CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

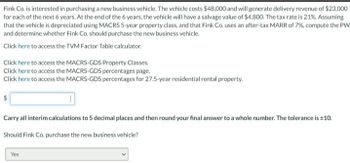

Transcribed Image Text:Fink Co. is interested in purchasing a new business vehicle. The vehicle costs $48,000 and will generate delivery revenue of $23,000

for each of the next 6 years. At the end of the 6 years, the vehicle will have a salvage value of $4,800. The tax rate is 21%. Assuming

that the vehicle is depreciated using MACRS 5-year property class, and that Fink Co. uses an after-tax MARR of 7%, compute the PW

and determine whether Fink Co. should purchase the new business vehicle.

Click here to access the TVM Factor Table calculator.

Click here to access the MACRS-GDS Property Classes.

Click here to access the MACRS-GDS percentages page.

Click here to access the MACRS-GDS percentages for 27.5-year residential rental property.

$

Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is ±10.

Should Fink Co. purchase the new business vehicle?

Yes

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Moore & Moore (MM) is considering the purchase of a new machine for $50,000, installed. MM will use the MACRS accelerated method to depreciate the machine, which is classified as 5-year property (see the following MACRS table for depreciation rates). MM expects to sell the machine at the end of its 4-year operating life for $10,000. If MM's marginal tax rate is 40%, what will the after-tax cash flow be when it disposes of the machine at the end of Year 4? Annual depreciation rates for years 1 through 6 are respectively as follows: 20%, 32%, 19%, 12%, 11%, 6%. A. $7,656 B. $8,059 C. $8,484 D. $8,930 E. $9,400arrow_forwardNonearrow_forwardChurchill Ltd. purchases an asset for $150,000. This asset qualifies as a five-year recovery asset under MACRS with the fixed depreciation percentages as follows: year 1 = 20.00%; year 2 = 32.00%; year 3 = 19.20%; year 4 = 11.52%. Churchill has a tax rate of 30%. If the asset is sold at the end of four years for $40,000, what is the cash flow from disposal?arrow_forward

- For specialized devices for use with its latest GPS / GIS system, Freeman Engineering charged $28,500. Using MACRS depreciation, the equipment was depreciated over a 3 year recovery period. After 2 years, the company sold the equipment for $5000 when it bought an improved system. (a) Assess the value of the recapture of depreciation or the capital loss involved in the asset sale. (b) What tax impact is that number going to have?arrow_forwardCustom Cars purchased $39,000 of fixed assets two years ago that are classified as 5-year MACRS property. The MACRS rates are 20 percent, 32 percent, 19.2 percent, 11.52 percent, 11.52 percent, and 5.76 percent for Years 1 to 6, respectively. The tax rate is 21 percent. If the assets are sold today for $19,000, what will be the after-tax cash flow (after- tax salvage value) from the sale? $20,280.00 $17,909.09 $18,941.20 $18,720.00 $19,000.00arrow_forwardIn year 0, an electrical appliance companypurchased an industrial robot costing $350,000. Therobot is to be used for welding operations, classified as seven-year recovery property, and has beendepreciated by the MACRS method. If the robot isto be sold after five years, compute the amounts ofgains (losses) for the following two salvage values(assume that both capital gains and ordinary incomesare taxed at 34%):(a) $20,000(b) $99,000arrow_forward

- Nozark Corp. is now in the final year of a project. The equipment originally cost $9,179, and the asset has been has been depreciated on a straight-line basis to a book value of $736. Nozark can sell the used equipment for $2,448, and its tax rate is 30%. The equipment's net after-tax salvage value is $_________. In other words, find the net after-tax cash flow effect of selling the equipment. Do not round any intermediate work. Round your *final* answer to 2 decimal places (example: 12.34567 = 12.35). Do not enter the $ sign.arrow_forwardIU purchased a super computer for $15,000. This computer qualifies for 5-year recovery under MACRS. Use the Table provided in lectures. IU has a tax rate of 20%. Assume that the super computer is sold for $4,000 at the end of year 4. What is the after- tax salvage value? O $2,765.21 O $1,877.00 O $3,718.40 O $2,765.34arrow_forwardRobert Cooper is considering purchasing apiece of business rental property containing storesand offices at a cost of $250,000. Cooper estimatesthat annual disbursements (other than income taxes)will be about $12,000. The property is expected toappreciate at the annual rate of 5%. Cooper expectsto retain the property for 20 years once it is acquired.Then it will be depreciated as a 39-year real-propertyclass (MACRS), assuming that the property will beplaced in service on January 1st. Cooper’s marginaltax rate is 30% and his MARR is 15%. What wouldbe the minimum annual total of rental receipts thatwould make the investment break even?arrow_forward

- In year 0, an electrical appliance company purchased an industrial robot costing $350,000. The robot is to be used for welding operations, classified as seven- year recovery property, and has been depreciated by the MACRS method. If the robot is to be sold after five years, compute the amounts of gains (losses) for the following two salvage values (assume that both capital gains and ordinary incomes are taxed at 21%): (a) $20,000 (b) $99,000 pany had sales revenues ofarrow_forwardIn year 0, an electrical appliance company purchased an industrial robot costing $350,000. The robot is to be used for welding operations, classified as seven-year recovery property, and has been depreciated by the MACRS method. If the robot is to be sold after five years, compute the amounts of gains (losses) for the following two salvage values (assume that both capital gains and ordinary incomes are taxed at 34%): $20,000 $99,000arrow_forwardA mixer was purchased two years ago for $63346 and can be sold for $171667 today. The mixer has been depreciated using the MACRS 5-year recovery period and the firm pays 40 percent taxes on both ordinary income and capital gain. Find the after tax proceeds.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you