Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

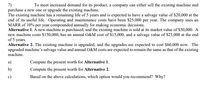

Transcribed Image Text:7)

purchase a new one or upgrade the existing machine.

The existing machine has a remaining life of 5 years and is expected to have a salvage value of $20,000 at the

end of its useful life. Operating and maintenance costs have been $25,000 per year. The company uses an

MARR of 10% per year compounded annually for making economic decisions.

Alternative 1. Á new machine is purchased, and the existing machine is sold at its market value of $50,000. A

new machine costs $150,000, has an annual O&M cost of $15,000, and a salvage value of $25,000 at the end

of 5 years.

Alternative 2. The existing machine is upgraded, and the upgrades are expected to cost $60,000 now. The

upgraded machine's salvage value and annual O&M costs are expected to remain the same as that of the existing

To meet increased demand for its product, a company can either sell the existing machine and

machine.

a)

Compute the present worth for Alternative 1.

b)

Compute the present worth for Alternative 2.

c)

Based on the above calculations, which option would you recommend? Why?

Expert Solution

arrow_forward

Step 1

Present worth means present value of the project or net profit generate or cost occur during the life of the project.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A land development company is considering the purchase of earth-moving equipment. The equipment will have a first cost of $190,000 and a salvage value of $70000 when the company sells it in 10 years. A service contract for maintenance on the equipment will cost $40000 per year. The operating cost is expected to be $260 per day. Alternatively, the company can rent the necessary equipment for $1100 per day and hire a driver at $180 per day. If the company's MARR is 10% per year, how many days per year must the company need the equipment in order to justify its purchase? Alternativelyarrow_forwardYou must evaluate a proposal to buy a new milling machine. Thebase price is $135,000 and shipping and installation costs would add another $8,000. Themachine falls into the MACRS 3-year class, and it would be sold after 3 years for $94,500.The applicable depreciation rates are 33%, 45%, 15%, and 7% as discussed in Appendix 12A.The machine would require a $5,000 increase in net operating working capital (increasedinventory less increased accounts payable). There would be no effect on revenues, but pretaxlabor costs would decline by $52,000 per year. The marginal tax rate is 35%, and the WACCis 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine.a. How should the $4,500 spent last year be handled?b. What is the initial investment outlay for the machine for capital budgeting purposes,that is, what is the Year 0 project cash flow? c. What are the project’s annual cash flows during Years 1, 2, and 3?d. Should the machine be purchased? Explain your…arrow_forwardPalmer Corporation is considering the purchase of a new plece of equipment. The cost savings from the equipment would result in an annual increase in net income of $152,000. The equipment will have an initial cost of $494,000 and a 8 year useful life. If the salvage value of the equipment is estimated to be $78,000, what is the payback period? Multiple Choice 2.42 years 3.25 years 8.00 years 4.00 yearsarrow_forward

- B2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $360,000 and has a 12-year life and no salvage value. B2B Company requires at least an 8% return on this investment. The expected annual income for each year from this equipment follows: (PV of $1. FV of $1. PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Equipment Selling, general, and administrative expenses Income (a) Compute the net present value of this investment. (b) Should the investment be accepted or rejected on the basis of net present value? Complete this question by entering your answers in the tabs below. Required A Required B Compute the net present value of this investment. Note: Round your present value factor to 4 decimals and other final answers to the nearest whole dollar. Years 1 through 12 Initial…arrow_forwardK Company has purchased a new machine costing $27,000 and the machine is expected to reduce the operating expenses by $7,000 every year. The useful life of machine is 5 years and the machine is expected to have a zero-scrap! value at the end of its useful life. The company's required rate of return is 12%. Calculate the Net Present Value (NPV) of the machine. (Round intermediate calculations to 3 decimal places and final answer to the nearest dollar.)arrow_forwardInformation for Terra Corp. Terra Corp is considering the purchase of a machine that is expected to cost $180,000. The machine will require an additional $40,000 to have it shipped, modified, and installed. The purchase of this machine is expected to require additional working capital of $20,000 upfront, which will be liquidated when the machine is sold off. Terra expects to use the machine for 4 years, and then sell it for $95,000. The machine will be fully depreciated over the four years, at a constant rate. In each of the four years, Terra’s revenues are expected to be $85,000 higher than they would be without the machine. Annual operating costs (not including depreciation) will also be higher, however, to the extent of $19,000. The firm pays a 30% rate in taxes, and its cost of capital is 7.5%. The initial outflow of cash for the proposed project is expected to be: $220,000 $200,000 $180,000 $190,000 $240,000arrow_forward

- The management of Kunkel Company is considering the purchase of a $38,000 machine that would reduce operating costs by $8,500 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 11%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?arrow_forwardInformation for Terra Corp. Terra Corp is considering the purchase of a machine that is expected to cost $180,000. The machine will require an additional $40,000 to have it shipped, modified, and installed. The purchase of this machine is expected to require additional working capital of $20,000 upfront, which will be liquidated when the machine is sold off. Terra expects to use the machine for 4 years, and then sell it for $95,000. The machine will be fully depreciated over the four years, at a constant rate. In each of the four years, Terra’s revenues are expected to be $85,000 higher than they would be without the machine. Annual operating costs (not including depreciation) will also be higher, however, to the extent of $19,000. The firm pays a 30% rate in taxes, and its cost of capital is 7.5% The net present value of the project is estimated to be: $34,774 $37,694 $23,976 $16,353 $1,337arrow_forwardNelson Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in cash flow of $105,000. The equipment will have an initial cost of $420,000 and have a 5 year life. If the salvage value of the equipment is estimated to be $80,000, what is the payback period? Ignore income taxes. Multiple Choice 3.24 years 4.00 years 4.76 years 7.00 yearsarrow_forward

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $360,500 and will generate $100,000 per year for 5 years. Calculate the IRR for this piece of equipment. (Click here to see present value and future value tables) fill in the blank 1%arrow_forwardBelmont Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual A in net operating income of $210,000. The equipment will have an initial cost of $1,000,000 and an 8-year useful ife, if there is no salvage value of the equipment, what is the accounting rate of return? Multiple Choice O O 21.0% 16.0% O 42.0% O 13.5%arrow_forward2. Super Apparel wants to replace an old machine with a new one. The new machine would increase annual revenue by $200,000 and annual operating expenses by $80,000. The new machine would cost $400,000. The estimated useful life of the machine is 10 years with zero salvage value. i. Compute Accounting Rate of Return (ARR) of the machine using above information. ii. Should Super Apparel purchase the machine if management wants an Accounting Rate of Return of 19% on all capital investments? Hint: Use Average Income or Profit after deducting tax, depreciation, and operating expenses.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education