Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

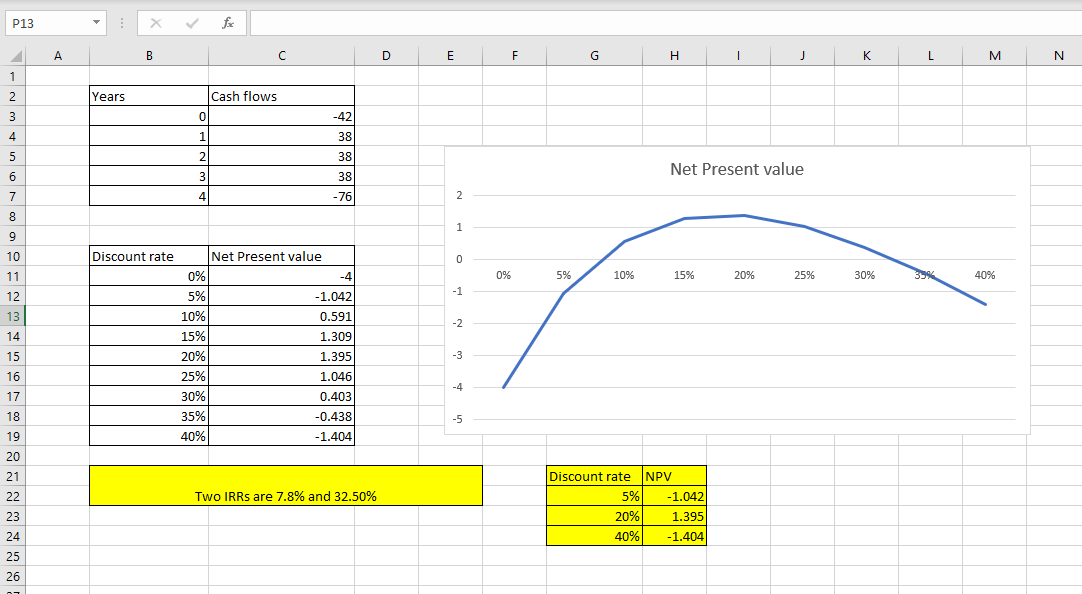

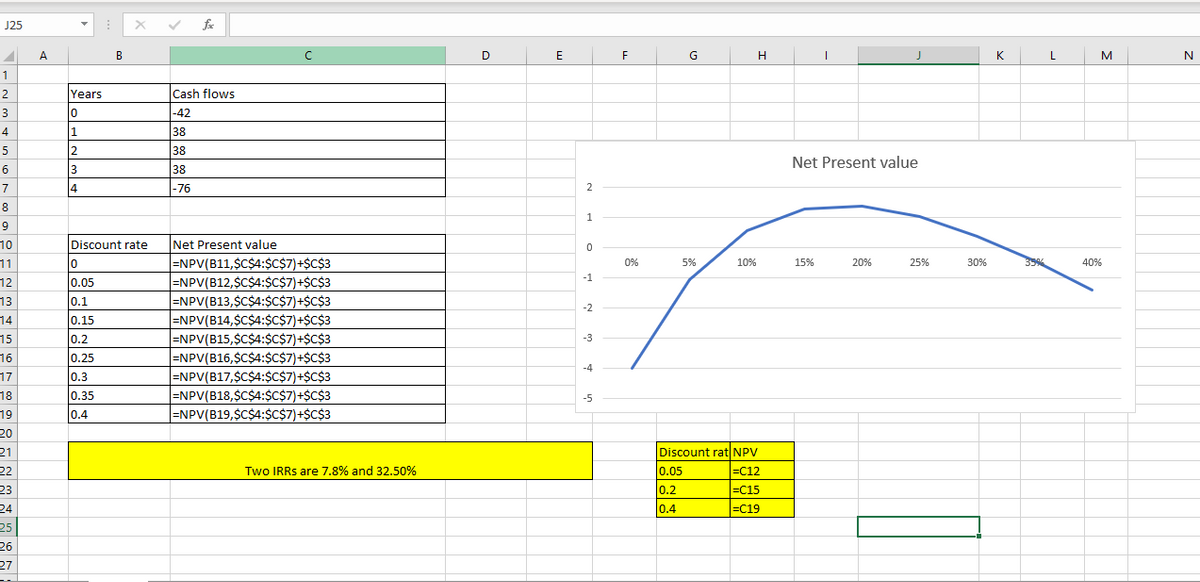

onsider the following cash flows:

C0=-$42

C1=+$38

C2=+$38

C3=+$38

C4=-$76

a. Which two of the following rates are the IRRs of this project?

