FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

a. Determine the number of units transferred to the next department.

b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places.

|

Cost per equivalent unit of direct materials Cost per equivalent unit of direct materials |

c. Determine the cost of units started and completed in November.

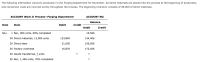

Transcribed Image Text:The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production,

and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $9,000 of direct materials.

ACCOUNT Work in Process-Forging Department

ACCOUNT NO.

Balance

Date

Item

Debit

Credit

Debit

Credit

Nov.

1 Bal., 900 units, 60% completed

10,566

30 Direct materials, 12,900 units

123,840

134,406

30 Direct labor

21,650

156,056

30 Factory overhead

16,870

172,926

30 Goods transferred, ? units

?

30 Bal., 1,400 units, 70% completed

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please refer to the attached images.arrow_forwardMagic Company adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of August is available. Work in process, August 1 (65% complete with respect to conversion) Started in August Completed Work in process, August 31 (71% complete with respect to conversion) Required: a. Compute the equivalent units for materials costs and for conversion costs using the weighted-average method. b. Compute the equivalent units for materials costs and for conversion costs using the FIFO method. a. Using the weighted-average method b. Using the FIFO method Equivalent Units Materials 17,700 118,900 118,900 17,700 Conversion Costsarrow_forwardSuppose that manufacturing is performed in sequential production departments. Prepare a journalentry to show a transfer of partially completed units from the first department to the second department. Assume the amount of costs transferred is $50,000.arrow_forward

- Reconcile the number of physical units to find the missing amounts. Determine the number of units started and completed each month. Beginning Work in Process Ending Work in Process Conversion Conversion Complete Complete (percent) (percent) Month February June September December Units 2,000 4,700 3,800 48 66 27 39 Units Started 23,900 26,400 22,900 Units Completed 23 36 59 76 Units Started and Completedarrow_forward7. Using the following terms, complete the production cost report shown below: Ending work in process Total costs to account for Cost per equivalent unit Units started into production Manufacturing Overhead Beginning work in process Total units accounted for Raw Materials Inventory Transferred in costs Incurred during the period Completed and transferred out Total costs accounted for Finished Goods Inventory Equivalent units Total units to account for Materials are added at the beginning of the production process and ending work in process inventory is 80% complete with regard to conversion costs. Use the information provided to complete a production cost report using the weighted-average method. Cost to Account For Beginning inventory: materials $ 25,000 Beginning inventory: conversion 30,500 Direct materials 2,000 Direct labor 45,000 Applied overhead…arrow_forwardUsing the following terms and following the format in the textbook, prepare the worksheet to show the calculation to answer the question: Units completed and transferred Cost per material Cost per conversion out Equivalent units conversion Beginning inventory Units started in production Total units to account for Total work in process Ending inventory Units transferred in Total units accounted for Costs to account for Question: How many units were started into production in a period if there were zero units of beginning work in process inventory, 1,100 units in ending work in process inventory, and 21,500 completed and transferred out units? PLEASE NOTE: For units, use commas as needed (i.e. 1,234). Term Unitsarrow_forward

- Savitaarrow_forwardI need to finish with these three questions and need help please. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. 2. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs. 3.Discuss the uses of the cost of production report and the results of part (c).arrow_forwardDaosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forward

- what is the formula to calcuate direct materials % added for beginning wip, started and completed and ending wip as well as converion percent for started nd completed.arrow_forwardDengo Company makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. October data for the Roasting department follow. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Costs added this period Direct materials. Conversion Total costs to account for Units 4,400 20, 600 25,000 3,800 $314, 760 1,374,948 Direct Materials Conversion Percent Percent Complete Complete 100% 30% 100% $ 124,790 1,689, 708 $ 1,814, 498 70%arrow_forwardThe costs per equivalent unit of direct materials and conversion in the Filling Department of Eve Cosmetics Company are $1.65 and $0.55, respectively. The equivalent units to be assigned costs are as follows: The beginning work in process inventory had a cost of $1,340. Determine the cost of completed and transferred-out production and the ending work in process inventory. If required, round to the nearest dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education