000 (a) If the company accepts all positive net present value investments, which of these projects will it accept? (b) If the company can choose only one project, which will it choose?arrow_forward

- Wavy Inc is examining a project that requires an initial investment of -10 million today. This will be followed by several years of positive incremental after-tax cash flows. However, during the last year of the project's life Wavy expects that the incremental cash flow will again be negative. By which method should Wavy determine whether or not to invest? A) Both NPV or IRR are fine, as they must arrive at same investment decision B) IRR, because there will be no NPV solution in this case C) Neither NPV or IRR are useful in this situation D) NPV, since this project will have two IRRsarrow_forward1. Calvulate the internal rate of return(IRR) of each project and based on this criterion. Indicate which project you would recommend or acceptance.arrow_forwardThe IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Cold Goose Metal Works Inc. is analyzing a project that requires an initial investment of $3,000,000. The project's expected cash flows are: Year Year 1 Cash Flow $375,000 Year 2 -175,000 Year 3 400,000 Year 4 450,000 Cold Goose Metal Works Inc.'s WACC is 7%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): O 14.83% O-19.30% O 20.07% 13.96% If Cold Goose Metal Works Inc.'s managers select projects based on the MIRR criterion, they should this independent project.arrow_forward

- Solve this onearrow_forward4arrow_forwardFord is evaluating a capital investment to convert it's current plant that produces Ford Focus to an electric Ford Ranger. Which of the following must Ford consider when evaluating this capital investment? All of the sales revenue from the new electric Ford Ranger will be included and accounted for when determining future cash flows for NPV analysis. Ford will include any sales revenue from the Ford Focus in its future cash flows of the capital investment project. Ford will need to deduct the current revenue from sales of the Focus when determining future cash flows of for the electric Ford Ranger project. Ford does not consider the Ford Focus revenue as the two projects are independent.arrow_forward

- TLT Ltd is considering the purchase of a new machine for use in its production process. Management has developed three alternative proposals to help evaluate the machine purchase. Only one of these proposals can be implemented. Proposals A and B both have the same cost to set up, but the output from proposal A (as measured by future net cash flows) commences at a high rate and then declines over time, while Proposal B starts at a low rate and then increases over time. Proposal C involves buying two of the machines considered under proposal B. That is, proposal C is simply Proposal B scaled by a factor of two. Proposal C results in net cash flows which are similar in magnitude to proposal A's net cash flows in the first two years. The estimated net cash flows, internal rates of return and net present values at 9% and 11% for each proposal are given in the following table. Proposal A -$290,000 $100,000 $90,000 Proposal B -$290,000 $40,000 $50,000 Proposal C -$580,000 $80,000 $100,000 End…arrow_forwardNewtown Corp. has to choose between two mutually exclusive projects. If it chooses project A, Newtown Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 12%? Cash Flow Project A Project B Year 0: –$15,000 Year 0: –$40,000 Year 1: 9,000 Year 1: 8,000 Year 2: 15,000 Year 2: 15,000 Year 3: 14,000 Year 3: 14,000 Year 4: 13,000 Year 5: 12,000 Year 6: 11,000 $13,512 $11,923 $15,897 $12,718 $10,333 Newtown Corp. is considering a five-year project that has a weighted average cost of capital of…arrow_forwardProblem #4: Capital Budgets Rambus Inc. would like to purchase a production machine for $325,000. The machine is expected to have a life of three years, and a salvage value of $50,000. Annual maintenance costs will total $12,500. Annual savings are predicted to be $112,500. The company's required rate of return is 12%. Factors: Present Value of $1 (r = 12%) Year 0 1.0000 Year 1 0.8929 Year 2 0.7972 Year 3 0.7118arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education