Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:(d)

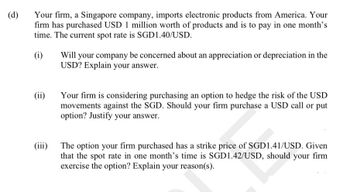

Your firm, a Singapore company, imports electronic products from America. Your

firm has purchased USD 1 million worth of products and is to pay in one month's

time. The current spot rate is SGD1.40/USD.

(i)

(ii)

(iii)

Will your company be concerned about an appreciation or depreciation in the

USD? Explain your answer.

Your firm is considering purchasing an option to hedge the risk of the USD

movements against the SGD. Should your firm purchase a USD call or put

option? Justify your answer.

The option your firm purchased has a strike price of SGD1.41/USD. Given

that the spot rate in one month's time is SGD1.42/USD, should your firm

exercise the option? Explain your reason(s).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PLEASE ANSWER FULLY AND CORRECTLY: DO NOT GIVE ME THE WRONG ANSWER Suppose a U.S. investor wishes to invest in a British firm currently selling for £40 per share. The investor has $10,000 to invest, and the current exchange rate is $2 per £. Consider three possible prices per share at £35, £40, and £45 after 1 year. Also, consider three possible exchange rates at $1.80 per £, $2 per £, and $2.20 per £ after 1 year. Calculate the standard deviation of both the pound- and dollar-denominated rates of return if each of the nine outcomes (three possible prices per share in pounds times three possible exchange rates) is equally likely. Note: Do not round intermediate calculations. Round your percentage answers to 2 decimal places.arrow_forwardSuppose that you are a currency speculator, based in the U.S., att January 1st, the spot rate for the Canadian dollar is $0.68. This is have C$160,000.00 to use on these positions. Suppose that on February 10th, the Canadian dollar depreciates (a In order to purchase C$160,000.00 in spot market, you will need $107,200.00 alize on a possible depreciation of the Canadian dollar (C$). On t which futures contracts for Canadian dollars are being sold. You $139,360.00 $128,640.00 $150,080.00 d) to $0.67 in the spot market. (U.S. dollars) for the exchange.arrow_forwardIdentify what transaction risk management is done in the following cases: (A) ABC Corporation will only accept P200,000 or its equivalent on the payment date despite having a USD4,000 sale. (B) ABC Corporation pays a foreign-currency denominated purchase early when it sees that the Philippine peso will decrease in value.a. Invoicing in home currency; Leadingb. Forward contract; Leadingc. Invoicing in home currency; Laggingd. Forward contract; Laggingarrow_forward

- Cray Research sold a supercomputer to the Max Planck Institute in Germany on credit and invoiced €11.00 million payable in six months. Currently, the six-month forward exchange rate is $1.15 per euro and the foreign exchange adviser for Cray Research predicts that the spot rate is likely to be $1.10 per euro in six months. Required: a. What is the expected gain/loss from a forward hedge? Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions. b. If you were the financial manager of Cray Research, would you recommend hedging this euro receivable? c. Suppose the foreign exchange adviser predicts that the future spot rate will be the same as the forward exchange rate quoted today. Would you recommend hedging in this case? d. Suppose now that the future spot exchange rate is forecast to be $1.22 per euro. Would you recommend hedging? a. b. Would you recommend hedging this euro…arrow_forward10. Suppose that Baltimore Machinery sold a drilling machine to a Swiss firm and gave the Swiss client a choice of paying either $10,000 or SF 15,000 in three months. (a) In the above example, Baltimore Machinery effectively gave the Swiss client a free option to buy up to $10,000 dollars using Swiss franc. What is the 'implied' exercise exchange rate? (b) If the spot exchange rate turns out to be $0.62/SF, which currency do you think the Swiss client will choose to use for payment? What is the value of this free option for the Swiss client? (c) What is the best way for Baltimore Machinery to deal with the exchange exposure?arrow_forward(Transaction Exposure)Trident — A U.S.-based company, has concluded a sale of telecommunications equipment to Regency (U.K.). A total payment of £2,000,000 is due in 90 days. Given the following exchange rates and interest rates, the break-even investment rate (for money market hedge) is _________% when comparing the forward hedge and the money market hedge. Assumptions Value 90-day A/R in pounds £2,000,000.00 Spot rate, US$ per pound ($/£) $1.5610 90-day forward rate, US$ per pound ($/£) $1.544 3-month U.S. dollar investment rate 14.000% 3-month U.S. dollar borrowing rate 12.000% 3-month UK investment interest rate 7.500% 3-month UK borrowing interest rate 10.000% Put options on the British pound: Strike rates, US$/pound ($/£) Strike rate ($/£) $1.55 Put option premium 1.2% Strike rate ($/£) $1.54 Put option premium 1.1% Strike rate ($/£) $1.55 Call option premium 2.1%…arrow_forward

