ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

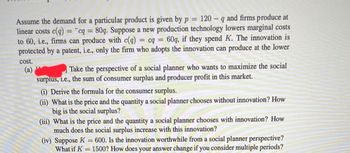

Transcribed Image Text:Assume the demand for a particular product is given by p = 120 q and firms produce at

linear costs c(q) = cq = 80q. Suppose a new production technology lowers marginal costs

to 60, i.e., firms can produce with c(q) = cq = 60q, if they spend K. The innovation is

protected by a patent, i.e., only the firm who adopts the innovation can produce at the lower

cost.

(a)

Take the perspective of a social planner who wants to maximize the social

surplus, i.e., the sum of consumer surplus and producer profit in this market.

(i) Derive the formula for the consumer surplus.

(ii) What is the price and the quantity a social planner chooses without innovation? How

big is the social surplus?

(iii) What is the price and the quantity a social planner chooses with innovation? How

much does the social surplus increase with this innovation?

(iv) Suppose K = 600. Is the innovation worthwhile from a social planner perspective?

What if K = 1500? How does your answer change if you consider multiple periods?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A microbrewery operates next to the Bushville Lake and uses water from the lake during production. The marginal cost of beer production is: MC = 8 + 2Q where Q is the quantity of beer produced (keg). The brewery sells its output at a market price of $40/keg. Because the industry is perfectly competitive, the brewery’s action does not affect the market price. The Bushville Lake is also used for kayaking and recreational fishing, but pollution from the brewery reduces the quantity of fish available and makes the lake very unpleasant. Each keg of beer produced emits a pound of pollutants that causes a loss of recreation opportunities worth $3. a) How much beer will be produced? b) What is the efficient level of beer production? If the government used a Pigouvian tax to achieve this goal, what would the tax be?arrow_forwardThese are not graded questions but revision questions from my textbookarrow_forwardA noncompetitive firm has the following total cost function: TC = 3Q³ – 40Q² + 250Q + 900 If the demand function for the firm's product is P = 2000 – 40Q. Find the firm's profit maximizing level of output and profit.arrow_forward

- Suppose that the inverse demand for aloe juice in Greece is given by P = 100 – 2Q, where P is the price per bottle (1000ml) of aloe juice and Q is the total quantity, i.e., number of bottles, supplied in the market. There are two aloe juice manufacturers in Greece, Aloe Health and Aloe Wealth, operating under similar cost conditions. Each manufacturer's cost function is C(q) = 4qi, i =1,2, where q¡ is the manufacturer's individual quantity produced and Q = qı + q2. (a) Based on demand conditions every year, they decide, independently of each other, the quantity of aloe juice that will be supplied, letting the market determine the price per bottle. Find the equilibrium price and each firm's profit in this market. %3D (b) Consider that the above two manufacturers form a cartel, agreeing to fix their total quantity in such a way that the market maintains a collusive price. For simplicity, the eventual cartel directory will determine the target total-quantity and price pair, and each firm…arrow_forwardA large number of firms enter the Swedish market for the game Padel. For simplicity assume that they all act as price takers and let the cost function for each of them be given by C(q)=1000+0.4*q² where q is the number of customers served. a) In the long run free entry should drive profit to zero. At this point p=MC=ATC. Intuitively why is this the case? b) The condition in c) implies that in a free entry equilibrium with firms that have the same cost function each firm's production will be given by the lowest point in the average total cost curve. How much does each firm produce in the free entry equilibrium? What is price in this equilibrium? (Hint: You can either differentiate the expression for average cost to determine its minimum or you can look for the minimum point using your graph in b). c) Assume that overall demand is given by Q-1200-2*P. How many firms will there be in equilibrium?arrow_forwardOptimization Problem #5arrow_forward

- R(x)= -0.956x^2 + 157x C(x)= 50.8x + 73.4 P(x)= R(x) - C(x) P(x)= -0.956x^2 + 106.2x - 73.4 What are the break-even points? What is the profit at the break-even points? What number of widgets sold will yield positive profit? Determine the number of widgets that you should try to sell in order to maximize profit. What is the maximum profit?arrow_forwardAn industry has the following cost function: C(X, Y ) = 1500+20X +20Y . Market demands for the 2 goods are given by PX =80−X, and PY =140−2Y Suppose the government wished to use two part tariffs in these markets, and suppose further that two part tariffs are feasible. Imagine that there are 10 consumer in each market. Solve for a set of two part tariffs (one for each martket) that pay the firm zero profits in total, yet achieves efficiency.arrow_forwardSuppose the Boston to Philadelphia airline route is serviced by three airlines – US Airways (Firm A) and JetBlue (Firm B) and Continental (Firm C). The demand for airline travel between these two cities is Q = 150 – p. The cost function is C(Q) = 30Q. The cost function is the same for all three airlines. Assume that the three airlines are making investments in airline capacity. In other words, they are simultaneously choosing quantity. (Cournot Competition) Derive US Airways’ residual demand function given JetBlue’s output, qB, and Continental’s output, qC. What is the Marginal Revenue for US Airways? Derive US Airways reaction function Derive the market equilibrium quantity, Q*, price, p*, and Profit.arrow_forward

- A pharmaceutical company is the only producer of a particular drug. It sells that drug in two countries, one rich and the other a development country. The inverse demand for the drug in the rich country is pr(qr) = 20 – 2qñ, and in the developing country it is pp(qp) 10- qp. The total cost of production is C(qR, qp) = (qr+qp)². What is the profit-maximizing quantity in the rich country, qR? (a) qR = 1 (b) qR = 3 (c) qR = 6 (d) qR 8 (e) qR 14arrow_forwardKatie's Quilts is a small retailer of quilts and other bed linen products. Katie currently purchases quilts from a large producer for $100 each and sells them in her store at a price that does not change with the number of quilts that she sells. Katie is considering vertically integrating by making her own quilts. If the fixed cost of vertically integrating is $25,000 and she can produce quilts at Homework: Homework 7 (Lecture 6) Save Score: 0 of 1 pt 6 of 10 (8 complete) HW Score: 80%, 8 of 10 pts Text Question 4.2 Ques $50 per quilt, her total cost of producing quilts, q, herself is C=25,000+50q. How many quilts does Katie need to sell for vertical integration to be a profitable decision? For vertical integration to be profitable, Katie must sell at least nothing quilts. (Enter your response rounded to the nearest whole number.)arrow_forwardA firm is producing computer monitors. The market price per monitor is P1=$450. The cost function is given by C(Q) = 1,500 + 2.8Q2. New information indicates that the new market price is P2=$130. Given this information, what are the optimal profits at the new price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education