FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Attached herewith is the picture;

Prepare the T- accounts for the actual Factory

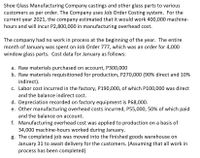

Transcribed Image Text:Shoe Glass Manufacturing Company castings and other glass parts to various

customers as per order. The Company uses Job Order Costing system. For the

current year 2021, the company estimated that it would work 400,000 machine-

hours and will incur P2,800,000 in manufacturing overhead cost.

The company had no work in process at the beginning of the year. The entire

month of January was spent on Job Order 777, which was an order for 4,000

window glass parts. Cost data for January as follows:

a. Raw materials purchased on account, P300,000

b. Raw materials requisitioned for production, P270,000 (90% direct and 10%

indirect).

c. Labor cost incurred in the factory, P190,000, of which P100,000 was direct

and the balance indirect cost.

d. Depreciation recorded on factory equipment is P68,000.

e. Other manufacturing overhead costs incurred, P55,000, 50% of which paid

and the balance on account.

f. Manufacturing overhead cost was applied to production on a basis of

34,000 machine-hours worked during January.

g. The completed job was moved into the finished goods warehouse on

January 31 to await delivery for the customers. (Assuming that all work in

process has been completed)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The cost accountant prepares the cost of production summary by first collecting the period’s production costs from summaries of material requisitions, payroll, and factory overhead analysis sheets. True or False?arrow_forwardPrepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.arrow_forwardThere are standard amounts of factory overhead. Explain the procedures to determine standard amounts of factory overhead at different levels of production.arrow_forward

- In the Excel, or spreadsheet, approach to recording financial transactions, the Manufacturing Overhead account is used to record two things-all actual overhead expenses and the amount of manufacturing overhead applied to production using the predetermined overhead rate. True or False True Falsearrow_forwardDescribe how the over or under application of overhead should be corrected in the accounting records.arrow_forwardThe entry to record the purchase of raw materials on account using a job costing system would include a credit to Work-in-Process Inventory account. debit to Accounts Payable account. debit to Work-in-Process Inventory account. debit to Raw Materials Inventory account.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education