FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

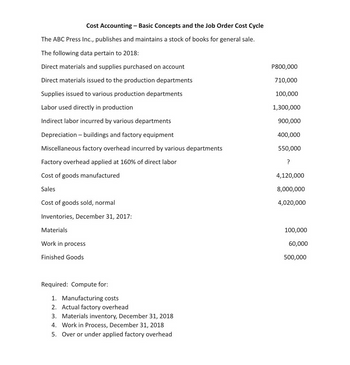

Transcribed Image Text:Cost Accounting - Basic Concepts and the Job Order Cost Cycle

The ABC Press Inc., publishes and maintains a stock of books for general sale.

The following data pertain to 2018:

Direct materials and supplies purchased on account

Direct materials issued to the production departments

Supplies issued to various production departments

Labor used directly in production

Indirect labor incurred by various departments

Depreciation - buildings and factory equipment

Miscellaneous factory overhead incurred by various departments

Factory overhead applied at 160% of direct labor

Cost of goods manufactured

Sales

Cost of goods sold, normal

Inventories, December 31, 2017:

Materials

Work in process

Finished Goods

Required: Compute for:

1. Manufacturing costs

2. Actual factory overhead

3. Materials inventory, December 31, 2018

4. Work in Process, December 31, 2018

5. Over or under applied factory overhead

P800,000

710,000

100,000

1,300,000

900,000

400,000

550,000

?

4,120,000

8,000,000

4,020,000

100,000

60,000

500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reports the following information: Direct Labor Direct Materials Used Raw Materials Purchased Cost of Goods Manufactured Ending Work-in-Process Inventory Corporate Headquarters' Property taxes Manufacturing Overhead Incurred Calculate the beginning balance of Work-in-Process Inventory O $4,500 O $5,000 O $21.000 59.400 $6,000 3.000 9,000 13,000 1.400 900 400arrow_forwardwork Required information [The following information applies to the questions displayed below.] The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. April 30 May 31 Inventories Raw materials Work in process $ 29,000 9,600 51,000 Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 1. Incurred other overhead costs (record credit to Other Accounts). 2. Applied overhead to work in process. Prepare journal entries for the above transactions for the month of May. View transaction list Journal entry worksheetarrow_forwardCurrent Attempt in Progress The following information is available for Marin Company. Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Manufacturing overhead Sales revenue (a) January 1, 2022 $17,600 eTextbook and Media 11,400 22,700 2022 $126,000 184,800 151,200 764,400 December 31, 2022 $25,200 14,500 17,640 Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) MARIN COMPANY Cost of Goods Manufactured Schedule QUO Attempte:0 of 3 used Submit Answerarrow_forward

- The Work in Process Inventory account for DG Manufacturing follows. Compute the cost of jobs completed and transferred to Finished Goods Inventory. Work in Process Inventory Debit Credit Beginning WIP 4,500 Direct materials 47,100 Direct labor 29,600 Applied overhead 15,800 To finished goods ? Ending WIP 8,900 The cost of jobs transferred to finished goods is:arrow_forwardi need the answer quicklyarrow_forwardRequired information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare its schedule of cost of goods manufactured for the year ended December 31.arrow_forward

- Required information [The following information applies to the questions displayed below.] The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Inventories Raw materials Work in process Finished goods Beginning of period $ 41,000 9,800 54,000 Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual) Indirect materials used. Indirect labor used Other overhead costs End of Period $ 37,000 19,700 35,000 $ 197,000 100,000 10,000 23,000 109,000arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,500 16,100 7,400 34,750 19,800 21,800 26,200 7,200 12,600 27,000 14,750 4,940 41,500 58,000 296,220 26,000 13,600 Pepper Company $ 17,350 22,050 9,450 25,150 39,400 14,600 20, 200 8,000 15,750 43,000 14,320 3,750 60,500 46,000 388,450 18,700 21,950 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of…arrow_forwardRequired information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. . Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses. Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,200,000 52,000 68,000 88,000 239,000 287,000 43,000 34,000 68,000 109,000 174,000 62,000 82,000 106,000arrow_forward

- Required information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,700 16,800 8,700 30,250 24,600 20,600 24,100 Required 1 5,800 12,600 24,500 14,900 5,660 40,000 Required 2 59, 200 283,890 34,000 14,200 Pepper Company $ 19,300 22,800 12,600 23,500 43,800 13,600 16,400 7,600 14,750 53,000 14,400 2,250 67,500 48,700 1. Compute the total prime costs for both Garcon Company and Pepper Company. 2. Compute the total conversion…arrow_forwardUse the cost information below for ABC Corporation to find the cost of goods manufactured (COGM) for the current year: Direct materials used Direct labor Total factory overhead Work in process inventory, beginning Work in process inventory, ending Multiple Choice $24,500. $15,200. $18,400. $19,300. $ 6,600 8,600 6,700 4,600 7,200arrow_forwardanswer in text form please (without image), answer both the partsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education