Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

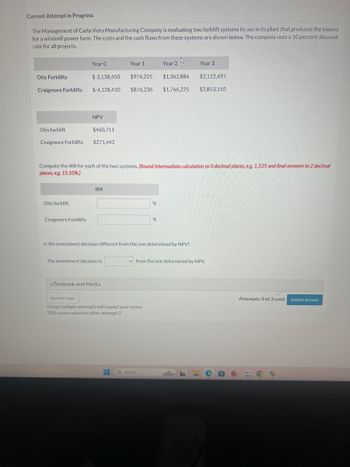

Transcribed Image Text:Current Attempt in Progress

The Management of Carla Vista Manufacturing Company is evaluating two forklift systems to use in its plant that produces the towers

for a windmill power farm. The costs and the cash flows from these systems are shown below. The company uses a 10 percent discount

rate for all projects.

Year 0

D

Year 1

Year 2

Year 3

Otis Forklifts

$-3,138,450

$974,225

$1,362,886

$2,112,497

Craigmore Forklifts

$-4,128,410 $876,236 $1,766,225

$2,853,110

NPV

Otis forklift

$460,711

Craigmore Forklifts

$271,442

Compute the IRR for each of the two systems. (Round intermediate calculation to O decimal places, e.g. 1,525 and final answers to 2 decimal

places, e.g. 15.10%.)

Otis forklift

Craigmore Forklifts

IRR

%

%

Is the investment decision different from the one determined by NPV?

The investment decision is

eTextbook and Media

from the one determined by NPV.

Save for Later

Using multiple attempts will impact your score.

20% score reduction after attempt 2

Q Search

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Management of Cullumber Manufacturing Company is evaluating two forklift systems to use in its plant that produces the towers for a windmill power farm. The costs and the cash flows from these systems are shown below. The company uses a 10 percent discount rate for all projects. Year 0 Year 1 Year 2 Year 3 Otis Forklifts $-3,109,450 $995,225 $1,376,886 $2,092,497 Craigmore Forklifts $-4,128,410 $856,236 $1,750,225 $2,851,110 Calculate net present value (NPV). (Enter negative amounts using negative sign e.g. -45.25. Do not round Discount factors.Round other intermediate calculations and final answers to 0 decimal places, e.g. 1,525.) NPV Otis forklift $enter a dollar amount rounded to 0 decimal places Craigmore Forklifts $enter a dollar amount rounded to 0 decimal places Determine which forklift system should be purchased. select the forklift system forklift…arrow_forwardic Yo NS io cer ist bun ngs nnée Current Attempt in Progress Blossom Manufacturing Co. is evaluating two projects. The company uses payback criteria of three years or less. Project A has a cost of $905,000, and project B's cost is $1,247,300. Cash flows from both projects are given in the following table. Year 1 2 3 4 Project A $86,212 313,562 427,594 285,552 Project B $586,212 413,277 231,199 What are their discounted payback periods? (Round answers to 2 decimal places, e.g. 15.25. If discounted payback period exceeds life of the project, enter 0.00 for the answer.) Discounted payback period of project A Discounted payback period of project B will he accepted with a discount rate of 8 percent? átv zoomarrow_forwardwhen answering the question please type out all of your workarrow_forward

- Jim Jones Sleepaway Camps, Inc. is looking for some payback period analysis for a new project in Janestown, Indiana. Suppose that the cost of acquiring the new camp, buildings, cabins, etc. and setting up trails and activities has an initial cost of $1.3M dollars but will generate the following cash-flows for the next four years: Year 1 $450,000 Year 2 $610,000 Year 3 $464,000 Year 4 $575,000 What is the payback period for this projectarrow_forwardThe line incorporate is considering a new piece of equipment that cost $60,000 the company can get 6000 for the trading on their old machine follow is financial data relevant to the new machine $24,000 revenue of $13,000 cash expenses peaceful life eight years appreciation expense $5500 per year internal rate of return is approximatelyarrow_forwardShould WMM lease or construct their own production facility Option 1: Construct Costs to incur: Actual expenditure towards buying land, construct building and getting ready for use $ 500,000Taxes, insurance, and repairs (per year) $ 20,000Intended years of use 18Projected market value in 18 years $ 1,000,000 Budgeted maximum expenditure towards buying land, construction of building and getting ready for use. $ 500,000Remainder in four payments of; $ 175,000Option 2: LeaseIntended years of use 18First lease payment due now $ 100,000Rest of the lease payments…arrow_forward

- devratarrow_forwardConsolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardGarnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the following cash flows over the next five years: $99,000, $88,000, $92,000. $87,000, and $72,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel. see Appendix C.arrow_forward

- Cash payback period for a service company Janes Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of 975,000 and each with a seven-year life and expected total net cash flows of 1,050,000. Location 1 is expected to provide equal annual net cash flows of 150,000, and Location 2 is expected to have the following unequal annual net cash flows: Determine the cash payback period for both location proposals.arrow_forwardA company is considering buying a new machine. Specific details: Initial Investment $400,000 Annual Cash Revenues $375,000 Annual Cash Expense $262,000 Expected Life 5 Years Salvage Value $0 Discount Rate 10% All cash flows are after tax. 1 Prepare a schedule that shows the applicable cash flows and other relevant items for this decision 2 Compute the payback period for the new machine 3 Compute the Accounting Rate of Return (ARR) for the new machinearrow_forwardNikularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College