Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

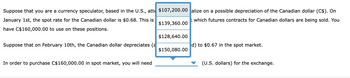

Transcribed Image Text:Suppose that you are a currency speculator, based in the U.S., att

January 1st, the spot rate for the Canadian dollar is $0.68. This is

have C$160,000.00 to use on these positions.

Suppose that on February 10th, the Canadian dollar depreciates (a

In order to purchase C$160,000.00 in spot market, you will need

$107,200.00 alize on a possible depreciation of the Canadian dollar (C$). On

t which futures contracts for Canadian dollars are being sold. You

$139,360.00

$128,640.00

$150,080.00

d) to $0.67 in the spot market.

(U.S. dollars) for the exchange.

Transcribed Image Text:Suppose that you are a currency speculator, based in the U.S., attempting to capitalize on a possible depreciation of the Canadian dollar (C$). On

January 1st, the spot rate for the Canadian dollar is $0.68. This is also the price at which futures contracts for Canadian dollars are being sold. You

have C$160,000.00 to use on these positions.

Suppose that on February 10th, the Canadian dollar depreciates (as you speculated) to $0.67 in the spot market.

In order to purchase C$160,000.00 in spot market, you will need

(U.S. dollars) for the exchange.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Use the following information for the next 2 questions. Assume that the U.S. one-year interest rate is 8% and the one-year interest rate on Australian dollars is 13%. The U.S. annual inflation is expected to be 5%, while the Australian annual inflation is expected to be 7%. The current spot exchange rate of an Australian dollar is $0.689. You have $100,000 to invest for one year. Question 4 (6.25 points) You believe that IFE holds. What will be the yield on your investment if you invest in the Australian market? (HINT: You believe that IFE holds, so the spot rate one year later is the rate obtained from IFE. Note that the interest rate given in the problem is the nominal rate.) 13.00% 8.00% 18.23% 7.16%arrow_forwardAssume that the Mexican peso currently trades at 11 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while Mexican inflation is expected to average 5%. What is the current value of one peso in terms of U.S. dollars? Given the relative inflation rates, what will the exchange rates be 1 year from now? Which currency is expected to appreciate and which currency is expected to depreciate over the next year? The current value of one Mexican peso in terms of U.S. dollars, USS, is US$/MP. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one U.S. dollar in terms of Mexican pesos, MP, one year from now will be MP/US$. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one Mexican peso in terms of U.S. dollars, US$, one year from now will be US$ /MP. (Round to six decimal places.) ▼is expected to appreciate, while the is expected to depreciate over the next year. (Select from the…arrow_forwardRequired: Suppose you conduct currency carry trade by borrowing $1 million at the start of each year and investing in the New Zealand dollar for one year. One-year interest rates and the exchange rate between the U.S. dollar ($) and New Zealand dollar (NZ$) are provided below for the period 2000 - 2009. Note that interest rates are one-year interbank rates on January 1st each year, and that the exchange rate is the amount of New Zealand dollar per U.S. dollar on December 31 each year. The exchange rate was NZ$1.9108 per $ on January 1, 2000. Fill out columns (4) - (7) and compute the total dollar profits from this carry trade over the ten-year period. Also, assess the validity of uncovered interest rate parity based on your solution of this problem. You are encouraged to use the Excel spreadsheet software to tackle this problem. Note: Negative value should be entered with a minus sign. Enter profit value answers in dollars, rather than in millions of dollars. Do not round intermediate…arrow_forward

- Suppose you own a portfolio of British securities valued at $430,000. The exchange rate is currently at $1= £0.57. A currency futures contract on British pounds is set at 62,500 pounds. a. How many contracts must you purchase to protect your portfolio from exchange rate risk? b. Suppose 1 month after you purchase the contracts, the exchange rate changes to $1 = £0.59. What is your profit/loss in USD?arrow_forwardSuppose that the U.S. firm Halliburton buys construction equipment from the Japanese firm Komatsu at a price of ¥300 million. The equipment is to be delivered to the United States and paid for in one year. The current exchange rate is ¥100 = $1. The current interest rate on one-year U.S. Treasury bills is 6%, and on one-year Japanese government bonds the interest rate is 4%. a. If Halliburton exchanges dollars for yen today and invests the yen in Japan for one year, it will need $ to exchange today in order to have ¥300 million in one year. (Round your response to the nearest dollar)arrow_forwardSuppose you are a U.S. investor who is planning to invest $805,000 in Mexico. Your Mexican investment gains 10.2 percent. If the exchange rate moves from 12.4 pesos per dollar to 12.7 pesos per dollar over the period, what is your total return on this investment? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Total return 4arrow_forward

- Suppose a U.S. investor wishes to invest in a British firm currently selling for £64 per share. The investor has $12,800 to invest, and the current exchange rate is $2/£.Suppose now the investor also sells forward £6,400 at a forward exchange rate of $1.90/£. Required:a. Calculate the dollar-denominated returns for each scenario. (Round your percentage answers to 2 decimal places. Negative amounts should be indicated by a minus sign.)arrow_forwardSuppose that California Co., a U.S. based MNC, seeks to capitalize a difference in interest rates between euros and British pounds via the use of a carry trade. In particular, after 1 month, funds invested in euros will yield a 0.50% percent return, while funds invested in pounds will yield a return of 2.00% percent. Currently the spot rate of the British pound is $1.00 while the spot rate of the euro is $0.80. In other words, the pound is worth 1.25 euros. California Co. expects these spot rates to remain constant over the next month. If California Co. takes $200,000 of its own funds and converts them to pounds it would have 600,000 euros and converts them to pounds, it will have pounds. pounds. If California Co. borrowsarrow_forwardA U.S. firm, sells merchandise today to a British company for £100,000. The current exchange rate is $1.38/£, the account is payable in three months, and the firm chooses to hedge by borrowing £98,765.43 today and exchanging the proceeds today for dollars; the loan will be paid back with the £100,000 accounts receivable (money market hedge). If Husky converted the borrowed pounds into dollars today and invested that amount at its WACC of 6% (1.5% for 90 days), how much much money in U.S. dollars will Husky Sporting Goods Company have in 90 days?arrow_forward

- Samuel Samosir works for Peregrine Investments in Jakarta, Indonesia. He focuses his time and attention on the U.S. dollar/Singapore dollar ($/S$) cross-rate. The current spot rate is $1.39/S$. After considerable study, he has concluded that the Singapore dollar will depreciate versus the U.S. dollar in the coming 90 days, probably to about $1.35/S$. He is considering trading options to profit and has the following options on the Singapore dollar to choose from: Option choices on the Singapore dollar: Strike price (US$/Singapore dollar) Premium (US$/Singapore dollar) Call on S$ $1.34 $0.075 Put on S$ $1.37 $0.006 Samuel decides to sell call options in Singapore dollars. What is Samuel's (net) profit/loss (in dollars) per option if the spot rate is $1.56/S$ at maturity?arrow_forwardNikularrow_forwardSuppose that you are a finance manager at a U.S. based MNC. On January 1st, you anticipate you will need to purchase C$170,000.00 (Canadian dollars) worth of supplies from a Canadian supplier in March using Canadian dollars (C$). The current spot rate for the Canadian dollar is $0.73. In order to lock in spot rate for this exchange, you purchase a futures contract specifying C$170,000.00 at $0.73 per Canadian dollar with a March 10th settlement date. On the settlement date, your MNC will need to pay (U.S. dollars) for the C$170,000.00.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education