FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the optimal conversion size for cash?

a. 41,335

b. 58,457

c. 60,000

d. 82,670

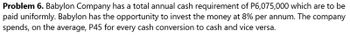

Transcribed Image Text:Problem 6. Babylon Company has a total annual cash requirement of P6,075,000 which are to be

paid uniformly. Babylon has the opportunity to invest the money at 8% per annum. The company

spends, on the average, P45 for every cash conversion to cash and vice versa.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following is not a factor in explaining why the present value of a future dollar is less than one dollar?A. InterestB. Inflation C. Risk of failure to receive expected cash inflows D. Historic costarrow_forwardChoose the correct option from the following: NPV = PV of cash outflow – PV of cash inflow NPV = PV of cash outflow + PV of cash inflow NPV = PV of cash inflow - PV of cash outflow NPV = PV of cash outflow / PV of cash inflow unanswered SaveSave your answer Submit You have used 0 of 1 attearrow_forward23. Which of the following would be included as a cash disbursement on a cash budget? A. Fixed asset purchases B. Depreciation C. Borrowings from a bank D. Both A & C 12arrow_forward

- What is the $/€ spread of 1.33 35/ 45 worth on €5 million? A. €5000 B.$5000 C. €50,000 D. $50,000 Please show Mathematical calculations and currency symbol calculations to get the answer of $5000arrow_forwardIn Question 3, assume that GDP=$12, C=$3, G=$2, M–X=$1, R=6%, INF=12%. Calculate the capital investment spending (I). A. I=$5. B. I=$8. C. I=-$3. D. I=$4.arrow_forwardWhat is temporary cash surplus and what should be done with it?arrow_forward

- Suppose S(NZD/USD) = 1.5000 and S(MYR/USD) = 4.4000. What is the cross rate S(MYR/NZD)? Choose the closest answer to your own calculations. a. 2.9333 b. 0.3409 c. 6.6000 d. 0.1515arrow_forwardH5. Show proper step by step calculationarrow_forwardWhich of the following will shorten the cash cycle? Select one: A. An increase in the raw materials inventory holding period B. An increase in the production period C. An increase in the trade receivables days D. An increase in the trade payables daysarrow_forward

- e Mon] 2.3 The Time Value of Money Which of the following variables are required to compute the future value of a lump sum? O I, N, FV O PMT, FV, I PMT, FV, N O I, N, PV Save for Later JAN ottvarrow_forwardQuestion 12 Which of the following methods does not adjust for the time value of money: A internal rate of return B net present value C profitability index D payback periodarrow_forwardWhich of the following has the most favorable cash conversion cycle? a. DSO 28, DOH = 32, DPO = 38. = = b. DSO 30, DOH = 45, DPO = 10. c. DSO 64, DOH = 48, DPO = 24. = d. DSO = 45, DOH = 22, DPO = 12.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education