ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

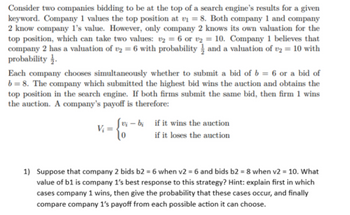

Transcribed Image Text:Consider two companies bidding to be at the top of a search engine's results for a given

keyword. Company 1 values the top position at v₁ = 8. Both company 1 and company

2 know company 1's value. However, only company 2 knows its own valuation for the

top position, which can take two values: v₂ = 6 or v₂ = 10. Company 1 believes that

company 2 has a valuation of ₂ = 6 with probability and a valuation of v2 = 10 with

probability.

Each company chooses simultaneously whether to submit a bid of b = 6 or a bid of

b = 8. The company which submitted the highest bid wins the auction and obtains the

top position in the search engine. If both firms submit the same bid, then firm 1 wins

the auction. A company's payoff is therefore:

V₁ =

{o

vi- bi if it wins the auction

if it loses the auction

1) Suppose that company 2 bids b2 = 6 when v2 = 6 and bids b2 = 8 when v2 = 10. What

value of b1 is company 1's best response to this strategy? Hint: explain first in which

cases company 1 wins, then give the probability that these cases occur, and finally

compare company 1's payoff from each possible action it can choose.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A reserve price is a minimum price set by the auctioneer. If no bidder is willing to pay the reserve price, the item is unsold at a profit of $0 for the auctioneer. If only one bidder values the item at or above the reserve price, that bidder pays the reserve price. An auctioneer faces two bidders, each with a value of either $39 or $104, with both values equally probable. Without a reserve price, the second highest bid will be the price paid by the winning bidder. The following table lists the four possible combinations of bidder values. Each combination is equally likely to occur. On the following table, indicate the price paid by the winning bidder with and without the stated reserve price. Bidder 1 Value Bidder 2 Value Probability Price Without Reserve? Price with $104 Reserve Price? ($) ($) ($) $39 $39 0.25 $39 $104 0.25 $104 $39 0.25 $104 $104 0.25 Without a reserve price, the expected price is…arrow_forwardIn Homework 1, we saw that there is no strict dominant strategy equilibrium in an inspection game. Thus, the players must randomize and play a mixed strategy in equilibrium. Suppose the agent shirks with probability p₁ and works with probability (1 - p₁), while the principal inspects with probability p2 and does not inspect with probability (1-P2). Find the mixed strategy equilibrium for this game. I NI S (0, -k) (w, -w) W (w c, p-w-k)| (wc, p-w) Table 1: Payoff matrix for the inspection gamearrow_forwardNonearrow_forward

- A buyer wants to purchase a house from a seller. Let v be the quality of this house. The quality v is known to the seller but unobservable to the buyer. The buyer thinks the chance that v=$1k is 20%, v=$10k is 40%, and v=$50k is 40%. The seller’s valuation of the house is v and the buyer’s valuation of the house is 2v a) Suppose both the buyer and the seller see the value of v . Also suppose the transaction price equals the value of v (i.e. if =10k, then the buyer pays 10k for the house). Calculate the buyer’s expected profit before seeing the value of b) Suppose only the seller sees v. Also suppose the buyer is allowed to make any offer to the seller and the seller accepts it if the offered price is above or equals to v. What is the buyer’s profit maximizing offer? What is the buyer’s maximum profit? c) Base on your answers from (a) and (b), what is the value of information (i.e. the benefits of seeing the value of ) to the buyer?arrow_forwardLet b(p,s,t) be the bet that pays out s with probability p and t with probability 1−p. We make the three following statements: S1: The CME for b is the value m such that u(m)=E[u(b(p,s,t))]. S2: A risk averse attitude corresponds to the case CME smaller than E[b(p,s,t))]. S3: A risk seeking attitude corresponds to a convex utility function. Are these statements true or false?arrow_forwardLucy and Henry each have $1652. Each knows that with 0.1 probability, they will lose 85% of their wealth. They both have the option of buying a units of insurance, with each unit costing $0.1. Each unit of insurance pays out $1 in the event the loss occurs. The cost of the insurance policy is paid regardless of whether the loss is incurred. Lucy's utility is given by u²(x) = x, Henry's utility is given by u¹(x) = √√x. Answer the following: (If rounding is needed, only round at the end and write your answer to three decimal places.) a) Without insurance, what is the expected value of the loss? b) c) d). e) ( For Henry, facing the "lottery " above without any insurance is as bad as losing how many dollars for sure? Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a. Now suppose insurance costs $0.2. Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a. What is Henry's utility maximising choice of a with the new price of…arrow_forward

