Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

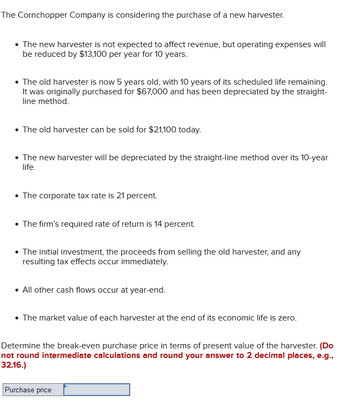

Transcribed Image Text:The Cornchopper Company is considering the purchase of a new harvester.

• The new harvester is not expected to affect revenue, but operating expenses will

be reduced by $13,100 per year for 10 years.

The old harvester is now 5 years old, with 10 years of its scheduled life remaining.

It was originally purchased for $67,000 and has been depreciated by the straight-

line method.

The old harvester can be sold for $21,100 today.

• The new harvester will be depreciated by the straight-line method over its 10-year

life.

• The corporate tax rate is 21 percent.

The firm's required rate of return is 14 percent.

The initial investment, the proceeds from selling the old harvester, and any

resulting tax effects occur immediately.

• All other cash flows occur at year-end.

• The market value of each harvester at the end of its economic life is zero.

Determine the break-even purchase price in terms of present value of the harvester. (Do

not round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

Purchase price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- One year ago, your company purchased a machine used in manufacturing for $90,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $155,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $50,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $22,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $8,182 per year. The market value today of the current machine is $55,000. Your company's tax rate is 38%, and the opportunity cost of capital for this type of equipment is 12%. Should your company replace its year-old machine?arrow_forwardNonearrow_forwardOne year ago, your company purchased a machine used in manufacturing for $107,800. You have learned that a new machine is available that offers many advantages and you can purchase it for $170,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $35,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $22,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $9,800 per year. The market value today of the current machine is $60,000. Your company's tax rate is 30%, and the opportunity cost of capital for this type of equipment is 11%. Should your company replace its year-old machine? The NPV of replacing the year-old machine is $ (Round to the…arrow_forward

- Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $194,000 and will require $29,400 in installation costs. It will be depreciated under MACRS using a 5-year recovery period Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 4% Totals 100% 100% 100% 100% A $30,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a…arrow_forwardA critical machine in BHP Billiton's copper refining operation was purchased 7 years ago for $160,000. Last year a replacement study was performed with the decision to retain it for 3 more years. The situation has changed. The equipment is estimated to have a value of $8000 if "scavenged" for parts now or anytime in the future. If kept in service, it can be minimally upgraded at a cost of $43,000 to make it usable for up to 2 more years. Its operating cost is estimated at $22,000 in the first year and $29,000 in the second year. Alternatively, the company can purchase a new system, the challenger, that will have an AWC of $-51,000 over its ESL. Use a MARR of 10% per year and annual worth analysis to determine when the company should replace the machine. The AW value of the challenger is $- ◻ ◻ and the AW value of the defender at the end of year 2 is $- 82,834.71 ◻ The company should replace the machine ◻ after two years A critical machine in BHP Billiton's copper refining operation was…arrow_forward5arrow_forward

- The manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2: $43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value of the plant at the end of year is $66,700, would you scrap the plant at the end of year one?arrow_forwardOne year ago, your company purchased a machine used in manufacturing for $95,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $150,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $40,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $25,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $8,636 per year. The market value today of the current machine is $45,000. Your company's tax rate is 35%, and the opportunity cost of capital for this type of equipment is 11%. Should your company replace its year-old machine? The NPV of replacing the year-old machine is $ (Round to the…arrow_forward2. Brown Company bought a new machine 1 year ago for 12 million dollars. At that time the machine was estimated to have a life of 6 years and no salvage value. Annual operating costs are estimated at 20 million dollars. A new machine produced by another company does the same job but with an annual operating cost of only 17 million dollars. This new machine costs $21 million with a 5 year lifespan and no salvage value. The old machine can be sold for 10 million dollars. Straight-line depreciation is used and 40 percent corporate tax. If the cost of capital is 8 percent after taxes, calculate:a). Initial investment costsb). After-tax incremental cash flow.c). NPV of new investment.arrow_forward

- You purchased a box-making machine that cost $50,000 five years ago At that time, the system was estimated to have a service life of five years with salvage value of $5,000. These estimates are still good. The property has been depreciated at a declining balance CCA rate of 30%. Now (at the end of year 5 from pur chase) you are considering selling the machine for $10,000. What UCC should you use in determining the disposal tax effect?arrow_forward6arrow_forwardCoparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education