FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

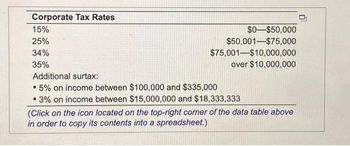

Transcribed Image Text:Corporate Tax Rates

15%

25%

34%

35%

$0-$50,000

$50,001-$75,000

$75,001-$10,000,000

over $10,000,000

Additional surtax:

• 5% on income between $100,000 and $335,000

• 3% on income between $15,000,000 and $18,333,333

(Click on the icon located on the top-right corner of the data table above

in order to copy its contents into a spreadsheet.)

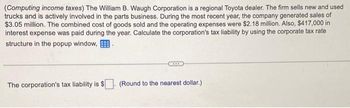

Transcribed Image Text:(Computing income taxes) The William B. Waugh Corporation is a regional Toyota dealer. The firm sells new and used

trucks and is actively involved in the parts business. During the most recent year, the company generated sales of

$3.05 million. The combined cost of goods sold and the operating expenses were $2.18 million. Also, $417,000 in

interest expense was paid during the year. Calculate the corporation's tax liability by using the corporate tax rate

structure in the popup window,

The corporation's tax liability is $

D

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need sum helparrow_forwardHank started a new business, Hank's Donut World (HW for short), in June of last year. He has requested your advice on the following specific tax matters associated with HW's first year of operations. Hank has estimated HW's income for the first year as follows: Revenue: Donut sales Catering revenues Expenditures: Donut supplies Catering expense Salaries to shop employees Rent expense Accident insurance premiums Other business expenditures Net Income $ 290,000 96,390 $394,398 $153,220 39,640 64,000 49,940 8,952 9,610 -325,362 $ 69,028 HW operates as a sole proprietorship, and Hank reports on a calendar year. Hank uses the cash method of accounting and plans to do the same with HW (HW has no inventory of donuts because unsold donuts are not salable). HW does not purchase donut supplies on credit, nor does it generally make sales on credit. Hank has provided the following details for specific first-year transactions. 1. A small minority of HW clients complained about the catering service.…arrow_forwardPlease help me solve this question. thanks so much!arrow_forward

- Tennis Pro is headquartered in Virginia. Assume it has a state income tax base of $240,000 after making the appropriate adjustments. Of this amount, $60,000 was non-business income.The non- business income included the following: $8,000 of dividend income, $15,000 of interest income, $37,000 of royalty income for an intangible used in Maryland. Tennis Pro has the following sales, payroll and property factors: Virginia Maryland Sales 40% 20% Payroll 80% 5% Property 90% 5% Assume that Virginia uses an equally weighted three-factor formula. Assuming a Virginia corporate tax rate of 6 percent, what is Tennis Pro's Virginia state tax liability? (Round your answer to the nearest whole number.)arrow_forward(Corporate income tax) G. R. Edwin Inc. had sales of $5.99 million during the past year. The cost of goods sold amounted to $2.9 million. Operating expenses totaled $2.56 million, and interest expense was $21,000. Use the corporate tax rates shown in the popup window, to determine the firm's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $. (Round to the nearest dollar.) The firm's average tax rate is %. (Round to two decimal places.) The firm's marginal tax rate is %. (Round to the nearest integer.) 2 W S X mmand 3 20 E D $ 4 C DOO DDD F4 R F % 5 V FS T G 6 B MacBook Air F6 Y & 7 Data table H Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet) 44 F7 U N Taxable Income $0-$50,000 $50,001-$75,000 $75,001-$100,000 $100,001-$335,000 39% $335.001-$10.000.000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% * 8 J DII 76 - Print 1 M 9 K DE Marginal Tax Rate 15% 25% MOSISO 19 O Done 1…arrow_forwardA corporation earns $8.30 per share before taxes. The corporate tax rate is 39%, the personal tax rate on dividends is 15%, and the personal tax rate on non-dividend income is 36%. What is the total amount of taxes paid per share if the company has a payout ratio of 45%? Answer to two decimals (dollars and cents) A corporation earns $8.30 per share before taxes. The corporate tax rate is 39%, the personal tax rate on dividends is 15%, and the personal tax rate on non-dividend income is 36%. What is the total amount of taxes paid per share if the company has a payout ratio of 45%? Answer to two decimals (dollars and cents) ASAParrow_forward

- Please Do not Give image formatarrow_forwarda calendar-year C Corporation, is considering investing in a business expenditure with a cost of $10,000. If $8,000 of the cost of the expenditure can be used as a tax credit rather than a tax deduction of $10,000 and the marginal tax rate is 21%, how much additional tax savings would the expenditure generate as a result of the tax credit relative to the tax deduction? a. $2,000 b. $8,000 c. $5,900 d. $2,100arrow_forwardAns.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education