FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

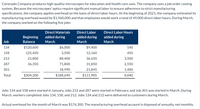

Question

Coronado Company produces high-quality microscopes for education and health care uses. The company uses a job order costing system. Because the microscopes’ optics require significant manual labor to ensure adherence to strict manufacturing specifications, the company applies overhead on the basis of direct labor hours. At the beginning of 2021, the company estimated its manufacturing overhead would be $1,960,000 and that employees would work a total of 49,000 direct labor hours. During March, the company worked on the following five jobs:

Jobs 134 and 158 were started in January, Jobs 212 and 287 were started in February, and Job 301 was started in March. During March, workers completed Jobs 134, 158, and 212. Jobs 134 and 212 were delivered to customers during March.

Actual overhead for the month of March was $176,300. The manufacturing overhead account is disposed of annually, not monthly.

| Job | Beginning Balance |

Direct Materials added during March |

Direct Labor added during March |

Direct Labor Hours added during March |

|||||

|---|---|---|---|---|---|---|---|---|---|

|

134

|

$120,600 | $6,000 | $9,400 | 140 | |||||

|

158

|

125,450 | 3,500 | 12,160 | 450 | |||||

|

212

|

21,800 | 88,400 | 36,650 | 3,500 | |||||

|

287

|

36,350 | 71,800 | 31,850 | 2,550 | |||||

|

301

|

18,990 | 21,845 | 1,400 | ||||||

|

Total

|

$304,200 | $188,690 | $111,905 | 8,040 |

Jobs 134 and 158 were started in January, Jobs 212 and 287 were started in February, and Job 301 was started in March. During March, workers completed Jobs 134, 158, and 212. Jobs 134 and 212 were delivered to customers during March.

Actual overhead for the month of March was $176,300. The manufacturing overhead account is disposed of annually, not monthly.

Calculate the total cost for each of the five jobs as of March 31.

| Job 134 | Job 158 | Job 212 | Job 287 | Job 301 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Total Cost

|

$enter a dollar amount | $enter a dollar amount | $enter a dollar amount | $enter a dollar amount | $enter a dollar amount |

Transcribed Image Text:Coronado Company produces high-quality microscopes for education and health care uses. The company uses a job order costing

system. Because the microscopes' optics require significant manual labor to ensure adherence to strict manufacturing

specifications, the company applies overhead on the basis of direct labor hours. At the beginning of 2021, the company estimated its

manufacturing overhead would be $1,960,000 and that employees would work a total of 49,000 direct labor hours. During March,

the company worked on the following five jobs:

Direct Materials

Direct Labor

Direct Labor Hours

Beginning

added during

added during

added during

Job

Balance

March

March

March

134

$120,600

$6,000

$9,400

140

158

125,450

3,500

12,160

450

212

21,800

88,400

36,650

3,500

287

36,350

71,800

31,850

2,550

301

18,990

21,845

1,400

Total

$304,200

$188,690

$111,905

8,040

Jobs 134 and 158 were started in January, Jobs 212 and 287 were started in February, and Job 301 was started in March. During

March, workers completed Jobs 134, 158, and 212. Jobs 134 and 212 were delivered to customers during March.

Actual overhead for the month of March was $176,300. The manufacturing overhead account is disposed of annually, not monthly.

Transcribed Image Text:Calculate the total cost for each of the five jobs as of March 31.

Job 134

Job 158

Job 212

Job 287

Total

$

$

Cost

%24

%24

Expert Solution

arrow_forward

CALCULATION

WORKING :

Overhead rate = $1,960,000 / 49,000 = 40 per direct labour hour

| JOB | OVERHEAD APPLIED |

| 134 | 140 X 40 = 5,600 |

| 158 | 450 X 40 = 18,000 |

| 212 | 3,500 X 40 = 140,000 |

| 287 | 2,550 X 40 = 102,000 |

| 301 | 1,400 X 40 = 56,000 |

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Robert Company produces pipes for concert-quality organs. Each job is unique. In April 2019, it completed all outstanding orders, and then, in May 2019, it worked on only two jobs, M1 and M2: (Click the icon to view the job information.) Direct manufacturing labor is paid at the rate of $26 per hour. Manufacturing overhead costs are allocated at a budgeted rate of $18 per direct manufacturing labor-hour. Only Job M1 was completed in May. Read the requirements. Requirement 1. Compute the total cost for Job M1. Job Costs May 2019 Total costs Job M1 Data table Robert Company, May 2019 Direct materials Direct manufacturing labor Job M1 $78,000 273,000 Job M2 $ 56,000 208,000arrow_forwardDream Makers is a small manufacturer of gold and platinum jewelry. It uses a job costing system that applies overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $465,800, and management budgeted 34,000 direct labor-hours. The company had no Materials, Work-in-Process, or Finished Goods Inventory at the beginning of April. These transactions were recorded during April: April insurance cost for the manufacturing property and equipment was $1,850. The premium had been paid in January. Recorded $1,060 depreciation on an administrative asset. Purchased 21 pounds of high-grade polishing materials at $16 per pound (indirect materials). Paid factory utility bill, $6,550, in cash. Incurred 4,000 hours and paid payroll costs of $160,000. Of this amount, 1,000 hours and $20,000 were indirect labor costs. Incurred and paid other factory overhead costs, $6,300. Purchased $25,000 of materials. Direct materials included unpolished semiprecious stones and gold.…arrow_forwardDelph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forward

