FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

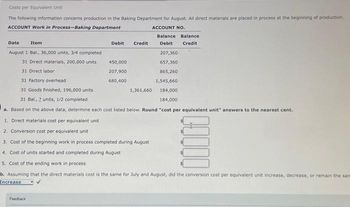

Transcribed Image Text:Costs per Equivalent Unit

The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production.

ACCOUNT Work in Process-Baking Department

ACCOUNT NO.

Date

Item

August 1 Bal., 36,000 units, 3/4 completed

31 Direct materials, 200,000 units

31 Direct labor

31 Factory overhead.

31 Goods finished, 196,000 units

31 Bal., 2 units, 1/2 completed

a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent.

1. Direct materials cost per equivalent unit

2. Conversion cost per equivalent unit

3. Cost of the beginning work in process completed during August

4. Cost of units started and completed during August

5. Cost of the ending work in process

b. Assuming that the direct materials cost is the same for July and August, did the conversion cost per equivalent unit increase, decrease, or remain the samm

Increase

Debit

Feedback

Credit

450,000

207,900

680,400

Balance Balance

Debit

Credit

1,361,660

207,360

657,360

865,260

1,545,660

184,000

184,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Costs per Equivalent Unit The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Balance Date Item Debit Credit Debit Credit August 1 Bal., 4,200 units, 3/5 completed 9,870 31 Direct materials, 75,600 units 143,640 153,510 31 Direct labor 31 Factory overhead 38,550 21,690 192,060 213,750 31 Goods finished, 76,500 units 206,424 31 Bal., ? units, 2/5 completed 7,326 7,326 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit $ X 2. Conversion cost per equivalent unit $ 3. Cost of the beginning work in process completed during August $ 4. Cost of units started and completed during August $ 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for July and August, did the…arrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department Date Item August 1 Bal., 36,000 units, 3/4 completed 31 Direct materials, 200,000 units 31 Direct labor 31 Factory overhead 31 Goods finished, 196,000 units 31 Bal., ? units, 1/2 completed Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest a. cent. Debit 450,000 207,900 680,400 Credit 1,361,660 ACCOUNT NO. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during August 4. Cost of units started and completed during August Balance Balance Debit Credit 207,360 657,360 865,260 1,545,660 184,000 184,000 00000 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for July and August, did the conversion cost per…arrow_forwardEquivalent Units of Production The following information concerns production in the Baking Department for December. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department Date Item Dec. 1 Bal., 4,200 units, 2/5 completed 31 Direct materials, 75,600 units 31 Direct labor 31 Factory overhead 31 Goods finished, 76,500 units 31 Bal., ? units, 3/5 completed Debit 113,400 34,410 19,350 Inventory in process, December 1 Credit 168,384 Whole Units ACCOUNT NO. Balance Debit a. Determine the number of units in work in process inventory at December 31. units 7,560 120,960 155,370 174,720 6,336 6,336 b. Determine the equivalent units of production for direct materials and conversion costs in December. If an amount is zero, enter in "0". Baking Department Equivalent Units of Production for Direct Materials and Conversion Costs For December Credit Equivalent Units Equivalent Direct Materials Units Conversionarrow_forward

- Cost of Units Completed and in Process The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process—Assembly Department Bal., 6,000 units, 55% completed 15,000 To Finished Goods, 138,000 units ? Direct materials, 141,000 units @ $1.4 197,400 Direct labor 207,100 Factory overhead 80,495 Bal., ? units, 25% completed ? Cost per equivalent units of $1.40 for Direct Materials and $2.10 for Conversion Costs. a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. 1. Cost of beginning work in process inventory completed this period $fill in the blank 1 2. Cost of units transferred to finished goods during the period $fill in the blank 2 3. Cost of ending work in process inventory $fill in the blank 3 4.…arrow_forwardThe charges to Work in Process—Baking Department for a period as well as information concerning production are as follows. The Baking Department uses the average cost method, and all direct materials are placed in process during production.Work in Process – Baking DepartmentBeginning balance 900 units, 40% completed $2,466 To finished goods, 8,100 units ?Direct materials, 8,400 units 43,500Direct labor 18,200Factory overhead 7,504Ending balance 1,200 units, 60% completed ?Determine the following: a. The number of whole units to be accounted for and to be assigned costs b. The number of equivalent units of production c. The cost per equivalent unit d. The cost of units transferred to Finished Goods e. The cost of units in ending Work in Processarrow_forwardplease read the first picture and answer questions on the second page. Thanks for your timearrow_forward

