FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE PROVIDE SOLUTION IN TEXT AND TABLE WITH INTRODUCTION OF CURRENT RATIO AND OTHERS DEFINA

Transcribed Image Text:Current Ratio

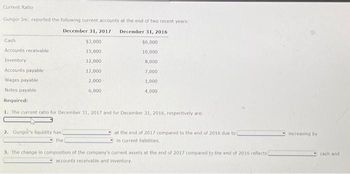

Gungor Inc. reported the following current accounts at the end of two recent years:

December 31, 2017 December 31, 2016

$3,000

$6,000

15,000

10,000

12,000

12,000

2,000

6,000

Cash

Accounts receivable

Inventory

Accounts payable

Wages payable

Notes payable

Required:

1. The current ratio for December 31, 2017 and for December 31, 2016, respectively are:

2. Gungor's liquidity has

the

8,000

7,000

1,000

4,000

at the end of 2017 compared to the end of 2016 due to

in current liabilities,

3. The change in composition of the company's current assets at the end of 2017 compared to the end of 2016 reflects)

accounts receivable and inventory.

increasing by

cash and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Number 5arrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forwardpre.3arrow_forward

- On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardNumber 1arrow_forward

- Sales Cost of goods sold Accounts receivable Numerator: 2021 $ 511,648 253,158 24,815 Numerator: Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. 2020 $ 332,239 164,397 19,403 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? Numerator: Trend Percent for Net Sales: 2019 $ 272,327 136,740 18,573 1 1 1 1 Denominator: Trend Percent for Cost of Goods Sold: 1 Denominator: 1 1 1 / 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Accounts Receivable: Denominator: 1 1 2021: 1 2020: 1 2019: 1 2018: 1 2017: 1 Is the trend percent for Accounts Receivable favorable or unfavorable? 2018 $ 200,979 99,730 11,757 = = = = = = = = = = = = = = = 2017 $ 146,700 71,883 10,064 = Trend percent Trend percent Trend percent % % % % % %…arrow_forwardCalculate the allowance ratio for the year ending 30 June 2020. Assume the number of days in the year is 365. Round the percentage change to one decimal placearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education