Caricolor Limited operates a paint manufacturing plant, housing two distinct departments: the

mixing department and the quality control department. The paint undergoes sequential

processing in both of these departments.

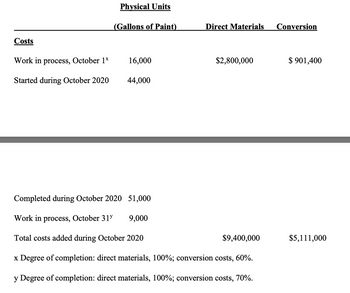

The company's process-costing system is structured around two primary cost categories:

direct materials and conversion costs. Direct materials are introduced at the initial stages of

the process, while conversion costs are gradually incurred throughout the process. After

completion of the mixing department's tasks on the paint, the product is promptly forwarded

to the quality control department. Caricolor employs the weighted-average method for

Data for the mixing department for October 2020 are as follows:

Required:

1. Compute equivalent units in the mixing department, for each cost category?

2. Summarize total mixing department costs for October 2020 for each cost category, and calculate the cost per equivalent unit?

Step by stepSolved in 1 steps

- The Calgary Company is a food processing company based in Aberta. It operates under the weighted average method of process costing and has two departments: cleaning and cleaning department, conversion costs are added evenly during the process, and direct materials are added at the beginning of the process Spoiled units are detected upon insp and are disposed of at zero net disposal value. All completed work is transferred to the packaging department Summary data for May follow (Click the icon to Required For the deaning deg process Carry unit For each cost categ Enter the physical u Fl Work in process, be Started during cum To account for Completed and tran Normal spolage Abnormal spolage Work in process, ending Accounted for Data table The Calgary Company: Cleaning Dept. Work in process, beginning inventory (May 1) Degree of completion of beginning work in process Started during May Good units completed and transferred out during May Work in process, ending inventory (May 31) Degree…arrow_forwardQualCo manufactures a single product in two departments: Cutting and Assembly. Information for the Cutting department for May follows. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for Equivalent units of production (EUP) Cost per equivalent unit of production + Equivalent units of production Cost per equivalent unit of production Cost assignment Beginning work in process To complete beginning work in process Direct materials Conversion Started and completed Direct materials Conversion Completed and transferred out Ending work in process Direct materials Conversion Total costs accounted for Units EUP Units 37,500 150,000 187,500 51, 250 Required: 1-3. Using the FIFO method, assign May's costs to the units transferred out and assign costs to its ending work in…arrow_forwardMuskoge Company uses a process-costing system. The company manufactures a product that isprocessed in two departments: Molding and Assembly. In the Molding Department, directmaterials are added at the beginning of the process; in the Assembly Department, additionaldirect materials are added at the end of the process. In both departments, conversion costs areincurred uniformly throughout the process. As work is completed, it is transferred out. Thefollowing table summarizes the production activity and costs for February: Molding AssemblyBeginning inventories: Physical units 10,000 8,000 Costs: Transferred in — $ 45,400 Direct materials $22,000 — Conversion costs $13,800 $ 16,700Current production: Units started 25,000 ? Units transferred out 30,000 35,000 Costs: Transferred in — ? Direct materials $ 56,250 $ 40,250 Conversion costs $103,500 $142,845 Percentage of completion: Beginning inventory 40% 55% Ending inventory 80 50Required:3. Using the FIFO method, prepare the following for…arrow_forward

- Manjiarrow_forwardRequired information [The following information applies to the questions displayed below.] Dengo Company makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. October data for the Roasting department follow. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Costs added this period Direct materials Conversion Total costs to account for Units 4,300 20,500 24,800 3,700 $ 309,760 1,382,724 Direct Materials Percent Complete 100% 100% Conversion Percent Complete 40% $ 124,510 1,692,484 $ 1,816,994 80%arrow_forwardDaosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forward

- Calculate the first production department's equivalent units of production for materials and conversions for May. Compute the first production departments cost per equivalent unit for materials and conversions for May. (Round your answer to 2 decimal places.) Compute the first production departments cost of ending work in process inventory for materials, conversions, and in total for May. (Round your intermediate calculations to 2 decimal places.) Compute the first production departments cost of the units transferred to the next production department for materials conversion, and in total for may. (Round your intermediate calculations to 2 decimal places.)arrow_forwardCranbrook Textiles Company makes silk banners and uses the weighted-average method of process costing. Direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. (Click the icon to view the process costing data.) Determine the equivalent units of work done in July, and calculate the cost of units completed and transferred out (including normal spoilage), the cost of abnormal spoilage, and the cost of units in ending inventory. - X Data table Physical Units Direct Conversion Enter the physical units in first, then calculate the equivalent units. (Banners) Materials Costs 1,300 $195,000 $8,000 Work in process, (July 1)" Started in July 2020 Good units completed and transferred out in July Normal spoilage Abnormal spoilage Physical 37,500 20,500 9,000 Flow of Production Units Work in process beginning…arrow_forwardMcKnight Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the assembly department and the finishing department. This problem focuses on the assembly department. The process-costing system at McKnight has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added when the assembly department process is 10% complete. Conversion costs are added evenly during the assembly department's process. McKnight uses the weighted-average method of process costing. Consider the following data for the assembly department in April: (Click the icon to view the data.) Required Work in process, ending Accounted for Equivalent units of work done to date Now summarize the total costs to account for. Work in process, beginning Costs added in current period Total costs to account for Completed and transferred out Work in process, ending IZU 570 Total costs accounted…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education