Expert Solution

arrow_forward

Step 1 Concept

Internal Rate of Return : It is a discount rate at which net present value of a project is zero.

Here two IRR means minimum and high discount rate at which the net present value of a project would be zero.

arrow_forward

Step 2 Calculation

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In Question 3, assume that GDP=$12, C=$3, G=$2, M–X=$1, R=6%, INF=12%. Calculate the capital investment spending (I). A. I=$5. B. I=$8. C. I=-$3. D. I=$4.arrow_forwardWhat is the yield on the following set of cashflows? Time Cashflow (£) t = 0 t=1 H 400 t=2 t = 3 -100 -120 t = 4 -140 t = 5 -160arrow_forwardThe cash flows associated with a project can be represented by the following decision tree (conditional probabilities are in parentheses): Year 0 Year 1 5000 O $289.09 O $317.46 O $232.35 $400 (4) O $345.83 O $260.72 $600 (0) Year 2 $300 (5) $600 (5) $400 (5) 5600 (5) Given this data, determine the expected NPV for this project if the appropriate cost of capital is 12.84 percent. Year 3 $200 (5) $400 (5) $400 (5) SEOD (5) $300 (5) $500 (5) $600 (5) $700 (5)arrow_forward

- Consider two assets with the following cash flow streams: Asset A generates $4 at t=1, $3 at t=2, and $10 at t=3. Asset B generates $2 at t=1, $X at t=2, and $10 at t=3. Suppose X=6 and the interest rate r is constant. For r=0.1, calculate the present value of the two assets. Determine the set of all interest rates {r} such that asset A is more valuable than asset Draw the present value of the assets as a function of the interest rate. Suppose r=0.2. Find the value X such that the present value of asset B is 12. Suppose the (one-period) interest rates are variable and given as follows: r01=0.1,r12=0.2, r23=0.3. Calculate the yield to maturity of asset A. (You can use Excel or ascientific calculator to find the solution numerically.)arrow_forward3. follows: Carnegie Corp. projects an annual cash flow for one of its divisions as Year 0 1 2 3 4 5 6 Cash flow (SM) 3 0 -10 2 2 2 2 What is the IRR for this cash flow stream? Try plotting the NPV as a function of the discount rate. Are there any problems with using IRR for this application?arrow_forwardHere are cash flows for a project under consideration. C(0)= -$8160, C(1)=6180, and C(2)=20280. What is the IRR of the project?arrow_forward

- Determine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Invested Amount i- n Future Value 1. $ 11,500 7% 15 23 $ 15,000 6% 14 $ 28,000 12% 14 4. S 48,000 8% 6arrow_forwardThere is a project with the following cash flows : Year 0 1 2 1345 Cash Flow -$ 23,350 6,300 7,400 8,450 7,350 5,900 What is the payback period?arrow_forwardWhat is the NPV of the following cash flows if the required rate of return is 0.09? Year 0 1 2 3 4 CF -3,935 687 1,937 3,189 968 Enter the answer with 2 decimals (e.g. 1000.23).arrow_forward

- Information on four investment proposals is given below: Investment required. Present value of cash inflows Net present value Life of the project Answer is complete but not entirely correct. Profitability Index Investment Proposal ABCO A В Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. с D 3 0.41 0.38 0.50 0.33 Rank Preference A $ (240,000) 337,300 $ 97,300 Second Third First Fourth ✓ ✔ 5 years Investment Proposal $ (73,500) 110,250 $36,750 B $ (105,000) 144,900 $ 39,900 7 years 6 years $ (126,000). 168,000 $ 42,000 6 yearsarrow_forwardTo project the appropriate anticipated cash flow for a project, we must put all cash flow knowledge together. This includes of the incremental cash flow. OA) the amount but not the timing B) the timing C) the amount D) both the amount and timing 33arrow_forwardWhich of the following has the most favorable cash conversion cycle? a. DSO 28, DOH = 32, DPO = 38. = = b. DSO 30, DOH = 45, DPO = 10. c. DSO 64, DOH = 48, DPO = 24. = d. DSO = 45, DOH = 22, DPO = 12.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education