ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

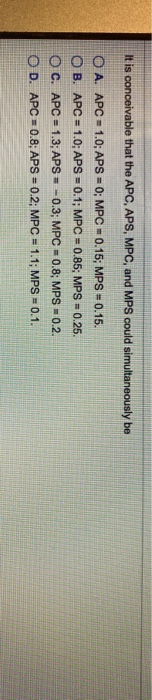

Transcribed Image Text:It is conceivable that the APC, APS, MPC, and MPS could simultaneously be

A. APC 1.0; APS= 0; MPC= 0.15; MPS= 0.15.

OB. APC= 1.0; APS= 0.1; MPC = 0.85; MPS = 0.25.

OC. APC= 1.3; APS - 0.3; MPC = 0.8; MPS = 0.2.

OD. APC 0.8; APS= 0.2; MPC = 1.1; MPS = 0.1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Attachedarrow_forwardB. using the diagram, determine the magnitude of the local market failure and the global market failure C. suppose that the anvilianian government has given production subsidies to the firms in anviliania. as a result, the firms have increased production ( and the number of firms have increased). consequently, the aggregate MAC is now MAC (anvil) = 800 -2.3e -- determine the magnitude of the intervention failurearrow_forwardIf MPC = 0.6 then MPS would be 0.3 True/Falsearrow_forward

- Q 47: Discuss the limitations faced in implementing gender budgeting in India. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardConsider the following prospects – A: (0.5, 0, 0.5: $100, $60, $10) B: (0, 0.9, 0.1: $100, $60, $10) C: (0.2, 0.5, 0.3: $100, $60, $10) D: (0.4, 0.2, 0.4: $100, $60, $10) Show that D>A>B>C is consistent with expected utility theory and that this preference ordering implies “risk-loving” preferences. Show that C>B>D>A is consistent with the expected utility theory.arrow_forwardonly typed solutionarrow_forward

- Suppose the City of Oolagah is considering building a new water treatment facility to better address nutrient pollution from agricultural runoff. The plant will cost the city $4 million and take one year to build, after which point it will generate $375,000 per year in health benefits over a 20 year time horizon. a)The city has a discount rate of 6%. Please neatly fill in the table below. Time Benefits Costs Net Benefits Present Value of Net Benefits 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 b)What is the Net Present Value of this proposed project? If efficiency was the only objective for making the decision and we have fully accounted for all costs and benefits would you recommend the project go ahead or not? c) Now suppose that the new plan would only generate health benefits for 17 years. What is the NPV of this proposed project? If efficiency was the only objective for making the decision and we have fully accounted for all costs and benefits would you recommend the…arrow_forwardnt.com/:w:/r/personal/ldemasi_student_sussex_edu/_layouts/15/Doc.aspx?sourcedoc=%7B94F3543 5Essay on Crimes a... Saved v P Search (Option + Q) erences Review View Help Editing v A 三ニv 三v A В 5-5. A nation's government has determined that mass transit, such as bus lines, helps alleviate traffic con- gestion, thereby benefiting both individual auto commuters and companies that desire to move products and factors of production speedily along streets and highways. Nevertheless, even though several private bus lines are in service, the country's commuters are failing to take into account the positive externality associated with the use of mass transit. a. Discuss, in the context of demand-supply analysis, the essential implications of commuters' failure to take into account the positive externality associated with bus ridership. b. Explain a government policy that might be effective in achieving the socially efficient use of bus services. Text Predictions: On 20 MacBook Airarrow_forward[A] Suppose that a drug company has developed an ointment that can be used to treat sores and reduce scarring. Surveys indicated that the ointment, which costs $10,000 for a full course of treatment, can improve the quality of life from 0.6 to 0.7 for patients with this problem. Assume that this population has a life expectancy of 70 years. No need to worry about discounting. 1. What is the Incremental Cost-Utility Ratio (ICUR) for taking the ointment over doing nothing for a typical 20-year-old patient? [Hint: This patient has only 50 years of life remaining.] 2. If the cost-effectiveness threshold is $5,000 per QALYS, will the 20-year-old patient choose to get the ointment? What about a 60-year-old patient? [B] Is it appropriate to evaluate a healthcare intervention using various methods of economic evaluation as discussed in this course, or should we choose one primary method that best fits the analysis?arrow_forward

- Consider the following prospects: A: (0.5, 0, 0.5: $100, $60, $10) B: (0, 0.9, 0.1: $100, $60, $10) C: (0.2, 0.5, 0.3:$100, $60, $10) D: (0.4, 0.2, 0.4:$100, $60, $10) (a) Show that D> A > B > C is consistent with expected utility theory, and that this preference ordering implies "risk loving" preferences. Show that C> B > D > A is inconsistent with expected utility theory. (b)arrow_forwardexpenditures, income 2-888R8÷ 120 110 100 90 80 70 60 50 40 30 20 10 0 -10 -20 -30 II 10-20 30 40 50 60 II 05. What will be the level of savings at an income level of 40? O (a) zero (b) 40 (c)-20 O (d) 20 40 50 60 70 IE income: Q C S +444 70 80 90 100 110 120 DO Qarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education