- You need to hire some new employees to staff your startup venture. You know that potential employees are distributed throughout the population as follows, but you can't distinguish among them: Employee Value $30,000 $49,000 $68,000 $87,000 Probability 0.25 0.25 0.25 0.25 The expected value of hiring one employee is $ Suppose you set the salary of the position equal to the expected value of an employee. Assume that employees will not work for a salary below their employee value. The expected value of an employee who would apply for the position, at this salary, is $ Given this adverse selection, your most reasonable salary offer (that ensures you do not lose money) isarrow_forwardBoris and Angela are negotiating a new trade deal, which resembles a modified centipede game. When it is their turn, each of them decides whether to cooperate (C) or to decline (D). Unfortunately, Angela is not sure how much time Boris has for the negotiations before he needs to leave to talk to Emmanuel. With probability p = 4/5, Boris will stay and insist on making the final proposal (long game, L). With probability 1 − p = 1/5, Boris will have to rush off, so that the game ends after Angela’s move (short game, S). Boris has perfect knowledge of his schedule. The structure and payoffs are represented in the game tree below (Attached picture). (a) Specify the set of possible histories H of the game. Underline terminal histories.(b) Specify the set of possible strategies for Boris and Angela.(c) How many subgames does this game have? Indicate all subgames in this gamearrow_forwardConsider two companies bidding to be at the top of a search engine's results for a given keyword. Company 1 values the top position at v₁ = 8. Both company 1 and company 2 know company 1's value. However, only company 2 knows its own valuation for the top position, which can take two values: v₂ = 6 or v₂ = 10. Company 1 believes that company 2 has a valuation of v2 = 6 with probability and a valuation of v2 = 10 with probability. Each company chooses simultaneously whether to submit a bid of b = 6 or a bid of b = 8. The company which submitted the highest bid wins the auction and obtains the top position in the search engine. If both firms submit the same bid, then firm 1 wins the auction. A company's payoff is therefore: V₁₂ = -{- Vi - bi if it wins the auction if it loses the auction 1) What are the possible types of company 2?arrow_forward

- Two construction companies are lobbying to obtain a share of work on repaving city streets. The share of the project going to each firm depends on money contributions to the mayor’s reelection fund. The project has value V in total. The mayor is somewhat biased in favor of firm 1, which is run by his niece. If firm 1 contributes x1 and firm 2 contributes x2, with at least one contribution strictly larger than zero, then the shares of the project going to firms 1 and 2 are s1 and s2, respectively, where (see picture)arrow_forwardSuppose there are two bidders for a single object. Each bidder has a value for the object, v1 and v2, which is randomly drawn uniformly from 0 to 80. (Note that this means the probability that a value is 25 or lower is 25/80, and more generally, the probability that a value is k or lower is k/80). Bidders see their own values but not the values of their rival bidders. Consider a first price sealed bid auction where the winner of the object is the bidder who submits the highest bid and pays the price that he bid. Suppose that you are bidder 1 and you believe that your rival always bids a constant fraction α of his value. (For example, if bidder 2’ value is 15, he will bid 15α.). 1. What is your expected winning probability of the auction from any given bid b1? (Hint, you win the auction when your bid amount b1 is greater than your opponent’s bid). 2. What is your expected payoff from any given bid, b1? (You need to write your answer as a function of v1, b1, and α). 3. Compute your best…arrow_forwardApple and Google are interested in hiring a new CEO. Both firms have the same set of final candidates for the CEO position: Indra, Cao, and Virginia. Both firms need to decide who to make a job offer to, and the hiring process is such that they each only make one job offer. If, say, Apple makes a job offer to Indra and Google makes a job offer to one of the other candidates, then Apple’s probability of success in hiring Indra is pIndra. The same is true for Google. If they both make a job offer to Indra, each has probability pIndra/2 of success. It has been estimated that pIndra = 20%, and pCao = pVirginia = 30% (Note that these probabilities need not add up to 100%). Suppose that both Apple and Google attach a valuation of 10 to successfully hiring Indra, and a valuation of 7 to successfully hiring each of the other candidates. A hiring attempt, if unsuccessful, has a valuation of zero. Convert this story into a game by completing the following game table; Google…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education