FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

H1.

Account

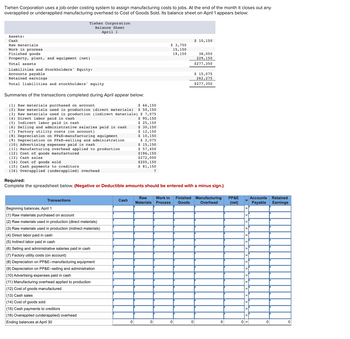

Transcribed Image Text:Tiehen Corporation uses a job-order costing system to assign manufacturing costs to jobs. At the end of the month it closes out any

overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Its balance sheet on April 1 appears below:

Tiehen Corporation

Balance Sheet

April 1

Assets:

Cash

Raw materials

Work in process

Finished goods

Property, plant, and equipment (net)

Total assets

Liabilities and Stockholders' Equity:

Accounts payable

Retained earnings

Total liabilities and stockholders' equity

Summaries of the transactions completed during April appear below:

(1) Raw materials purchased on account

$ 66,150

(2) Raw materials used in production (direct materials) $ 50,150

$ 7,075

(3) Raw materials used in production (indirect materials)

(4) Direct labor paid in cash

$ 95,150

(5) Indirect labor paid in cash

$ 25,150

$ 30,150

$ 12,150

$ 10,150

$ 2,075

$ 15,150

$ 57,450

$196,150

$272,000

$205,150

$ 81,150

(6) Selling and administrative salaries paid in cash

(7) Factory utility costs (on account)

(8) Depreciation on PP&E-manufacturing equipment

(9) Depreciation on PP&E-selling and administration

(10) Advertising expenses paid in cash

(11) Manufacturing overhead applied to production

(12) Cost of goods manufactured

(13) Cash sales.

(14) Cost of goods sold

(15) Cash payments to creditors

(16) Overapplied (underapplied) overhead

Transactions

Beginning balances, April 1

(1) Raw materials purchased on account

(2) Raw materials used in production (direct materials)

(3) Raw materials used in production (indirect materials)

(4) Direct labor paid in cash

(5) Indirect labor paid in cash

(6) Selling and administrative salaries paid in cash

(7) Factory utility costs (on account)

(8) Depreciation on PP&E--manufacturing equipment

(9) Depreciation on PP&E--selling and administration

(10) Advertising expenses paid in cash

(11) Manufacturing overhead applied to production

(12) Cost of goods manufactured

(13) Cash sales

(14) Cost of goods sold

(15) Cash payments to creditors

(16) Overapplied (underapplied) overhead

Ending balances at April 30

Cash

0

?

Required:

Complete the spreadsheet below. (Negative or Deductible amounts should be entered with a minus sign.)

$3,750

15,150

19,150

0

$ 10,150

0

38,050

229, 150

$277,350

Raw Work in Finished Manufacturing

Materials Process Goods Overhead

0

$ 15,075

262,275

$277,350

0

PP&E

(net)

|=

=

0=

Accounts Retained

Payable Earnings

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education