Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

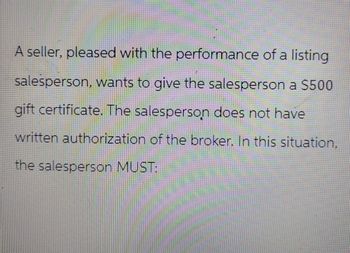

Transcribed Image Text:A seller, pleased with the performance of a listing

salesperson, wants to give the salesperson a $500

gift certificate. The salesperson does not have

written authorization of the broker. In this situation,

the salesperson MUST:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- All of the following are true concerning an invoice except: When a shipment arrives, the receiving department counts the items received against the purchase order. The vendor ships items ordered after it receives a purchase requisition. The invoice is sent to the buyer's accounting department where it is placed in the voucher. Ⓒ When all coples are in the voucher, the accounting department can record the purchase and approve its payment.arrow_forwardWhich one of the following documents is not needed to process a payment to a vendor? A. vendor invoice B. packing slip C. check request D. purchase orderarrow_forwardSuppose you are being interviewed for a bookkeeping job for a retailer that uses a perpetual inventory system. The employer feels that the only way to determine whether or not the person being interviewed actually understands how to record transactions, is to ask them to provide an example showing the accounts (no amounts necessary) that would be debited and credited for the following: Purchase merchandise inventory on account. Sale of goods on account Return of part of the merchandise purchased in 1. above to the supplier. Payment to supplier, taking advantage of the discount that was offered. Return of goods by customer for credit. Payment received from customer, taking advantage of discount that was offered.arrow_forward

- After invoicing a regular customer, PaintPros realizes that it billed the customer for prep work that was supposed to be free per the estimate. How should a credit memo be created for this customer? Select an answer: Apply the credit memo to the overbilled invoice and send the customer a check. Apply the credit memo to any open invoice by selecting Receive Payment. Apply the credit memo to the customer's most recent payment and send the customer a refund.arrow_forwardA receiving report is filled out when we receive: An inventory shipment from a vendor. Items that a customer is authorized to return from a previous sale. A payment on a customer's account. a and b only. Answer is not the First option!arrow_forwardIs it properly segragated? If no explain the reason why.arrow_forward

- Which of the following procedures is least effective in preventing the purchasing agent from receiving kickbacks? a. Prenumbering and periodically accounting for all purchase orders b. Requiring purchasing agents to disclose any financial investments in potential suppliers c. Requiring approval of all purchase orders d. Maintaining a list of approved vendors and requiring all purchases to be made from vendors on that listarrow_forwardIn the case of sales where the customer is billed before delivery of the goods, the seller should always recognize revenue before the products are delivered to the customer. the goods belong to the customer and revenue recognition is deferred until delivery. the seller may recognize revenue if control of the goods has been transferred to the customer even though physical delivery has not taken place. revenue will not be recognized until the goods are shipped to the customer.arrow_forwardIf one of NetSolution's customers returns some merchandise that had been purchased on account (accounts receivable), NetSolutions will inform the customer that the return has been authorized as indicated by a _______ memo. Group of answer choices credit memo debit memo sales return memo sales memoarrow_forward

- Why does billing receive a copy of the sales order when the order is approved but does not bill until the goods are shipped?arrow_forwardWhat is the reason for ensuring that every copy of a vendor's invoice has a receiving report? O To ascertain that merchandise billed by the vendor was received by the company. O To ascertain that merchandise received by the company was billed by the vendor. O To ascertain that the invoice was correctly prepared. O To ascertain that a check was prepared for every invoice.arrow_forwardRequired: A sales invoice typically includes the date of sale, salesperson, customer data, items included in the sale, and amount. Which foreign keys should be added to the following table to link all of these data elements? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Sales Table Invoice# Date Amount S-101 10/05/2021 2549.90 S-105 11/01/2021 949.95 S-107 11/02/2021 1209.70 S-108 11/06/2021 699.90 ?Salesperson # ? Customer # ? Receipt # ? Inventory # ? Remittance Advice # ? Sales # ?Cashier # ?Casharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,