ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

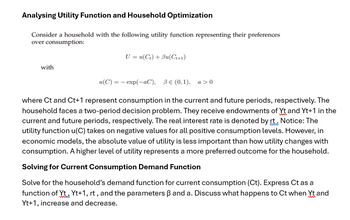

Transcribed Image Text:Analysing Utility Function and Household Optimization

Consider a household with the following utility function representing their preferences

over consumption:

with

U = u(C) + Bu(C++1)

u(C) = exp(-aC), BE (0,1), a>0

where Ct and Ct+1 represent consumption in the current and future periods, respectively. The

household faces a two-period decision problem. They receive endowments of Yt and Yt+1 in the

current and future periods, respectively. The real interest rate is denoted by rt. Notice: The

utility function u(C) takes on negative values for all positive consumption levels. However, in

economic models, the absolute value of utility is less important than how utility changes with

consumption. A higher level of utility represents a more preferred outcome for the household.

Solving for Current Consumption Demand Function

Solve for the household's demand function for current consumption (Ct). Express Ct as a

function of Yt, Yt+1, rt, and the parameters ẞ and a. Discuss what happens to Ct when Yt and

Yt+1, increase and decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a worker who is offered a salary bonus of $2,000 for each of the next two years if he or she enrolls in a job training program this year. The total cost to the worker, including any forgone earnings, is $3,000. (1). What is the internal rate of return on this investment? (2). Would this be a good investment for someone with a discount rate of 9%? Why? Please show your solution process and explain.arrow_forwardIf Peregrine consumes(1,500,880)and earns(1,300,1,100)and if the interest rate is10%, the present value of his endowment isarrow_forwarda) Present the Lagrangian (constrained maximisation) problem for the household under this modified specification and derive the first order conditions in this case. Hint: the household chooses c1, c2, ℓ1 and ℓ2. b) Use the first order conditions for ℓ1 and ℓ2 to derive an expression for the relative amount of leisure time chosen by the household over the two periods, i.e. derive an expression for (1–ℓ1)/(1–ℓ2). Explain how an increase in the relative wage (w2/w1) affects the household’s decision about how much leisure to enjoy in each period. c) Calculate the intertemporal elasticity of substitution between period 1 and period 2 leisure time in this case. Explain how the magnitude of this elasticity influences the household’s decision-making in the model. d) Use the first order conditions for c1 and c2 to derive an expression for the relative amount of consumption chosen by the household over the two time periods, i.e. derive an expression for c2/c1. Provide an economic interpretation…arrow_forward

- Yakov lives in Montreal and runs a business that sells boats. In an average year, he receives $793,000 from selling boats. Of this sales revenue, he must pay the manufacturer a wholesale cost of $430,000; he also pays wages and utility bills totalling $301,000. He owns his showroom; if he chooses to rent it out, he will receive $15,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Yakov does not operate this boat business, he can work as a financial advisor and receive an annual salary of $50,000 with no additional monetary costs. No other costs are incurred in running this boat business. Identify each of Yakov's costs in the following table as either an implicit cost or an explicit cost of selling boats. Implicit Cost Explicit Cost The rental income Yakov could receive if he chose to rent out his showroom The wholesale cost for the boats that Yakov pays the manufacturer The salary Yakov could earn if he worked as a financial…arrow_forwardFelix lives in San Francisco and runs a business that sells pianos. In an average year, he receives $711,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $411,000; he also pays wages and utility bills totaling $279,000. He owns his showroom; if he chooses to rent it out, he will receive $1,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Felix does not operate this piano business, he can work as a financial advisor and receive an annual salary of $31,000 with no additional monetary costs. No other costs are incurred in running this piano business. Identify each of Felix's costs in the following table as either an implicit cost or an explicit cost of selling pianos. Implicit Cost Explicit Cost The salary Felix could earn if he worked as a financial advisor The wages and utility bills that Felix pays The rental income Felix could receive if he chose to rent out his showroom The…arrow_forwardPlease solve the last 3 partsarrow_forward

- A6.arrow_forward3. Consider a parent who is altruistic towards her child, but also cares about her own consumption. The parent's utility over her own consumption and that of her child is up = log(co) +a log(ci) where c is the child's consumption, and a > 0 is the degree of parental altruism. Suppose that the parent can invest in the child's human capital by spending money (e) on her education; education generates human capital h /() and human capital is paid at rate w. The parent has a total income of (a) Write down an expression for the child's future consumption in terms of the parent's choice of e. (b) Now write down the Lagrangian for the parent's decision problem.arrow_forwardonly typed solutionarrow_forward

- A decision maker allocates an endowment of W > 0 dollars across two periodst = 1, 2. He discounts the future by β ∈ (0, 1) while facing a gross interest rateof R > 1. His utility is the same as studied in class. Solve for the intertemporalchoice problem. Show that the optimal consumption is decreasing over time ifβR < 1, constant over time if βR = 1, and increasing over time if βR > 1.arrow_forwardJames has a wage income of $50.000 in the present and $200.000 in the future. His utility is given as U = min (2Cp, Cr) - that is, his utility is the lesser of twice the dollars spent on present consumption or the dollars spent on future consumption. The interest rate is 30%. (A) What is the minimum amount of money James would be willing to accept today to have the interest rate at 40% rather than 30%? Explain and show work (B) What is the maximum amount of money James would pay today to have the interest rate at 30% rather than 40%? Explain and show workarrow_forwardA decision maker allocates an endowment of W > 0 dollars across two periodst = 1, 2. He discounts the future by β ∈ (0, 1) while facing a gross interest rateof R > 1. His utility is the same as studied in class. Solve for the intertemporalchoice problem. Show that the optimal consumption is decreasing over time ifβR < 1, constant over time if βR = 1, and increasing over time if βR > 1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education