- Roger Company produces pipes for concert-quality organs. Each job is unique. In April 2019, it completed all outstanding orders, and then, in May 2019, it worked on only two jobs, M1 and M2: (Click the icon to view the job information.) Direct manufacturing labor is paid at the rate of $25per hour. Manufacturing overhead costs are allocated at a budgeted rate of $16per direct manufacturing labor-hour. Only Job M1 was completed in May. Read the requirements. Requirement 1. Compute the total cost for Job M1. Job Costs May 2019 Total costs Job M1 ... Data table Roger Company, May 2019 Direct materials Direct manufacturing labor Print Job M1 $70,000 275,000 209,000 Job M2 $ 54,000 Done - Xarrow_forwardAli Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department X and machine hours in Department Z. In establishing the predetermined overhead rates for 2020, the following estimates were made for the year. Department X Z Manufacturing overhead $78000 $75000 Direct labor costs $60000 $60000 Direct labor hours 5000 4000 Machine hours 10000 15000 During March, the job cost sheets showed the following costs and production data. Department X Z Direct materials used $9200 $6400 Direct labor costs $4800 $5000 Manufacturing overhead incurred $6600 $6210 Direct labor hours 400 420 Machine hours 800 1260 Required: Compute the predetermined overhead rate for…arrow_forwardCards by Hallmark allocate factory overhead based on hours used by a piece of equipment. At the beginning of the period, the company estimates factory overhead to be $25,000 and expects the equipment to be used for 4,000 hours. During the period Job, 22 requires 1,900 hours of use of the equipment. Job 23 requires 1,700 hours, and Job 24 requires 100 hours. As of March 31, actual indirect costs include: $4,000 for indirect materials, $9,100 for indirect labor, $6,000 for utilities, and $5,200 for equipment depreciation. Required: a. Prepare the journal entry to record the costs considered factory overhead. b. Calculate the predetermined factory overhead rate. c. Prepare the journal entry required to apply the factory overhead to the jobs at the end of the month.arrow_forward

- Attached herewith is the picture; Prepare the T- accounts for the actual Factory overheadarrow_forwardPlease create a Statement of Cost of Goods Manufacturedarrow_forwardThe Fleming Company of Anguilla (FCA) designs and produces automotive parts. In 2019. actual variable manufacturing overhead is $290,000. FCA's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged nonconpetitive prices, so FCA's controller Matthias Hodge reaálizes that it is time to exanine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design production, and engineering Interviews with the department personnel and examination of time records yield the following detailed information: Usage of Cost of Drivers by Customer Contract Gumbs Connor Manufacturing Overhead in 2019 Richardson Cost Driver | CAD design hors Engineering hours Machine hours Motors Motors Auto Department Design Production Engineering Total $35,000 250 T00 3,700 150 T30…arrow_forward

- Checker Inc. produces automobile bumpers. Overhead is applied on the basis of machine hours required for cutting and fabricating. A predetermined overhead application rate of $12.70 per machine hour was established for 2019. Required: If 9,000 machine hours were expected to be used during 2019, how much overhead was expected to be incurred? Actual overhead incurred during 2019 totaled $121,650, and 9,100 machine hours were used during 2019. Calculate the amount of over- or underapplied overhead for 2019. (Input the amount as positive value.) Whether the overapplied or underapplied overhead for the year is normally transferred to cost of goods sold in the income statement?arrow_forwardKenos Pte Ltd manufactures all types of custom-made furniture. It uses a job-costing system and applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totalled $2,400,000. It has a maximum capacity of 320,000 machine hours. However, it is budgeted to be able to use 75% of this capacity during this period. On 31 July, Kenos Pte Ltd has the following balances: Work in process inventory -Job 123 -Job 124 Raw materials inventory $13,360 Finished inventory -Job 122 $18,000 $8,620 In August, the following occurred: (i)Raw materials purchased on credit (ii) Raw materials requisitions $23,000 (v) Job number 123 124 125 Indirect labour (vi) -Job number 123 -Job number 124 -Job number 125 -Indirect materials (used in production) (iii)Machine hours, direct labour hours and wages for factory employees (iv)Other overhead incurred: Required: Depreciation (machineries) Depreciation (delivery vans) Machine hours Labour hours 2,400 2,320…arrow_forwardPlease help me fill in the red.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education