ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

- Tom Tolkien, the CEO, is not happy with the quality of information being presented by his business manager. He asks the best economic consultancy firm in the country to provide an accurate

macroeconomic forecast , which they guarantee would be 100% accurate. What is the most that Tolkien Transport should be willing to pay the research firm for this information (in other words what is the value of perfect information concerning the state of the economy)?

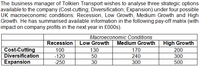

Transcribed Image Text:The business manager of Tolkien Transport wishes to analyse three strategic options

available to the company (Cost-cutting; Diversification; Expansion) under four possible

UK macroeconomic conditions: Recession, Low Growth, Medium Growth and High

Growth. He has summarised available information in the following pay-off matrix (with

impact on company profits in the next year in £000s).

Macroeconomic Conditions

Medium Growth

Recession Low Growth

High Growth

Cost-Cutting

Diversification

Expansion

100

130

170

200

-120

50

240

300

-250

30

300

500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In an efficient market, investors can consistently make high returns since it is easier to estimate price movements. True or False?arrow_forwardPlease respond to the following prompt in at least 350 words: Dean Brothers Corp. owns and operates a steel-drum manufacturing plant. Lowell Wyden, the plant superintendent, hires Best Security Patrol, Inc. (BSP), a security company, to guard the property to "deter thieves and vandals." Some BSP security guards, as Wyden knew, carried firearms. Pete Sidell, a BSP security guard, was not certified as an armed guard but nevertheless took his gun to work. While working at the Dean Brother's Plant on October 31, 2014, Sidell fired his gun at Tyrone Gaines, in the belief that Gaines was an intruder. The bullet struck and killed Gaines. Gaines' mother filed a lawsuit claiming that her son's death was the result of BSP's negligence, for which Dean Brothers Corp. was responsible. (see liability in Agency Relationships). 1) What is the plaintiff's best argument to establish that Dean Brother's Corp. is responsible for BSP's actions? 2) What is Dean Brother's Corp. best defense?arrow_forwardNote : Please answers all the parts , don't leave any part please it's a request. Donald is a small-scale orange juice producer, and he has a small orange juice producing factory in Mildura. He purchases oranges and other ingredients from shops in the local area. He sells all the produced juice bottles to the Mildura superstore for $7 per juice bottle; however, the superstore sells these bottles for the final consumer for $8.50. Donald spent $4200 last quarter and made 1000 juice bottles. (2 marks) a) What is the definition of value-added? (0.4 marks) b) What is Donald’s cost per bottle of juice? (0.4 marks), c) What is Donald’s value-added per bottle of juice? (0.4 marks) d) What is the total value-addition by Donald? (0.4 marks) e) What is the final contribution to the GDP from the orange juice according to the above information? (0.4 mark)arrow_forward

- Does a firm have the riight to "create" wants and try to persuade consumers to buy goods and services they didn't know about earlier? 'What are examples of "good" and "bad" want creation? Who should decide what is good and what is bad?arrow_forwardThe Zagat Restaurant Survey provides food, decor, and service ratings for some of the top restaurants across the United States. For 15 restaurants located in Boston, the average price of a dinner, including one drink and tip, was $48.60. You are leaving on a business trip to Boston and will eat dinner at three of these restaurants. Your company will reimburse you for a maximum of $50 per dinner. Business associates familiar with these restaurants have told you that the mea cost at one-third of these restaurants will exceed $50. Suppose that you randomly select three of these restaurants for dinner. a. What is the probability that none of the meals will exceed the cost covered by your company (to 4 decimals)? b. What is the probability that one of the meals will exceed the cost covered by your company (to 4 decimals)? c. What is the probability that two of the meals will exceed the cost covered by your company (to 4 decimals)? d. What is the probability that all three of the meals will…arrow_forwardBest Buy sees its earnings drop in the early part of November and late October (before Black Friday sales). The cause for this drop is because future price is; to :: increase therefore current demand will :: decrease :: remain the same :: expected :: required :: unchangedarrow_forward

- In 2012–2015, the price of jet and diesel fuel used by air freight companies decreaseddramatically. As the CEO of FedEx, you have been presented with the following proposals to deal with the situation:a. Reduce shipping rates to reflect the expense reduction.b. Increase the number of deliveries offered per day in some markets.c. Make long-term contracts to buy jet fuel and diesel at a fixed price for the nexttwo years and set shipping rates to a level that will cover these costs.Evaluate these alternatives in the context of the decision-making model presented inthe text.arrow_forwardThe Montag Family purchased a house in 2020 and expects its value (in thousands of dollars) t years in the future will be well-modeled by the function V(t)=310(1.08). By what percentage does the model predict the house will increase in value each year?arrow_forwardExercise 4. You are a manager at a certain factory that designs small gadgets. The factory has been quite successful in the past years. Your CEO is wondering whether or not it is a good idea to expand the factory this year. The cost to expand the factory is $1.5M. Doing nothing will result in expected $3M in revenue if the economy stays good and people continue to buy plenty of gadgets, but only $1M in revenue is expected if the economy is bad. On the other hand, expanding the factory carries an expected $6M in revenue if economy is good and $2M if the economy is bad. Assume there is a 40% chance of a good economy and a 60% chance of a bad economy. Also, assume the costs of operating the factory account to $.5M if the factory is expanded and $.3M if not. a. Illustrate a Decision Tree showing these choices. b. What should you do?arrow_forward

- The formula for economic impact is I(r)=(A)/1-r The formula for impact change is ∆I= I'(r)*∆r The formula for percentage change is g(r)=(r)/1-rarrow_forwardThe COVID-19 pandemic has caused an unprecedented increase in savings in many countries around the world. In the EU, the savings rate of households has jumped from 12.5% to 17%. In 2008-2009, it had moved from 12.5% to 14% (Dossche and Zlatanos 2020). Even if the source of 2020 surge in savings is different from the one of 2008, it is obvious that this increase does not result in more investment and growth. QUESTION: 1. With reference to the paradox of thrift discuss the appropriate approach by the government to get the economy out of economic downturn swiftlyarrow_forwardUse the following for the next 2 questions: A company needs to build a warehouse for a new product line. The product is to be stored in cases that are 2 feet long x 2 feet wide x 3 feet high. The cases are stored on racks that are 5 cases high. Due to the configuration of the racks, only 60% of the space in the storage area is actually used for storage. The company wants to be able to expand the product line in the future so the storage area should be designed to be 70% utilized in the first year. 1. If annual demand is expected to be 50,000 cases in year 1 with an annual turnover of 4, how many square feet are needed to store this product? - 1,587 square feet - 121,593 square feet - 52,809 square feet - 4,762 square feet - 14,287 square feet - 71,429 square feet - 23,810 square feet 2. The product is expected to have seasonal demand with the peak month being 10,000 cases in October. If the annual turnover is 6, how many square feet are needed to store this…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education