Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

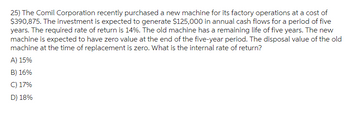

Transcribed Image Text:25) The Comil Corporation recently purchased a new machine for its factory operations at a cost of

$390,875. The investment is expected to generate $125,000 in annual cash flows for a period of five

years. The required rate of return is 14%. The old machine has a remaining life of five years. The new

machine is expected to have zero value at the end of the five-year period. The disposal value of the old

machine at the time of replacement is zero. What is the internal rate of return?

A) 15%

B) 16%

C) 17%

D) 18%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The management of Kanban Company is considering the purchase of a $27,000 machine that would reduce operating costs by $6,000 per year. At the end of the machine's six-year useful life, it will have zero salvage value. The company's required rate of return is 10%. ---------------------------------------- What is the total 'undiscounted' cash savings that this machine will provide over its useful life?arrow_forward6. Required information [The following information applies to the questions displayed below.]Beacon Company is considering automating its production facility. The initial investment in automation would be $12.39 million, and the equipment has a useful life of 10 years with a residual value of $1,090,000. The company will use straight-line depreciation. Beacon could expect a production increase of 34,000 units per year and a reduction of 20 percent in the labor cost per unit. Current (no automation) 75,000 units Current (no automation) 75,000 units Proposed (automation) 109,000 units Proposed (automation) 109,000 units Production and sales volume Per Unit Total Per Unit Total Sales revenue $92 $ ? $ 92 $? Variable costs Direct materials $17 $17 Direct labor 20 ? Variable manufacturing overhead 12 12 Total variable manufacturing costs 49 ? Contribution margin…arrow_forward4 Excelsior Industries is evaluating the purchase of a new manufacturing machine for its product line (referred to as a "project" for the purpose of setting up the questions). The machine has an estimated life of four years. The cost of the machine is $250,000, and the machine will be depreciated using the straight-line method to a residual value of $0. The machine is expected to generate additional sales of 10,000 units in year 1, with sales growing by 8% annually through year four. The selling price per unit will be $120, and the cost of goods sold unit will be $75. perarrow_forward

- 7) costs for the current machine. The current machine is based on older technology and has negligible market value. The purchase price of the new equipment is $500,000 and it is expected to last for 10 years. Its terminal salvage value is $50,000. Operating and maintenance (O&M) costs are estimated to be $20,000 for the first year. Thereafter, these O&M costs are expected to increase by $2,000 each year over the previous year's costs. MARR is 10% per year compounded annually. a) b) purchase this new equipment? Explain. EmKay, Inc. has decided to purchase new equipment because of the increasing maintenance Compute the present worth for this new equipment purchase. If the annual O&M costs for the current machine are $75,000, would you support the decision toarrow_forwardA new machine costing $150,000 is expected to save the McKaig Brick Company $11,000 per year for 5 years before depreciation and taxes. The machine will be depreciated on a straight-line basis for a 5-year period to an estimated salvage value of $0. The firm’s marginal tax rate is 40 percent. What are the annual net cash flows associated with the purchase of this machine? Round your answer to the nearest dollar. $ Compute the net investment (NINV) for this project. Round your answer to the nearest dollar. $arrow_forwardCC1 company is considering an investment (at time = 0) in a machine that produces arrows. The cost of the machine is 42205 dollars with zero expected salvage value. Annual production in units during the 3-year life of the machine is expected to be (starting at time = 1) 4046 , 7950, and 10350. The arrows sale price per unit is 13 dollars in year one and it is expected to increase by 6% per year thereafter. Production costs per unit will be 5 dollars in year one, and then increase by 4% per year. Depreciation on the machine is fixed at 14204 dollars per year, and the overall tax rate is 40%. and the minimum acceptable rate of return is 10% percent. Calculate the net present value of this investment. Assume all flows are at the end of each year. round your answer to the nearest cent.arrow_forward

- K Company has purchased a new machine costing $27,000 and the machine is expected to reduce the operating expenses by $7,000 every year. The useful life of machine is 5 years and the machine is expected to have a zero-scrap! value at the end of its useful life. The company's required rate of return is 12%. Calculate the Net Present Value (NPV) of the machine. (Round intermediate calculations to 3 decimal places and final answer to the nearest dollar.)arrow_forwardShinoda Manufacturing, Incorporated, has been considering the purchase of a new manufacturing facility for $460,000. The facility is to be fully depreciated on a straight- line basis over seven years. It is expected to have no resale value at that time. Operating revenues from the facility are expected to be $370,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 5 percent. Production costs at the end of the first year will be $215,000, in nominal terms, and they are expected to increase at 6 percent per year. The real discount rate is 8 percent. The corporate tax rate is 22 percent. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forwardK Company has purchased a new machine costing $27,000 and the machine is expected to reduce the operating expenses by $7,000 every year. The useful life of machine is 5 years and the machine is expected to have a zero-scrap value at the end of its useful life. The company's required rate of return is 12%. Calculate the Net Present Value (NPV) of the machine. (Round intermediate calculations to 3 decimal places and final answer to the nearest dollar.) -$1,765 $1765 -$464 $25,235arrow_forward

- The management Biden ltd intends to replace it existing two-year-old milk scheming machine whose original cost wash. 1000,000. The machine is two years old and it has a current market value of sh 700,000. The capital budgeting analysts believe that the machine has five more years of useful life. At the end of the five years, the asset will have a zero-salvage value. The netbook value of the machine is sh 800,000. The management is contemplating the purchase of a new machine to replace the old one. The new machine costs sh 1,600,000 and installation estimated at sh 300,000. It has an estimated salvage value of shs. 200,000 at the end of five-year useful life. The new machine will have a greater technological capacity and therefore annual sales are expected to increase by sh 240,000 operating efficiencies with the new machine will produce an expected savings of shs 260,000 a year. The company uses modified accelerated capital recovery depreciation method of 23% ,17%,20% ,21% and 19% from…arrow_forward1. Howell Petroleum is considering a new project that complements its existing business. The machine required for the project costs $3.82 million. The marketing department predicts that sales related to the project will be $2.52 million per year for the next four years, after which the firm expects to sell it for $500,000. The machine is a five-year class asset and will be depreciated down to zero over five years under the straight-line method. Cost of goods sold and operating expenses related to the project are predicted to be 25 percent of sales. Howell also needs to add net working capital of $200,000 immediately. The additional net working capital will be recovered in full at the end of the project’s life. The corporate tax rate is 35 percent. The required rate of return (or discount rate) for the project is 12.5 percent. Compute the NPV, IRR, and payback period of the project. The firm’s acceptable payback period is 3 years. Is this project acceptable to the firm?arrow_forwardA machine that costs $8,000 is expected to operate for 10 years. The estimated salvage value at the end of 10 years is $0. The machine is expected to save the company $1,554 per year before taxes and depreciation. The company depreciates its assets on a straight-line basis and has a marginal tax rate of 35 percent. What is the internal rate of return on this investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education