Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

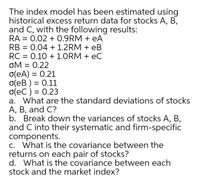

Transcribed Image Text:The index model has been estimated using

historical excess return data for stocks A, B,

and C, with the following results:

RA = 0.02 + 0.9RM + eA

RB =

0.04 + 1.2RM + eB

RC = 0.10 + 1.ORM + eC

OM

oM = 0.22

o(eA) = 0.21

o(eB ) = 0.11

o(eC ) = 0.23

a. What are the standard deviations of stocks

A, B, and C?

b. Break down the variances of stocks A, B,

and C into their systematic and firm-specific

components.

c. What is the covariance between the

returns on each pair of stocks?

d. What is the covariance between each

stock and the market index?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

- Assume that using the Security Market Line the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on the market portfolio is denoted by RM. Find the ratio of beta of A (bA) to beta of B (bB).arrow_forwardS Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA = 3.6% + 1.20RM + eA RB = -1.6% + 1.5RM + eB OM = 16%; R-squareд = 0.25; R-squareg = 0.15 What is the standard deviation of each stock? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Stock A Stock B Standard Deviation % %arrow_forwardGiven the following information, determine the beta coefficient for Stock L that is consistent with equilibrium: = 8%; rRF = 3%; IM = 12%. Round your answer to two decimal places.arrow_forward

- You run a regression for the Tesla stock return on a market index to estimate the SML equation and find the following Excel output: Multiple R R-Square Adjusted R-Square Standard Error Observations Intercept Market = 0.28 0.25 0.02 40.01 60 13.35 and 0.97 0.8 and 0.1 0.28 and 0.25 0.26 and 1.36 0.2 and 0.75 Coefficients Standard Error t-Stat p-Value 0.2 0.75 The resulting SML equation for Laternios is given by: Er Laternios] 13.35 0.26 0.80 0.97 1.36 0.10 + __ × (E[rM] - rf)arrow_forwardThe index model has been estimated from the excess returns for stock A with the following results: = RA 12.00% +1.55RM+ eA °M = 24.00% σ(eд) = 18.50% What is the standard deviation of the return for stock A? (Round your answer to 2 decimal places.) Standard deviation %arrow_forwardK (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Probability 0.20 0.60 0.20 Common Stock B Return 13% 17% 18% Probability 0.10 0.40 0.40 0.10 (Click on the icon in order to copy its contents into a spreadsheet.) Return -7% 5% 16% 21% www a. Given the information in the table, the expected rate of return for stock A is 16.40 %. (Round to two decimal places.) The standard deviation of stock A is 1.74 %. (Round to two decimal places.) b. The expected rate of return for stock B is 9.8 %. (Round to two decimal places.) The standard deviation for stock B is 6.12 %. (Round to two decimal places.)arrow_forward

- Consider the following probability distribution for stocks A and B: Table 4 Probability Distribution for Stocks A and B State Probability Return on Stock A Return on Stock B 1 0.1 10% 8% 2 0.2 13% 7% 3 0.2 12% 6% 4 0.3 14% 9% 5 0.2 15% 8% The variances of Stocks A and B are _____ and _____, respectively. Group of answer choices .015%; .019% .022%; .012% .032%; .02% .015%; .011% .014%; .021%arrow_forwardIn the CAPM world, if Sharpe ratio of the market portfolio is 1.25 and the correlation coefficient between stock i and the market portfolio is 0.60, what is the stock i's Sharpe ratio? → (1) 0.25; (2) 0.45; (3) 0.50; (4) 0.75; (5) 0.80; (6) 1.00; (7) 1.25; 8 (8) 1.50; (9) 1.75; (10) 2.05;arrow_forwardWhen we test CAPM using historical data, a classic test is to regress excess returns of stocks onto the stock betas, using the following regression specification across stocks: - Rp Rf =α+By+ε where Rup - Rf is the average excess return of a security or portfolio, ẞ is the estimated beta of the security or portfolio, & is the regression residual, and a (Alpha) and y (Gamma) are regression coefficients. Based on the regression, which of the following statements are true if CAPM is true? Select all two correct statements. The Alpha is zero The Alpha is positive The Gamma is positive The Gamma is zeroarrow_forward

- Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return 0.35 13% 0.25 −7% 0.30 17% 0.25 8% 0.35 21% 0.25 15% 0.25 23% (Click on the icon in order to copy its contents into a spreadsheet.) Question content area bottom Part 1 a. Given the information in the table, the expected rate of return for stock A is enter your response here%. (Round to two decimal places.)arrow_forwardVinayarrow_forwardAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education