ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

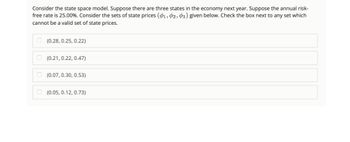

Transcribed Image Text:Consider the state space model. Suppose there are three states in the economy next year. Suppose the annual risk-

free rate is 25.00%. Consider the sets of state prices (01, 02, 03) given below. Check the box next to any set which

cannot be a valid set of state prices.

(0.28, 0.25, 0.22)

(0.21, 0.22, 0.47)

(0.07, 0.30, 0.53)

(0.05, 0.12, 0.73)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider an economy that is composed of identical individuals who live for two periods. These individuals have preferences over consumption in periods 1 and 2 given by U = /(C,) + (C2). They receive an income of 45 in period 1 and an income of 20 in period 2. They can save as much of their income as they like in bank accounts, earning an interest rate of 10% per period. They do not care about their children, so they spend all their money before the end of period 2. Each individual's lifetime budget constraint is given by C1 + C2/(1 + r) = Y1 + Y2/(1 + r). Individuals choose consumption in each period by maximizing lifetime utility subject to this lifetime budget constraint. (a) What is the individual's optimal consumption in each period? How much saving does he or she do in the first period? (b) The government has decided to set up a social security system. This system will take $10 from each individual in the first period, put it in the bank, and transfer it to each person with…arrow_forwardes Ergonomics Incorporated sells ergonomically designed office chairs. The company has the following information: Average demand = 31 units per day Average lead time = 45 days Item unit cost = $65 for orders of less than 350 units Item unit cost $63 for orders of 350 units or more Ordering cost = $40 Inventory carrying cost = 20% The business year is 250 days. a. How many chairs should the firm order each time? Assume there is no uncertainty at all about the demand or the lead time. b. What will the firm's average inventory be under each alternative? c. What will be the annual ordering and holding costs for each alternative?arrow_forwardSocioeconomic impacts of COVID-19 – can globalization prevail in the face of the impeding recession?As the COVID-19 crisis continues to deepen, the significant health and economic consequences of this disease is crippling even the most developed nations. With < 0.5% of globally confirmed cases occurring in Africa, the continent appears so far to be relatively spared the untoward direct health consequences of the COVID-19 pandemic. The disease nonetheless has already had a destabilizing effect on the lives of millions of Africans with disproportionate impact on the poor and underserved. The interconnectedness that characterizes globalization has brought economic benefits to many African countries. With COVID-19, there have been disruptions in Africa’s global supply chains in the face of tumbling oil prices and a lowered global demand for African non-oil products, which constitutes a threat to the economic stability of the continent. Projected losses from oil shocks alone may result…arrow_forward

- Consider the model where an individual has wealth k which they can either save or consume. If they save it, they receive a fixed and exogenous return r. The instantaneous utility function is given by: u(c, k) = c + a(k) where c is consumption, k is wealth, and a(k) is a function that defines the utility that an individual gets from holding wealth. The growth in wealth is given as the returns on wealth rk, plus income from working z(t), minus consumption c(t). a. Write out the differential equation for wealth. b. For an infinite time model, set up the optimal control problem with discounting at a rate 8. c. Write the current-valued Hamiltonian of this problem. d. Derive the steady-state level of consumption.arrow_forwardAssume that the production function for a country is given by Y=√K and annual investment is given by the function I=γ×YI where γ=0.280, and that the yearly depreciation rate is 4.67%. Suppose that this year, the output in the country is 1, and a neighbor country's output is 50% higher. Calculate the time it would take for the country's output to catch up with its neighbor's output. Assume the neighbor country's economy is neither growing nor shrinking.arrow_forwardIf a forecast made using all available information is NOT perfectly accurate, then it is an adaptive expectation. not a rational expectation. still a rational expectation. a second-best expectation.arrow_forward

- Exercise 4. You are a manager at a certain factory that designs small gadgets. The factory has been quite successful in the past years. Your CEO is wondering whether or not it is a good idea to expand the factory this year. The cost to expand the factory is $1.5M. Doing nothing will result in expected $3M in revenue if the economy stays good and people continue to buy plenty of gadgets, but only $1M in revenue is expected if the economy is bad. On the other hand, expanding the factory carries an expected $6M in revenue if economy is good and $2M if the economy is bad. Assume there is a 40% chance of a good economy and a 60% chance of a bad economy. Also, assume the costs of operating the factory account to $.5M if the factory is expanded and $.3M if not. a. Illustrate a Decision Tree showing these choices. b. What should you do?arrow_forwardAssume a two-period small open economy model, where the national product is 50 in the current period, and 88 in the future period. The world real interest rate is 10% per period. The representative consumer has the following utility function: U(c,G,c’,G’) = ln(c+G) + ln(c’+G’). a) What are the optimal consumption plus government spending in the current and in the future period? What is the current account surplus? Show this in a diagram. b) Now, suppose that governments in the rest of the world impose a tax on lending to foreigners of 5%. Determine how this affects consumption plus government spending in the present and the future, and the current account surplus. Explain your results. c) Suppose that governments in the rest of the world still impose a tax on lending to foreigners of 5%. However, the national country found a huge reserve of oil and the current period income increased to 100. The Determine how this affects consumption plus government spending in the present and the…arrow_forwardThe COVID-19 pandemic has caused an unprecedented increase in savings in many countries around the world. In the EU, the savings rate of households has jumped from 12.5% to 17%. In 2008-2009, it had moved from 12.5% to 14% (Dossche and Zlatanos 2020). Even if the source of 2020 surge in savings is different from the one of 2008, it is obvious that this increase does not result in more investment and growth. QUESTION: 1. With reference to the paradox of thrift discuss the appropriate approach by the government to get the economy out of economic downturn swiftlyarrow_forward

- It is conceivable that the APC, APS, MPC, and MPS could simultaneously be A. APC 1.0; APS= 0; MPC= 0.15; MPS= 0.15. OB. APC= 1.0; APS= 0.1; MPC = 0.85; MPS = 0.25. OC. APC= 1.3; APS - 0.3; MPC = 0.8; MPS = 0.2. OD. APC 0.8; APS= 0.2; MPC = 1.1; MPS = 0.1.arrow_forwardOn average, the per-capita grocery spending in Maine takes up 9.08% of all personal consumption spending compared with 7.49% nationwide. Could either or both of these consumption figures be considered a point estimate? Explain your reasoning.arrow_forward: Suppose that Charlene has an income of $110,000 per year and that there is a 1 QUESTION in 5 (20%) chance that she will get sick in a given year. Let's suppose that the cost of the illness (in terms of lost work time and medical bills) is $80,000 which leaves her with an income of only $30,000 in that particular year. Utility UHealthy UE = UR Usick $30,000 $88,000 $94,000 $110,000 Income a) What is the actuarially fair premium for Charlene's situation? b) Continue to assume the given information. Suppose that the figure above represents Charlene's utility over various income levels. What is Charlene willing to pay for insurance? c) Continue to assume the given information. We know that Charlene would buy actuarially fair insurance but if the insurance company applied a 20% loading fee would Charlene still purchase the health insurance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education