FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

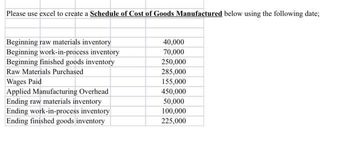

Transcribed Image Text:Please use excel to create a Schedule of Cost of Goods Manufactured below using the following date;

Beginning raw materials inventory

Beginning work-in-process inventory

Beginning finished goods inventory

Raw Materials Purchased

Wages Paid

Applied Manufacturing Overhead

Ending raw materials inventory

Ending work-in-process inventory

Ending finished goods inventory

40,000

70,000

250,000

285,000

155,000

450,000

50,000

100,000

225,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Beginning Inventory $ 96,000 223,500 Ending Inventory $ 116,350 60,500 243,300 200,100 150,500 44,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Direct labor Direct labor-Cutting Direct labor-Stitching Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs Factory Overhead Rates Cutting Stitching Sales $ 115,000 26,250 $ 24,600 98,400 $ 68,400 58,600 65,000 (150% of direct materials used) (120% of direct labor used) $ 976,000 Requirement General Journal General Ledger Trial Balance Raw Materials Cost of Goods Mfg Cutting Cost of Goods Mfg Stitching Cost of Goods Sold Gross Profit Verify the ending balance in raw materials inventory. Materials used should be indicated…arrow_forwardA process manufacturer's first production department reports the following. Beginning work in process inventory Units started this period Conversion Costs added this period. Direct materials Conversion Total costs to account for Units 80,000 406,000 384,000 102,000 Completed and transferred out Ending work in process inventory The first production department reports the cost information below. Beginning work in process inventory Direct materials $184,444 1,327,279 885,242 Cost per equivalent unit of production: FIFO method Direct Materials Conversion Percent Complete 65% 46,359 $ 230,803 Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) 858 2,212,521 $ 2,443,324 Percent Complete 35% Compute the department's costs per equivalent unit of production for both direct materials and conversion. Note: Round "Cost per EUP" to 2 decimal places. 358 Direct Materials Conversionarrow_forwardThe following data show the units in beginning work in process inventory, the number of units started, the number of units transferred, and the percent completion of the ending work process for conversion. Given that materials are added at the beginning of the process. Beginning Quarter WIP Transferred Conversion (%) 134,350 133,550 25 522 132,593 132,515 24 337 133,245 133,432 20 487 134,845 134,032 23 What are the equivalent units for material and conversion costs for each quarter using the weighted-average method? Assume that the quarters are independent. Quarter 1 Quarter 2 Quarter 3 Quarter 4 1 2 3 4 - Started Out Units for material costs Units for conversion costsarrow_forward

- Please explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwardPlease help mearrow_forwardUse the included information about Raw Materials Inventory (RM), Work in Process Inventory (WIP), Finished Goods Inventory (FG), and the Income Summary (IS). Determine the total conversion costs added. 1 2 3 4 5 6 7 1 00 RM B Bal T1 T2 T3 T4 E Bal 8 9 FG 10 B Bal 11 T1 12 T2 13 T3 14 T4 15 E Bal 2 Debits 4300 29 050 Debits 4800 45 592 3 Credits 28 000 Credits 33 500 4 5 WIP B Bal DM DL FOH CGM E Bal IS Rev CGS V Op Exp F Op Exp NIBT 6 Debits 8920 28 000 17 430 11 130 Debits 33 500 5130 7960 7 Credits 45 592 Credits 66 200arrow_forward

- Direct materials: Beginning inventory Purchases Ending inventory Direct manufacturing labor Manufacturing overhead Beginning work-in-process inventory Ending work-in-process inventory Beginning finished goods inventory Ending finished goods inventory P 40,000 123,200 20,800 32,000 24,000 8,000 1,600 48,000 32,000 Required: A. What is the cost of direct materials used during 2022? B. What is cost of goods manufactured for 2022? C. What is cost of goods sold for 2022? D. What amount of prime costs was added to production during 2022? E. What amount of conversion costs was added to production during 2022?arrow_forwarddls.3arrow_forwardCullumber Company's accounting records reflect the following inventories: Raw materials inventory Work in process inventory Finished goods inventory O $1280000. O $750000. O $840000. O $1230000. Dec. 31, 2022 $390000 Save for Later 300000 190000 Dec. 31, 2021 $340000 160000 During 2022, $890000 of raw materials were purchased, direct labor costs amounted to $670000, and manufacturing overhead incurred was $640000. (Assume that all raw materials used were direct materials.) The total raw materials available for use during 2022 for Cullumber Company is 150000 Attempts: 0 of 1 used Submit Answerarrow_forward

- Inventories Raw materials, beginning Work in process, beginning Finished goods, beginning Cost of goods manufactured Cost of goods sold (not considering over- or underapplied overhead) Sales Predetermined overhead rate based on direct materials used $ 39,000 13,400 Required 2 9,750 96,290 0 84,200 101,000 Finished Goods Inventory 90% 1. Complete the T-accounts for each of the three Inventory accounts using the data provided in the above table. 2. Compute overapplied or underapplied overhead. Complete this question by entering your answers in the tabs below. Costs incurred for the period Raw materials purchases Direct materials used Direct labor used. Factory overhead (actual) Required 1 Complete the T-accounts for each of the three inventory accounts using the data provided in the above table. Raw Materials Inventory Indirect materials used Indirect labor used Other overhead costs Work in Process Inventory 0 $19,460 45,250 23,800 10,300 17,400 5,300arrow_forwardSubject: acountingarrow_forwardInformation related to Scullio Manufacturing appears below. What is the ending balance in the work-in-process (WIP) inventory account? Cost of good manufactured 44,500 Beginning WIP inventory 32,000 Total current manufacturing costs 35,000 Manufacturing overhead applied 11,000 Direct labor cost 16,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education