Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

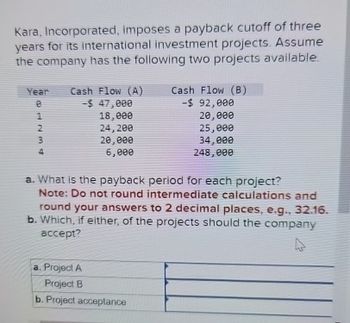

Transcribed Image Text:Kara, Incorporated, imposes a payback cutoff of three

years for its international investment projects. Assume

the company has the following two projects available.

Year Cash Flow (A)

е

-$ 47,000

Cash Flow (B)

-$ 92,000

62331

4

18,000

24,200

20,000

6,000

20,000

25,000

34,000

248,000

a. What is the payback period for each project?

Note: Do not round intermediate calculations and

round your answers to 2 decimal places, e.g., 32.16.

b. Which, if either, of the projects should the company

accept?

a. Project A

Project B

b. Project acceptance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Carlo Company has been allocated RM600,000 on investment projects for the coming year. Four projects, each with a four year life and with the following cash flows are currently being considered: Year 0 1 2 3 4 Project RMk RMk RMk RMk RMk A -300 100 10 200 200 В -200 0 400 -100 0 80 80 D -150 60 60 60 60 1. Distinguish between hard and soft capital rationing 2. Assuming that the projects are divisible recommend to the Board, which projects should be accepted using the Net Present Value method and evaluate the total net present value that would be generated 3. Discuss the impact on your analysis of each project being indivisiblearrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) -$ 15,456 5,225 8,223 13,013 8,705 0 1 234 -$ 276,363 26,400 51,000 57,000 402,000 Whichever project you choose, if any, you require a 6 percent return on your investment. a. What is the payback period for Project A? Payback period b. What is the payback period for Project B? Payback period c. What is the discounted payback period for Project A? Discounted payback periodarrow_forwardWhen evaluating international investment projects, Checks Inc. imposes a payback cutoff of three years. Year Cash Flow (A) Cash Flow (B) 0 -$ 40,000 -$ 55,000 1234 14,000 11,000 18,000 13,000 17,000 16,000 4 11,000 255,000 What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B years years Which project should the company accept? O Project B O Project Aarrow_forward

- Duo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 4 5 Cash Flow -$ 15,300 6,400 7,600 7,200 6,000 -3, 400 The company uses an interest rate of 9 percent on all of its projects. Calculate the MIRR of the project using all three methods. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach Combination approach % % %arrow_forwardBadr & Sons. is evaluating 2 (TWO) mutually exclusive investment projects. INITIAL CAPITAL OUTLAY for both projects are as stated in Year 0. The company’s REQUIRED RATE OF RETURN IS 10.50% and sets 2.5 YEARS AS ITS MINIMUM (DESIRED) PAYBACK PERIOD. Information about cash flows from the project for the next four years is tabulated below: YEAR PROJECT ALPHA PROJECT BETA 0 SR -185,000 SR -145,000 1 45,000 41,000 2 75,000 45,000 3 55,000 55,000 4 66,000 70,000 What is PAYBACK PERIOD for PROJECT ALPHA ONLY.?arrow_forwardMonroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year0 ($11,368,000)1 $2,112,5892 $3,787,5523 $3,300,6504 $4,115,8995. $ 4,556,424 Round to two decimal places. For year 0 , its initial investment .arrow_forward

- The Carlo Company has been allocated RM600,000 on investment projects for the coming year. Four projects, each with a four year life and with the following cash flows are currently being considered: Year 0 1 2 3 4 Project RMk RMk RMk RMk RMk A -300 100 10 200 200 B -200 0 0 0 400 C -100 0 0 80 80 D -150 60 60 60 60 Distinguish between hard and soft capital rationing Assuming that the projects are divisible recommend to the Board, which projects should be accepted using the Net Present Value method and evaluate the total net present value that would be generated Discuss the impact on your analysis of each project being indivisiblearrow_forwardes Andouille Spices, Incorporated, has the following mutually exclusive projects available. The company has historically used a three-year cutoff for projects. The required return is 14 percent. Year 0 Project F -$ 138,000 Project G -$ 208,000 12345 58,500 38,500 51,500 53,500 61,500 91,500 4 56,500 121,500 51,500 136,500 a. Calculate the payback period for both projects. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Calculate the NPV for both projects. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. c. Which project, if any, should the company accept? a. Project F Project G b. Project F C. Project G Project G years yearsarrow_forwardMansukhbhaiarrow_forward

- 1. Kara, Incorporated, imposes a payback cutoff of three international investment projects. Year Cash Flow (A)Cash Flow (B) -$ 73,000 0 1 2 3 4 $63,000 24,500 31,000 22,500 9,500 16,500 19,500 29,000 233,000 What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$ 243,567 -$ 15,530 1 27,200 55,000 60,000 413,000 234 5,173 8,261 13,237 8,729 Whichever project you choose, if any, you require a 6 percent return on your investment. a. What is the payback period for Project A? Payback periodarrow_forwardEmusk Inc. is evaluating two mutually exclusive projects. The required rate of return on these projects is 8%. Calculate the profitability index for project A. (Round to 3 decimals) Year 0 1 2 3 4 5 Project A -15,000,000 2,000,000 3,000,000 5,000,000 5,000,000 6,000,000 Project B -15,000,000 6,000,000 6,000,000 6,000,000 1,000,000 1,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education