ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

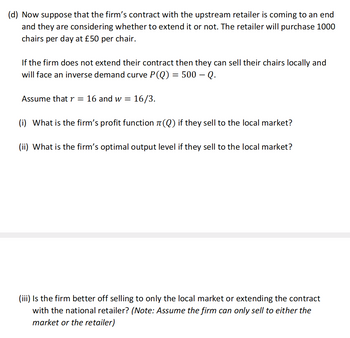

Transcribed Image Text:(d) Now suppose that the firm's contract with the upstream retailer is coming to an end

and they are considering whether to extend it or not. The retailer will purchase 1000

chairs per day at £50 per chair.

If the firm does not extend their contract then they can sell their chairs locally and

will face an inverse demand curve P(Q) = 500 — Q.

Assume that r = 16 and w= 16/3.

(i) What is the firm's profit function (Q) if they sell to the local market?

(ii) What is the firm's optimal output level if they sell to the local market?

(iii) Is the firm better off selling to only the local market or extending the contract

with the national retailer? (Note: Assume the firm can only sell to either the

market or the retailer)

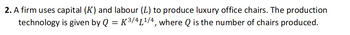

Transcribed Image Text:2. A firm uses capital (K) and labour (L) to produce luxury office chairs. The production

technology is given by Q = K ³/4L¹/4, where Q is the number of chairs produced.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 30 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- HP has developed a new, high-end, high-resolution printer, which can print 40 pages per minute. Its market research identified two target segments of customers: 3,500 large businesses and 6,500 university labs. A large business has a valuation of $900 for the new printer, whereas a university lab has a valuation of $630. HP’s variable cost for the printer is $450/unit; all fixed costs are sunk. Assume that each customer needs at most one new HP printer (i.e., no customer will buy multiple units). (a) Suppose that HP cannot price discriminate the two segments of customers, i.e., it can charge only one price for its printer. What is HP’s optimal price for the new printer? What is its maximum profit? (b) Suppose that HP can install an extra chip in the printer to slow down printing to 15 pages per minute. Such a chip costs HP $20 to make and install for each printer. The slower version of the printer is valued at $700 by a large business customer and $600 by a university lab. With…arrow_forwardR(x)= -0.956x^2 + 157x C(x)= 50.8x + 73.4 P(x)= R(x) - C(x) P(x)= -0.956x^2 + 106.2x - 73.4 What are the break-even points? What is the profit at the break-even points? What number of widgets sold will yield positive profit? Determine the number of widgets that you should try to sell in order to maximize profit. What is the maximum profit?arrow_forwardConsider a computer hardware production firm with total cost function TC = 2200+480Q+20Q2, and market demand function Qd = 190 – 2P; Q is output and P is market price. (a) Determine the firm’s Total Cost when it produces 120 units of output. (b) Determine the firm’s Marginal Cost when it produces 120 units of output. (c) Determine the firm’s Average Cost when it produces 120 units of output. (d) Find the market price of the firm’s output when it sells 120 units of output. (e) Determine whether the firm makes profit, or loss, at 120 units of output.arrow_forward

- am. 114.arrow_forwardHercules Films is deciding on the price of the video release of its film Son of Frankenstein. Its marketing people estimate that at a price of p dollars, it can sell a total of q = 280,000 - 20,00 copies. What price will bring in the greatest revenue? = $arrow_forwardEach firm in a perfectly competetive market has a long-run total cost of LRTC = 100g – 10q + 100. The market demand is Q* = 2150 – 5P. At the long-run equilibrium price, how many firms will there be in the market? (а) 500 (b) 1,000 (c) 1,200 (d) 2,000 (e) 2,400arrow_forward

- Suppose a large of firms have cost function C(q ) = = 72+ 4q+2q 2 and the market demand Q_{D = 712 4p What is equilibrium and the long-run number of firms? (a) Q = 600 and N = 100 (b) Q 688 and V100 (c) Q = 600 and N = = 688 and N = 115 (e) None of the above 115 (d) Qarrow_forwardExercise 2 Firm A and Firm B sell coffee and engage in Bertrand competition. They have a constant marginal cost equal to 10 and zero fixed costs. Total costs are therefore C₁ (9) = 10q, for i = A, B. (a) Suppose that consumers perceive the two brands of coffee as perfect substitutes; demand for firm i = A, B is then equal to Qi(Pi-Pj) 40 - Pi 0, 40-P, if p Pi if pi=Pj Describe what happens in equilibrium. Can firms make positive profits in equilibrium? (b) assume that consumers consider the two products as differentiated: demand for firm A is QA (PA, PB) = 40-2pA+PB and demand for firm B is QB (PB-PA) = 40-2p8+PA. Compute best response functions and characterize an equilibrium for this setting. Can firms make positive profits in equilibrium?arrow_forwardThe Jones are small farmers in the wheat industry – they are price takers. Their cost function is: TC = 600,000 + 3,000Q + Q2 and MC = 3,000 + 2Q. The market price is $5,000 per ton. Assuming the Jones are maximizing profits (or minimizing loses), how much profit are they making? You must show your work.arrow_forward

- Let R(x), C(x), and P(x) be, respectively, the revenue, cost, and profit, in dollars, from the production and sale of x items. If R(x) = 4x and C(x)=0.003x² + 1.6x + 50, find each of the following a) P(x) b) R(150), C(150), and P(150) c) R'(x), C'(x), and P'(x) d) R'(150), C'(150), and P'(150) a) P(x) = (Use integers or decimals for any numbers in the expression.) b) R(150)=$ (Type an integer or a decimal.) C(150)=$ (Type an integer or a decimal) *** P(150) $ (Type an integer or a decimal.) c) R'(x) = (Type an integer or a decimal) C'(x)= (Use integers or decimals for any numbers in the expression) P'(x)= (Use integers or decimals for any numbers in the expression)arrow_forward20) This decision tree represents the expected profits and the standard deviations associated with three decisions facing a mobile phone producer (All figures are in millions of dollars). The root node (the one on the left) represents the decision of whether to produce the phones in China or North America. The second pair of nodes represent the decision of whether to market the phones in China or North America; and the final nodes represent the choice of selling price: if the phones are sold in China, they will be sold for either $30 or $40, whereas if they are sold in North America, they will be sold for either $40 or $50. Based on the calculated values, what is the company's best strategy? Mean $30 1.250, sd 750 Sell China $40 Mean 375, sd = 625 Make in China Mean= -1,000, sd = 1,500 $40 Sell NA S50 Mean =-1,500, sd = 1,250 Sell China $30 $40 Make in NA Mean 1,250, sd.- 2,137 Sell NA $40 S50 Mean --250, sd-1.639arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education