- (C) US Bank is considering investing in a three years' project in Europe country. The project would require an initial investment of $750,000 and it is expected to generate €80,000, €100,000 and €150,000 in year one until three, respectively. The business risk will be identical to the firm's existing line of business in the euro-zone, the required rate of return in the euro-zone is 18 percent. The exchange rate is $1.20/€ where the dollar also shows appreciating by one percent for every year. Determine the Net Present Value (NPV) in dollar currency for this project and justify.arrow_forwardUnion Corp must make a single payment of €5 million in six months at the maturity of a payable to a French firm. The finance manager expects the spot price of the € to remain stable at the current rate of $1.60/€. But as a precaution, the manager is concerned that the rate could rise as high as $1.70/€ or fall as low as $1.50/€. Because of this uncertainty, the manager recommends that Union Corp hedge the payment using either options or futures. Six months Call and Put options with an exercise price of $1.60/€ are available. The Call sells for $.08/€ and the Put sells for $.04/€. A six month futures contract on € is trading at $1.60/€. Should the manager be worried about the dollar depreciating or appreciating? If Union Corp decides to hedge using options, should it buy Calls or Puts to hedge the payment? Why? If futures are used to hedge, should the company buy or sell € futures? Why? What will be the net payment on the payable if an option contact was used? assume…arrow_forwardSuppose you are working for a company based in Ireland (where the euro is used). This company exports product to the UK, but invoices its prices in euros (instead of pounds). Suppose you believe the euro will appreciate versus the pound over the coming year. Would that impact the profitability of your company this year? If not, explain. If so, explain how (and the type of risk you’re facing.arrow_forward

- i need help with this problem i know the answer is 5.86 i just need help on how to do it step by steparrow_forward1-) Assume that a U.S. based investor began applying a carry trade strategy by borrowing in the U.S. and investing in Turkey, as of December 2023. The corresponding interest rates are 3% in the U.S. and 40% in Turkey. The current spot rate between TL and USD is 29.2TL per USD. The strategy will be in place for a year, hence will end in December 2024. Note that the investor is taking an exchange rate risk here. If he decides to hedge some of that exchange rate risk via selling Turkish lira forward, what is the price range for the contract that is acceptable for her/him? 2-) Assume that a U.S.-based investor began applying a carry trade strategy by borrowing in the U.S. and investing in Turkey as of December 2023. The corresponding interest rates are 3% in the U.S. and 40% in Turkey. The current spot rate between TL and USD is 29.2TL per USD. The strategy will be in place for a year and will end in November 2023. Note that the investor is taking an exchange rate risk here. To hedge some…arrow_forwardSelect each of the following strategies that can be used to hedge the foreign exchange risk of a British entity expecting to receive 1m INR in one year: Group of answer choices Borrowing GBP against the receivable, converting to INR, and investing the INR at Indian interest rates. Entering a long position in a forward contract on the INR. Entering a short position in a put on the INR. Entering a long position in a put on the INR. Borrowing INR against the receivable, converting to GBP, and investing the GBP at British interest rates. Entering a short position in a forward on the INR.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education