Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:<

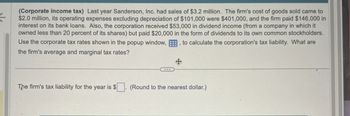

(Corporate income tax) Last year Sanderson, Inc. had sales of $3.2 million. The firm's cost of goods sold came to

$2.0 million, its operating expenses excluding depreciation of $101,000 were $401,000, and the firm paid $146,000 in

interest on its bank loans. Also, the corporation received $53,000 in dividend income (from a company in which it

owned less than 20 percent of its shares) but paid $20,000 in the form of dividends to its own common stockholders.

to calculate the corporation's tax liability. What are

Use the corporate tax rates shown in the popup window,

the firm's average and marginal tax rates?

The firm's tax liability for the year is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve this problemarrow_forwardGreen Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's earnings before taxes (EBT) * $4,627 $5,638 $5,114 $5,369 $4,870 Mori Company's net income last year was $25,000 and cash dividends declared and paid to the company's stockholders totaled $10,000. Changes in selected balance sheet accounts for the year appear below: Increases (Decreases) Debit balances: Accounts receivable $(6,000) Inventory $2,000 Prepaid expenses $(1,000) Long term investments $20,000 Credit balances: Accumulated depreciation $12,000 Accounts payable $9,000 Taxes payable $(5,000) Based solely on this information, the net cash provided by operations under the indirect method on the statement of cash flows would be: * $46,000 $36,000 $37,000 $4,000arrow_forward1. Tommy’s Woodworking had sales of $4 million this past year. Its COGS was $2.75 million and its operating expenses were $800,000. Interest expenses on outstanding debt were $200,000 and the company paid $40,000 in stock dividends. Its tax rate is 35%. What was the company’s taxable income (EBT) and tax liability (tax expense)?arrow_forward

- Dollar Inc. recently reported operating income (EBIT) of $3.25 million, depreciation of $0.56 million, and had a tax rate of 40%. The firm's expenditures on fixed assets and net operating working capital totaled $0.37 million. How much was its free cash flow, in millions? $2.36 $1.93 $2.03 $2.14 $2.25arrow_forwardThe Little Books Inc. recently reported $3 million of net income. The company’s EBIT was $6 million and the corporate tax rate was 40%. Calculate the firm’s interest expense.arrow_forward(Corporate income tax) Last year Sanderson, Inc. had sales of $3.0 million. The firm's cost of goods sold came to $2.0 million, its operating expenses excluding depreciation of $100,000 were $400,000, and the firm paid $150,000 in interest on its bank loans. Also, the corporation received $50,000 in dividend income (from a company in which it owned less than 20 percent of its shares but paid $25,000 in the form of dividends to its own common stockholders. Use the corporate tax rates shown in the popup window,, to calculate the corporation's tax liability. What are the firm's average and marginal tax rates? Etext pages @ 2 The firm's tax liability for the year is $. (Round to the nearest dollar.) S W * X H Get more help - # 3 E D 80 13 C $ 4 900 000 14 R F V % 5 FS T G A 6 B MacBook Air F6 Y H & 7 N F7 U J * 8 DII Fa I M l 9 MOSISO D K DD 19 O V H - C 0 L F10 P > Clear all - : ; I F11 { [ command option + 11 = ? Check answer "1 1 13) F12 } 1 deletarrow_forward

- (Corporate income tax) The Robbins Corporation is an oil wholesaler. The firm's sales last year were $1.01 million, with the cost of goods sold equal to $590,000. The firm paid interest of $211,250 and its cash operating expenses were $104,000. Also, the firm received $45,000 in dividend income from a firm in which the firm owned 22% of the shares, while paying only $11,000 in dividends to its stockholders. Depreciation expense was $48,000. Use the corporate tax rates shown in the popup window, , to compute the firm's tax liability. What are the firm's average and marginal tax rates? ☑ The Robbins Corporation's tax liability for the year is $ (Round to the nearest dollar.) Data table Taxable Income Marginal Tax Rate $0-$50,000 15% $50,001 - $75,000 25% $75,001-$100,000 34% $100,001 - $335,000 39% $335,001-$10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001-$18,333,333 38% Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet.)arrow_forward(Corporate income tax) Last year Sanderson, Inc. had sales of $3.2 million. The firm's cost of goods sold came to $2.1 million, its operating expenses excluding Kdepreciation of $100,000 were $402,000, and the firm paid $152,000 in interest on its bank loans. Also, the corporation received $55,000 in dividend income (from a company in which it owned less than 20 percent of its shares) but paid $26,000 in the form of dividerids to its own common stockholders. Use the corporate tax rates shown in the popup window, to calculate the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar.) w an example Data table Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 Marginal Tax Rate 15% 25% 34% 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38 % 35% Over $18,333,333 (Click on the icon in order to copy its contents into a spreadsheet.)…arrow_forwardLast year the P.M. Postem corporation had sales of $419,000, with a cost of goods sold of $111,000. The firm’s operating expenses were $126,000, and its increase in retained earnings was $85,700. There are currently 20,000 shares of common stock outstanding, the firm’s pays a $1.63 dividend per share, and the firm has no interest-bearing debt. A. Assuming the firm’s earnings are taxed at 35%, construct the firm’s income statement. Complete the income statement below: round to the nearest dollar Revenues Cost of goods sold Gross profit Operating expenses Net operating income Interest expenses Earnings before taxes Income taxes Net incomearrow_forward

- Broward Manufacturing recently reported the following information:Net income $615,000ROA 10%Interest expense $202,950Accounts payable and accruals $950,000Broward’s tax rate is 30%. Broward finances with only debt and common equity, so it hasno preferred stock. 40% of its total invested capital is debt, and 60% of its total investedcapital is common equity. Calculate its basic earning power (BEP), its return on equity(ROE), and its return on invested capital (ROIC).arrow_forwardMacon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $38 million. Included in the income was interest expense of $3,300,000. The company's tax rate was 40%. Total assets were $465 million, current liabilities were $109,000,000, and $67,000,000 of the current liabilities are noninterest bearing. What are the invested capital and ROI for Macon? Enter your answer in whole dollar. Round "ROI" answer to two decimal places.arrow_forwardNeed sum helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education