- Costs per Equivalent Unit The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Date Mar. Item 1 Bal., 5,100 units, 4/5 completed 31 Direct materials, 91,800 units 31 Direct labor Debit 156,060 40,880 23,002 Credit Debit 222,996 11,322 167,382 208,262 231,264 8,268 8,268 31 Factory overhead 31 Goods finished, 93,000 units 31 Bal. ? units, 3/5 completed a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during March 4. Cost of units started and completed during March 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for February and March, did the conversion cost per equivalent…arrow_forwardThe charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 3,000 units, 50% completed 9,150 To Finished Goods, 69,000 units ? Direct materials, 71,000 units @ $2.1 149,100 Direct labor 100,100 Factory overhead 38,900 Bal. ? units, 40% completed ? Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount is zero or a blank, enter in "0". Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs Whole Units Equivalent UnitsDirect Materials Equivalent UnitsConversion Inventory in process, beginning Started and completed Transferred to…arrow_forwardEquivalent Units of Production and Related Costs The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 8,000 units, 65% completed 31,880 To Finished Goods, 184,000 units ? Direct materials, 188,000 units @ $2.10 394,800 Direct labor 404,400 Factory overhead 157,320 Bal., ? units, 20% completed ? Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount is zero or a blank, enter in "0". Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs WholeUnits Equivalent UnitsDirect Materials Equivalent UnitsConversion Inventory in process, beginning…arrow_forward

- Equivalent Units of Production: Weighted average method The following information concerns production in the Finishing Department for May. The Finishing Department uses the Weighted average method. ACCOUNT Work in Process—Finishing Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit May 1 Bal., 20,300 units, 75% completed 121,800 31 Direct materials, 99,500 units 364,170 485,970 31 Direct labor 225,800 711,770 31 Factory overhead 229,400 941,170 31 Goods transferred, 105,600 units 906,048 35,122 31 Bal., ? units, 30% completed 35,122 a. Determine the number of units in work in process inventory at the end of the month.fill in the blank 1 units b. Determine the number of whole units to be accounted for and to be assigned costs and the equivalent units of production for May. Assume that direct materials are placed in process during production. Whole units to…arrow_forwardThe charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department 21,200 To Finished Goods, 115,000 units 153,400 370,300 144,050 Bal., 5,000 units, 70% completed Direct materials, 118,000 units @ $1.3 Direct labor Factory overhead Bal., ? units, 35% completed Cost per equivalent units of $1.30 for Direct Materials and $4.50 for Conversion Costs. a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) b. Did the production costs change from the preceding period? 0000 c. Assuming that the direct materials cost per unit did…arrow_forwardCost of Units Completed and in Process The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process—Assembly Department Bal., 6,000 units, 45% completed 16,290 To Finished Goods, 138,000 units ? Direct materials, 141,000 units @ $1.5 211,500 Direct labor 292,800 Factory overhead 113,925 Bal., ? units, 55% completed ? Cost per equivalent units of $1.50 for Direct Materials and $2.90 for Conversion Costs. a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. 1. Cost of beginning work in process inventory completed this period $ 2. Cost of units transferred to finished goods during the period $ 3. Cost of ending work in process inventory $ 4. Cost per unit of the completed beginning work in process…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education