Concept explainers

Costs per Equivalent Unit

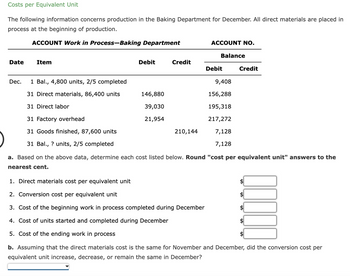

The following information concerns production in the Baking Department for December. All direct materials are placed in process at the beginning of production.

a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent.

1. Direct materials cost per equivalent unit

2. Conversion cost per equivalent unit

3. Cost of the beginning work in process completed during December

4. Cost of units started and completed during December

5. Cost of the ending work in process

b. Assuming that the direct materials cost is the same for November and December, did the conversion cost per equivalent unit increase, decrease, or remain the same in December?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Costs per Equivalent Unit The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Date Mar. Item 1 Bal., 5,100 units, 4/5 completed 31 Direct materials, 91,800 units 31 Direct labor Debit 156,060 40,880 23,002 Credit Debit 222,996 11,322 167,382 208,262 231,264 8,268 8,268 31 Factory overhead 31 Goods finished, 93,000 units 31 Bal. ? units, 3/5 completed a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during March 4. Cost of units started and completed during March 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for February and March, did the conversion cost per equivalent…arrow_forwarda. Determine the number of units transferred to the next department. b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials Cost per equivalent unit of direct materials c. Determine the cost of units started and completed in November.arrow_forward1.(8) The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $98,310 of direct materials.arrow_forward

- Magic Company adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of August is available. Work in process, August 1 (65% complete with respect to conversion) Started in August Completed Work in process, August 31 (71% complete with respect to conversion) Required: a. Compute the equivalent units for materials costs and for conversion costs using the weighted-average method. b. Compute the equivalent units for materials costs and for conversion costs using the FIFO method. a. Using the weighted-average method b. Using the FIFO method Equivalent Units Materials 17,700 118,900 118,900 17,700 Conversion Costsarrow_forwardInacio Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory Materials costs Conversion costs Percent complete with respect to materials Percent complete with respect to conversion Units started into production during the month Units transferred to the next department during the month Materials costs added during the month Conversion costs added during the month Ending work in process inventory: Units in ending work in process inventory Percent complete with respect to materials Percent complete with respect to conversion The cost per equivalent unit for materials for the month in the first processing department is closest to: Multiple Choice $16.70 $17.95 800 $ 12,900 $ 5,000 75% 20% 9,500 8,400 $ 172,000 $ 240,200 1,900 90% 30%arrow_forwardPeridot Company's grinding department had the following data for the month of January: Production: Units in process, January 1, 75% complete Units completed and transferred out Units in process, January 31, 45% complete Costs: Work in process, January 1 13,000 tons 39,000 tons 20,000 tons Costs added during January $6,265 $20,135 Determine the cost to be assigned to ending work-in-process (EWIP) using the weighted average method. (Note: Round the unit cost to two decimal places.) a. $4,950 Ob. $7,565 ○ c. $8,984 Od. $3,790arrow_forward

- Savitaarrow_forwardDaosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forwardSur Company uses the weighted-average method in its process costing system. Information for the month of May concerning Department A, the first stage of the company's production process follows: Materials Conversion Work in process, beginning.. OR 4,000 OR 3,000 Current costs added. 20,000 16,000 Total costs... Equivalent units.. Costs per equivalent unit. oods completed... 90,000 units Work in process, ending.. 10,000 units Material costs are added at the beginning of the process. The ending work in process is 50% complete with respect to conversion costs.. The total Cost Per Equivalent Unit will be:arrow_forward

- Prepare a Production Cost Report Troika Company The production information for Troika's Smoothing department for August is as follows: Work in process Beginning balance: materials Beginning balance: conversion Materials Labor Overhead Cost $ 1,550 2,500 7,441 14,520 7,930 Beginning units Transferred in Transferred in Transferred out Units 650 1,780 1,810 All materials are added at the beginning of the period. The ending work in process is 30% complete as to conversion. Prepare a production cost report for August for the Smoothing Department.arrow_forwardplease provide handwritten solutionsarrow_forwardEasy Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's firs processing department for a recent month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Materials cost Conversion cost Work in process, ending: Units in process Percent complete with respect to materials Percent complete with respect to conversion Required: Using the FIFO method: Complete this question by entering your answers in the tabs below. Req A and B Req C and D $ $ a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education