ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

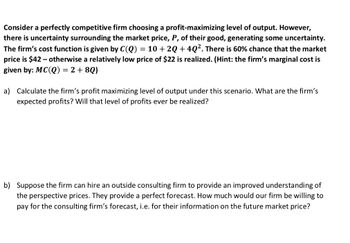

Transcribed Image Text:Consider a perfectly competitive firm choosing a profit-maximizing level of output. However,

there is uncertainty surrounding the market price, P, of their good, generating some uncertainty.

The firm's cost function is given by C(Q) = 10 + 2Q +4Q². There is 60% chance that the market

price is $42 - otherwise a relatively low price of $22 is realized. (Hint: the firm's marginal cost is

given by: MC(Q) = 2 + 8Q)

a) Calculate the firm's profit maximizing level of output under this scenario. What are the firm's

expected profits? Will that level of profits ever be realized?

b) Suppose the firm can hire an outside consulting firm to provide an improved understanding of

the perspective prices. They provide a perfect forecast. How much would our firm be willing to

pay for the consulting firm's forecast, i.e. for their information on the future market price?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the inverse demand for aloe juice in Greece is given by P = 100 – 2Q, where P is the price per bottle (1000ml) of aloe juice and Q is the total quantity, i.e., number of bottles, supplied in the market. There are two aloe juice manufacturers in Greece, Aloe Health and Aloe Wealth, operating under similar cost conditions. Each manufacturer's cost function is C(q) = 4qi, i =1,2, where q¡ is the manufacturer's individual quantity produced and Q = qı + q2. (a) Based on demand conditions every year, they decide, independently of each other, the quantity of aloe juice that will be supplied, letting the market determine the price per bottle. Find the equilibrium price and each firm's profit in this market. %3D (b) Consider that the above two manufacturers form a cartel, agreeing to fix their total quantity in such a way that the market maintains a collusive price. For simplicity, the eventual cartel directory will determine the target total-quantity and price pair, and each firm…arrow_forwardOptimization Problem #5arrow_forwardWindow cleaning is a perfectly competitive market in Boston. The daily market demand for window cleaning in Boston is Q(P) = 360 ‒ 4P, where Q represents the daily number of houses served and P is the price per house; and (2) the current market price per house served is 30. Each window-cleaning firm faces a daily total cost of TC(q) 72+ 1/2 q2, where q represents the number of houses served per day. What is the current daily profit for each window-cleaning firm? A. -72 B. 0 C. 378 D. 400 E. 578arrow_forward

- Suppose that the finance department of our favorite company, TVZ R US, determines that the total = 500+ 2x. The marketing department's cost of producing a amount of televisions is C (x) estimate of the demand function for televisions has not changed and remains p = 10 -0.01x. A) Write an equation for the profit of this company. B) Use the first derivative to find the marginal profit of the function you wrote in part A. C) Compute the second derivative and determine if the value you found in Part B is an absolute maximum or absolute minimum. D) Find the maximum profit of the company. E) At what price are profits maximized?arrow_forwardThe total cost equation for a firm producing two products is TC(Q1, Q2) = 25 + Q12 + 4Q22 + 5Q1Q2 (d) Suppose that the firm is currently producing 5 units of Q1, and 10 units of Q2, What is the firm's total cost of production? e) Suppose that the firm divests itself of the division selling Q1 to a competitor. How much will it cost the firm to continue producing 10 units of Q2? What is the total cost of producing both Q1 and Q2 if the firm producing Q1 produces 5 units?arrow_forwardA firm is producing computer monitors. The market price per monitor is P1=$450. The cost function is given by C(Q) = 1,500 + 2.8Q2. New information indicates that the new market price is P2=$130. Given this information, what are the optimal profits at the new price?arrow_forward

- Firms in a competitive market can sell as much as they like at a market price of $16. The cost function for each firm is TC = 50 + 4Q +2Q². The associated marginal cost function is MC = 4 + 4Q and the point of minimum average cost is Q = 5. How much profit is each firm earning?arrow_forwardces Problem 08-06 The diagram below shows the demand, marginal revenue, and marginal cost of a monopolist. 120 MC MR 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Quantity a. Determine the profit-maximizing output and price. Profit-maximizing output units Profit-maximizing price: $ b. What price and output would prevail if this firm's product was sold by price-taking firms in a perfectly competitive market? Price: $ Output: units c. Calculate the deadweight loss of this monopoly. Mc Graw Hill 110 100 90 80 70 60 50 40 30 20 10 19 BU Carrow_forwardA demand of 230 banquet attendees can be expected at a dinner plate price of $80.00 each. A demand of 370 banquet attendees can be expected at a dinner plate price of $45.00 each. Catering Service A has a fixed cost of $1,800 and a marginal cost of $30 for each plate. Catering Service B has a fixed cost of $2,500 and a marginal cost of $22 for each plate. Costs for both caterers include the food, drinks, plates, utensils, tablecloths, glasses, crew, and cleanup. Dinner plates will only be sold as an entire unit. To justify company resources and to ensure the event will benefit the charity, the CEO insists the tickets be sold for no less than $40. All profits will go toward a charity of the committee's choosing. Additional spontaneous donation to the charity will be accepted the night of the banquet. Studies estimate that 5% will give $5, 23% will give $20, 18% will give $50, 7% will give $100, and 2% will give $500. Find the Profit function, P(x) , for each of the two possible…arrow_forward

- A company’s demand and cost functions are given by p(q)=-0.05q+525andC(q)=q3 -7q2 +85q. What price should be set if marginal profit is $0 per item?arrow_forwardThe Lead Zeppelin Company produces powered and steerable lighter-than-air craft. The company’s airships are specially lined and are therefore safer than normal dirigibles. The table below shows the weekly production of dirigibles, along with the associated Average Cost and Total Revenue figures (the Average Cost and Total Revenue figures are actually in thousands of dollars, so the $15 represents $15,000, but we have left off the zeros to save space). Quantity Average Cost Total Cost Total Revenue 0 -- 0 $0 1 $15 15 $10 2 $9 18 $20 3 $8 24 $30 4 $8.50 34 $40 5 $9 45 $50 6 $10 60 $60 7 $12 84 $70 The Lead Zeppelin Company has decided that it will produce at least 1 dirigible. Now the question becomes, how many more dirigibles should it produce to make as much profit as possible? Use the profit-maximizing rule to explain how many dirigibles the Lead Zeppelin Company should produce to…arrow_forwardSuppose your product sells for $1.20 per unit. The total cost of producing x units is C(x) = 50 + 0.20x + .001x^2 dollars. a.) Find the marginal revenue and marginal profit functions b.) Find the marginal profit when x = 400 c.) What is the approximate profit from selling the 401st unit? d.) Find the value of x for which the marginal profit is zero.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education