FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

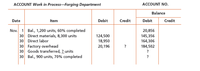

The above information (picture) concerns production in the Forging Department for November. All direct materials are placed in process at the beginning of production.

What is the Direct Materials Cost Per Equvalent Unit? ________________

What is the Conversion cost per equivalent unit? _____________________

What is the cost of the beginning work in process completed during May? __________________

What is the cost of the ending work in process? ___________________

What is the amount of the costs transfered to Finished Goods (or the next department)? _____________________

Transcribed Image Text:ACCOUNT Work in Process-Forging Department

ACCOUNT NO.

Balance

Date

Item

Debit

Credit

Debit

Credit

Nov. 1 Bal., 1,200 units, 60% completed

30 Direct materials, 8,300 units

30 Direct labor

30 Factory overhead

30 Goods transferred, 2 units

30 Bal., 900 units, 70% completed

20,856

145,356

164,306

184,502

124,500

18,950

20,196

?

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Magic Company adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of August is available. Work in process, August 1 (65% complete with respect to conversion) Started in August Completed Work in process, August 31 (71% complete with respect to conversion) Required: a. Compute the equivalent units for materials costs and for conversion costs using the weighted-average method. b. Compute the equivalent units for materials costs and for conversion costs using the FIFO method. a. Using the weighted-average method b. Using the FIFO method Equivalent Units Materials 17,700 118,900 118,900 17,700 Conversion Costsarrow_forwardQuestion: Ebony Company uses the weighted-average method of process costing to assign production costs to the products. Information for April follows. Assume that all materials are added at the beginning of the production process, and that direct labor and factory overhead are added uniformly throughout the process. Complete a process cost summary using the following sections: Beginning WIP Units completed and transferred Units Material Conversion 5000 50000 100000 20000 250000 500000 Ending WIP 80% complete with 7000 respect to conversion and 100% for materials 1. Costs charged to production 2. Unit cost information 3. Equivalent units of production 4. Cost per Equivalent unit of productionarrow_forwardSavitaarrow_forward

- I need to finish with these three questions and need help please. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. 2. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs. 3.Discuss the uses of the cost of production report and the results of part (c).arrow_forwardShirley Processing, Incorporated (SPI) makes adhesive tape. The following information on the physical flow of units and costs for month of March: Quantities Beginning work-in-process Started To account for Transferred out Ending work in process Accounted for Physical units Percentage Complete. Materials 107,000 100% Conversion 40% 957,000 1,064,000 975,500 100% 100% 88,500 100% 20% 1,064,000 Cost Beginning work-in-process Current period Total $ 186,570 1,871,298 Direct Materials $ 167,180 1,234,530 Conversion $ 19,390 636,768 Total $ 2,057,868 $ 1,401,710 $ 656,158 Required: a. Compute the equivalent units for the conversion cost calculation for March assuming Shirley Processing. Incorporated uses the weighted-average method. b. Compute the cost per equivalent unit for direct materials and conversion costs for March assuming Shirley Processing, Incorporated uses the weighted-average method. Complete this question by entering your answers in the tabs below. Required A Required B Compute…arrow_forwardDaosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forward

- At Greytown Company, materials are entered at the beginning of each process. Work in process inventories, with the percentage of work done on conversion, and production data for its Painting Department in selected months are as follows: Beginning Work In Process Ending Work In Process Percentage Units Completed Percentage Month Units Completed and Transferred Out Units Completed July -0- — 11,000 1,500 90% Sept. 2,500 20% 9,000 5,000 70% Instructions Compute the equivalent units of production for materials and conversion costs for September.arrow_forwardPrepare a Production Cost Report Troika Company The production information for Troika's Smoothing department for August is as follows: Work in process Beginning balance: materials Beginning balance: conversion Materials Labor Overhead Cost $ 1,550 2,500 7,441 14,520 7,930 Beginning units Transferred in Transferred in Transferred out Units 650 1,780 1,810 All materials are added at the beginning of the period. The ending work in process is 30% complete as to conversion. Prepare a production cost report for August for the Smoothing Department.arrow_forwardEasy Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's firs processing department for a recent month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Materials cost Conversion cost Work in process, ending: Units in process Percent complete with respect to materials Percent complete with respect to conversion Required: Using the FIFO method: Complete this question by entering your answers in the tabs below. Req A and B Req C and D $ $ a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory.…arrow_forward

- Accounting Use the FIFO method of process costing. Prepare schedules to accomplish each of the following process-costing steps for the month of April. l. Analysis of physical flow of units. 2. Calculation of equivalent units. 3. Computation of unit costs. 4. Analysis of total costs Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process. Work in process, April 1—10,000 units: Direct material: 100% complete, cost of . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 22,000 Conversion: 20% complete, cost of . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,500 Balance in work in process, April 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 26,500 Units started during April . . . . . . . . . . . . . . . . . . . . . . . . .…arrow_forwardShirley Processing. Incorporated (SPI) makes adhesive tape. The following information on the physical flow of units and costs for month of March: Quantities Beginning work-in-process Started To account for Transferred out Ending work in process Accounted for Cost Beginning work-in-process Current period Total Physical 108,000 957,588 1,065,500 976,588 89,000 1,065,508 Total $ 188,570 1,891,498 $ 2,088,068 Equivalent units Percentage Complete Conversion 48% Materials 100% 100% 100% Required A Direct Materials $ 168,180 1,244,750 $ 1,412,938 Required: a. Compute the equivalent units for the conversion cost calculation for March assuming Shirley Processing, Incorporated uses the weighted-average method. b. Compute the cost per equivalent unit for direct materials and conversion costs for March assuming Shirley Processing, Incorporated uses the weighted-average method. Complete this question by entering your answers in the tabs below. 100% 28% Conversion $ 28,390 646,748 $ 667,138 Required…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education