Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

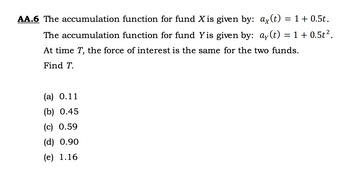

Transcribed Image Text:AA.6 The accumulation function for fund X is given by: ax(t) = 1 + 0.5t.

The accumulation function for fund Yis given by: ay(t)

= 1 + 0.5t².

At time T, the force of interest is the same for the two funds.

Find T.

(a) 0.11

(b) 0.45

(c) 0.59

(d) 0.90

(e) 1.16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PV = Cash Flow/Interest Rate is the present value shortcut formula for which of the following: * A perpetuity A single cash flow in the future A growing perpetuity An annuityarrow_forwardFind the internal rate of return (IRR) for the following cash flows. Enter your answer as a percent and include at least two decimal points, e.g., 8.35 for 8.35 %, not 0.08. Year Cash Flow 0 750 1 200 2 375 3 250 4 100 5 75arrow_forwardConsider two assets with the following cash flow streams: Asset A generates $4 at t=1, $3 at t=2, and $10 at t=3. Asset B generates $2 at t=1, $X at t=2, and $10 at t=3. Suppose X=6 and the interest rate r is constant. For r=0.1, calculate the present value of the two assets. Determine the set of all interest rates {r} such that asset A is more valuable than asset Draw the present value of the assets as a function of the interest rate. Suppose r=0.2. Find the value X such that the present value of asset B is 12. Suppose the (one-period) interest rates are variable and given as follows: r01=0.1,r12=0.2, r23=0.3. Calculate the yield to maturity of asset A. (You can use Excel or ascientific calculator to find the solution numerically.)arrow_forward

- Direction: Define, draw the cash flow diagram, and write the general formula of the following: ANNUITY 1. Ordinary Annuity a) Sum/Future of Ordinary Annuity b) Present Worth of Ordinary Annuity 2. Annuity Due 3. Deferred Annuityarrow_forwardThe following information relates to four assets: Probability Return on E Return on F Return on G Return on H 0.1 10% 6% 14% 2% 0.2 10% 8% 12% 6% 0.4 10% 10% 10% 9% 0.2 10% 12% 8% 15% 0.1 10% 14% 6% 20% (a) What is the expected return for each of the assets? (4) (b) Calculate the variance of each asset. (8) (c) Determine the covariance of asset F and G. (4) (d) What is the correlation coefficient between assets F and G? (4)arrow_forward2. We know the following two premiums: E(r) – E(˜Â) = 0.4 and E(rÂ) — rƒ = 0.1. (a) Calculate ₁. (b) If security B has BB : = 1 and E(rB) - rf = 0.5. What is aß?arrow_forward

- Assume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which equation best represents the calculation of a future value (FV) using: Compound interest? O FV = PV / (1+1)N O FV = PV + (PV XIX N) O FV = PV x (1 + I)N Simple interest? OFV = PV + (PV XIX N) O FV = PV XIX N O FV = PV/(PV XIX N)arrow_forwardWhich formula is correct for the compound interest calculation? Select one: a. P = F(1+i)^-n b. P = F/(1+in) c. P = F/(1+i/n)arrow_forwardn is the number of periods of an investment, PV is the starting value, FVn is the future value n periods ahead, and ^ means 'to the power of'. What is the correct formula for calculating return? a)(PV/FVn)^n - 1 b)(FVn/PV)^n c)1 - (FVn/PV)^n d)(FVn/PV)^n - 1arrow_forward

- Round to four decimal places.arrow_forwardThe correct formula to calculate the future value (FV) of a present value (PV) when simple interest is used is? Note: N would be number of periods and i would be the interest rate. A. FV = PV X (1+i)^N, where^ represents power B. FV = PV X (1+i)^-N, where^ represents power O C. FV = PV/((1+i) X N) D. FV = PV x (1 + (N x i)) Reset Selection Mark for Review What's This? The correct formula to calculate the future value (FV) of a present value (PV) when simple interest is used is? Note: N would be number of periods and i would be the interest rate. A. FV = PV X (1+i)^N, where^ represents power OB. FV = PV X (1+i)^-N, where^ represents power C. FV = PV /((1+i) x N) D. FV = PV x (1 + (N X i)) Reset Selection Mark for Review What's This?arrow_forward20. What is X in the formula: FV = X(1+r) ? Select one: a. The future value of an annuity with X cash flows b. The present value of a single cash flow in one period's time c. The future value of a single cash flow in one period's time d. The present value of an annuity with X cash flowsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education