FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

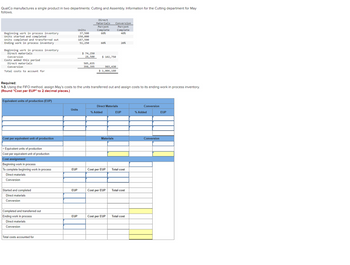

Transcribed Image Text:QualCo manufactures a single product in two departments: Cutting and Assembly. Information for the Cutting department for May

follows.

Beginning work in process inventory

Units started and completed

Units completed and transferred out

Ending work in process inventory

Beginning work in process inventory

Direct materials

Conversion

Costs added this period

Direct materials

Conversion

Total costs to account for

Equivalent units of production (EUP)

Cost per equivalent unit of production

+ Equivalent units of production

Cost per equivalent unit of production

Cost assignment

Beginning work in process

To complete beginning work in process

Direct materials

Conversion

Started and completed

Direct materials

Conversion

Completed and transferred out

Ending work in process

Direct materials

Conversion

Total costs accounted for

Units

EUP

Units

37,500

150,000

187,500

51, 250

Required:

1-3. Using the FIFO method, assign May's costs to the units transferred out and assign costs to its ending work in process inventory.

(Round "Cost per EUP" to 2 decimal places.)

EUP

EUP

$74,250

28,500

505,035

398, 395

Direct

Materials

Percent

Complete

60%

60%

$ 102,750

903,430

$ 1,006,180

Conversion

Percent

Complete

40%

Direct Materials

% Added

Materials

Cost per EUP

Cost per EUP

Cost per EUP

20%

EUP

Total cost

Total cost

Total cost

Conversion

% Added

Conversion

EUP

Expert Solution

arrow_forward

Notes

Under FIFO method, the cost added during the period is considered to calculate cost per equivalent unit.

The equivalent unit is computed by multiplying the units produced with their level of completion.

For beginning work in process, the level of completion is the remaining level that was incomplete.

Example

for material, it is 100% - 60% = 40%

For conversion, it is 100% - 40% = 60%

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aztec Inc. produces sort drinks. Mixing is the first department, and its output is measured in gallons. Aztec uses the FIF thod. All manuracturing costs are added uniformly. For July, the mixing department provided the following information: Production: Units in process, July 1, 60% complete 18,000 gallons Units completed and transferred out 138,000 gallons Units in process, July 31, 55% complete 24,000 gallons Costs: Work in process, July 1 $36,000 Costs added during July 379.080 Required: Prepare a production report. Aztec Inc. Mixing Department Production Report For the Month of July (FIFO Method) Unit Information Physical flow: Units to account for: Units Units in beginning WIP Units started Total units to account for Units to account for: Units Units started and completedarrow_forwardBeginning work in process (40% complete) Direct materials Conversion cost Total cost of beginning work in process Number of units started Number of units completed and transferred to finished goods Ending work in process (75% complete) Current period costs Direct materials Conversion cost Total current period costs a. Reconcile the number of physical units worked on during the period. b. Calculate the number of equivalent units. Required: 1. Using FIFO method of process costing, complete each of the following steps: c. Calculate the cost per equivalent unit. d. Reconcile the total cost of work in process. Complete this question by entering your answers in the tabs below. Reg 1A Req 1B Req 1C Units Req 1D ? 35,900 34,300 21,350 Costs $ 1,331,500 620,800 $ 1,952,300 $ 2,397,400 1,261,500 $ 3,658,900 Using FIFO method of process costing, reconcile the total cost of work in process. Note: Use Equivalent Units rounded to the nearest whole unit and Cost per Equivalent Unit rounded to 5…arrow_forwardHow do I do this?arrow_forward

- Beginning work in process (40% complete) Direct materials. Conversion cost Total cost of beginning work in process Number of units started Number of units completed and transferred to finished goods Ending work in process (75% complete) Current period costs Direct materials Conversion cost Total current period costs a. Reconcile the number of physical units worked on during the period. b. Calculate the number of equivalent units. Required: 1. Using FIFO method of process costing, complete each of the following steps: c. Calculate the cost per equivalent unit. d. Reconcile the total cost of work in process. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Units Req 1D ? 35,900 34,300 21,350 Costs $ 1,331,500 620,800 $ 1,952,300 $ 2,397,400 1,261,500 $ 3,658,900 Using FIFO method of process costing, reconcile the total cost of work in process. Note: Use Equivalent Units rounded to the nearest whole unit and Cost per Equivalent Unit rounded to 5…arrow_forwardInacio Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory Materials costs Conversion costs Percent complete with respect to materials Percent complete with respect to conversion Units started into production during the month Units transferred to the next department during the month Materials costs added during the month Conversion costs added during the month Ending work in process inventory: Units in ending work in process inventory Percent complete with respect to materials Percent complete with respect to conversion The cost per equivalent unit for materials for the month in the first processing department is closest to: Multiple Choice $16.70 $17.95 800 $ 12,900 $ 5,000 75% 20% 9,500 8,400 $ 172,000 $ 240,200 1,900 90% 30%arrow_forwardSuppose that manufacturing is performed in sequential production departments. Prepare a journalentry to show a transfer of partially completed units from the first department to the second department. Assume the amount of costs transferred is $50,000.arrow_forward

- Question: Ebony Company uses the weighted-average method of process costing to assign production costs to the products. Information for April follows. Assume that all materials are added at the beginning of the production process, and that direct labor and factory overhead are added uniformly throughout the process. Complete a process cost summary using the following sections: Beginning WIP Units completed and transferred Units Material Conversion 5000 50000 100000 20000 250000 500000 Ending WIP 80% complete with 7000 respect to conversion and 100% for materials 1. Costs charged to production 2. Unit cost information 3. Equivalent units of production 4. Cost per Equivalent unit of productionarrow_forward7. Using the following terms, complete the production cost report shown below: Ending work in process Total costs to account for Cost per equivalent unit Units started into production Manufacturing Overhead Beginning work in process Total units accounted for Raw Materials Inventory Transferred in costs Incurred during the period Completed and transferred out Total costs accounted for Finished Goods Inventory Equivalent units Total units to account for Materials are added at the beginning of the production process and ending work in process inventory is 80% complete with regard to conversion costs. Use the information provided to complete a production cost report using the weighted-average method. Cost to Account For Beginning inventory: materials $ 25,000 Beginning inventory: conversion 30,500 Direct materials 2,000 Direct labor 45,000 Applied overhead…arrow_forward1.arrow_forward

- Manjiarrow_forwardSheridan Company has gathered the following information. All materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. Units in beginning work in process Units started into production Units in ending work in process Percent complete in ending work in process: Conversion costs Materials Cost of beginning work in process, plus costs incurred during the period: Direct materials Direct labor Overhead Completed and transferred out $ 18,400 Ending work in process 150,880 22,080 60 % 100 % Show the assignment of costs to units completed and transferred out and to work in process at the end of the period. $84,640 $151,616 $169,280arrow_forwardEasy Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's firs processing department for a recent month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Materials cost Conversion cost Work in process, ending: Units in process Percent complete with respect to materials Percent complete with respect to conversion Required: Using the FIFO method: Complete this question by entering your answers in the tabs below. Req A and B Req C and D $ $ a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education