Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

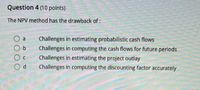

Transcribed Image Text:Question 4 (10 points)

The NPV method has the drawback of:

Challenges in estimating probabilistic cash flows

Challenges in computing the cash flows for future periods

Challenges in estimating the project outlay

Challenges in computing the discounting factor accurately

O000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose an investment has conventional cash flows with positive NPV. how would it impact your decision based on capital budgeting techniques mentioned below? 1.profitability index 2.internal rate of return 3.payback periodarrow_forward3. In a comparison of the NPV and IRR techniques, which of the following is true? statements A. Both methods give the same accept or reject decision, regardless of the pattern of the cash flows. B. IRR is technically superior to NPV and easier to calculate. C. The NPV approach is superior if discount rates are expected to vary over the life of the project. D. NPV and accounting ROCE can be confused.arrow_forwardsolve these 2 pratice problemsarrow_forward

- 6 An advantage of the net present value method over the internal rate of return model in discounted cash flow analysis is that the net present value method Group of answer choices Uses discounted cash flows whereas the internal rate of return model does not Computes a desired rate of return for capital projects Can be used when there is no constant rate of return required for each year of the project Uses a discount rate that equates the discounted cash inflows with the outflowsarrow_forwardQUESTION #1: Which of the following is a disadvantage of using the IRR method of capital budgeting over other types: A- IRR does not consider the time and value of money. B- IRR assumes reinvestment of project cash flows at the same rate as the IRR C- IRR ignores the prudent simplicity of paybacks D- None of the above QUESTION #2: The net present value (NPV) of an investment is___________. A- The present value of all benefits (cash inflows) B- The present value of all costs (cash outflows) of the project C- The present value of all benefits (cash inflows) minus the present value of all costs (cash outflows) of the project D- The present value of all benefits (cash outflows) minus the present value of all costs (cash inflows) of the projectarrow_forwardbe appropriate? Explain. 8.4 Average Accounting Return Concerning AAR: LO 2 Describe how the average accounting return is usually calculated and describe the information this measure provides about a sequence of cash flows. What is the AAR criterion decision rule? a. b. What are the problems associated with using the AAR as a means of evaluating a project's cash flows? What underlying feature of AAR is most troubling to you from a financial perspective? Does the AAR have any redeeming qualities?arrow_forward

- Which figure of merit provides an interest rate at which the present value of the future cash flows equals the amount invested? a) NPV b) IRR c) Cap Rate d) DCF Please ensure accuracy and explain your choicearrow_forwardModified internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project’s IRR. Consider the following situation: Green Caterpillar Garden Supplies Inc. is analyzing a project that requires an initial investment of $2,225,000. The project’s expected cash flows are: Year Cash Flow Year 1 $350,000 Year 2 –125,000 Year 3 450,000 Year 4 450,000 Green Caterpillar Garden Supplies Inc.’s WACC is 7%, and the project has the same risk as the firm’s average project. Calculate this project’s modified internal rate of return (MIRR): -12.63% 26.46% 30.64% 29.24% If Green Caterpillar Garden Supplies Inc.’s managers select projects based on the MIRR criterion,…arrow_forward2. Match each of the following terms with the appropriate definition. The time expected to recover the cash initially invested in a project. A minimum acceptable rate of return on a potential investment. 1. Discounting A return on investment which results in a zero net present value. 2. Net Present Value A comparison of the cost of 3. Capital Budgeting an investment to its projected cash flows at a single point in time. 4. Accounting Rate of Return 5. Net Cash Flow A capital budgeting method focused on the rate of return on a project's average investment. 6. Internal Rate of Return 7. Payback Period The process of restating future cash flows in terms 8. Hurdle Rate of present time value. Cash inflows minus cash outflows for the period. A process of analyzing alternative long-term investments. >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education