Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

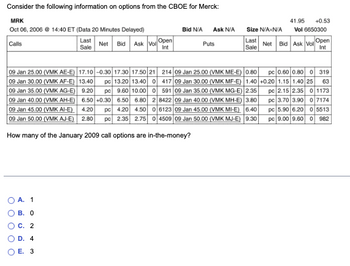

Transcribed Image Text:Consider the following information on options from the CBOE for Merck:

MRK

Oct 06, 2006 @ 14:40 ET (Data 20 Minutes Delayed)

Calls

O O

O O

O

A.

1

B. 0

09 Jan 25.00 (VMK AE-E) 17.10 -0.30 17.30 17.50 21 214 09 Jan 25.00 (VMK ME-E) 0.80 pc 0.60 0.80 0 319

09 Jan 30.00 (VMK AF-E) 13.40 pc 13.20 13.40 0417 09 Jan 30.00 (VMK MF-E) 1.40 +0.20 1.15 1.40 25 63

09 Jan 35.00 (VMK AG-E) 9.20 pc 9.60 10.000 591 09 Jan 35.00 (VMK MG-E) 2.35 pc 2.15 2.35 01173

09 Jan 40.00 (VMK AH-E) 6.50 +0.30 6.50 6.80 2 8422 09 Jan 40.00 (VMK MH-E) 3.80 pc 3.70 3.90 07174

09 Jan 45.00 (VMK AI-E) 4.20 pc 4.20 4.50 06123 09 Jan 45.00 (VMK MI-E) 6.40

09 Jan 50.00 (VMK AJ-E) 2.80 pc 2.35 2.75 04509 09 Jan 50.00 (VMK MJ-E) 9.30

pc 5.90 6.20 0 5513

pc 9.00 9.600 982

How many of the January 2009 call options are in-the-money?

C. 2

D. 4

Last

Sale

E. 3

Net Bid Ask Vol

Open

Int

Bid N/A Ask N/A

Puts

41.95 +0.53

Vol 6650300

Size N/A N/A

Last

Sale Net Bid Ask Vol Open

Int

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please correct answer and don't use hend raitingarrow_forwardUsing the spot and outright forward quotes in the table below, determine the corresponding bid-ask spreads in points. Spot 1.3508 − 1.3524 One-Month 1.3520 − 1.3541 Three-Month 1.3536 − 1.3562 Six-Month 1.3576 − 1.3610arrow_forwardNorwegian Krone (CME) - 2,000,000 Kroner; $ per contract. MONTH CHART LAST CHANGE PRIOR SETTLE OPEN HIGH LOW VOLUME JUN 2023 NOKM3 0.09586 -0.00064 (-0.66%) 0.09650 0.09662 0.09662 0.09581 67 3. Given the above information, calculate the dollar value of a Norwegian Krone SEP 2022 futures contract. 4. You hold securities in Australia valued at AUD (Australian Dollar) 55 million. How many SEP AUD futures should be bought or sold to hedge the foreign exchange risk. SEP AUD futures contracts (AUD 100,000 per contract) settled most recently at AUD 1.4202/$.arrow_forward

- Calculate the price weighted index value for 31 Dec 2020, prior to the splits. Shares W and X had 2 for 1 splits after the close on 31 Dec 2020. The pre-split divisor was 4. Share W X Y Z Select one: O A. 121.25 O B. 72.5 O C. 81.69 O D. 100.0 31-Dec-20 Closing Price $ 75.00 $ 150.00 $ 25.00 $ 40.00 31-Dec-20 Shares 10,000 5,000 20,000 25,000 31-Dec-21 Closing Price $50.00 $65.00 $35.00 $50.00 31-Dec-21 Shares 20,000 10,000 20,000 25,000arrow_forwardConsider the following limit order book. Limit buy order: Price Size 84.77 200 84.76 100 84.75 400 Limit Sell Order Price Size 84.79 100 84.80 300 85.70 700 If you submitted a market sell order for 400 shares, how much would you receive?arrow_forward2arrow_forward

- ZZ Industries: Price 34.36 Calls: Strike Symbol Last Chg Bid Ask Vol 30.00 ZZBF 4.30 1.07 4.30 4.40 62 32.50 ZZBZ 1.87 1.07 1.82 1.87 236 35.00 ZZBG .01 1.05 .00 .01 3119 Puts: Strike Symbol Last Chg Bid Ask 30.00 ZZNF 32.50 ZZNZ .01 .00 .00 .01 1.02 .00 35.00 ZZNG .60 1.14 .63 Multiple Choice $3.00 Vol 0 $4.00 .01 .01 .68 2637 562 Open Int 3,429 8,168 38,017 You want the right, but not the obligation, to sell 300 shares of ZZ Industries stock at a price of $32.50 a share. How much will it cost you to establish this option position? Open Int 7,258 34,972 19,686 Help Save & Exit Suarrow_forwardFollowing JPMorgan Chase's significant acquisition of First Republic Bank in 2023, how does the Efficient Market Hypothesis (EMH) explain the market's reaction to major corporate financial decisions, and what implications does this have for a company's approach to capital structure and dividend policy? Consider how information asymmetry between management and investors affects market efficiency, particularly during periods of banking sector stress, and analyze how the market's processing of complex financial information influences both the timing and structure of major corporate actions like acquisitions, stock buybacks, or dividend changes. Examine the relationship between market efficiency and the speed at which new information is incorporated into stock prices, especially in cases involving large financial institutions where systemic risks may be a concern.arrow_forwardSolve question barrow_forward

- Using the forward price approach to finish the following blanks. The expected closing basis was -$.15. And the actual closing basis was -$0.25. Date 1-Oct Cash Cash Price $6.30 Futures May Futures $6.75 Cost of holding from Oct 1 to May 1 (including interest) = $0.21 What is the forward price? What is the break-even price? What is the expected profit margin? = 1-Oct 1-May Sell Cash @ $6.40 Sell May Futures @ $6.75 Buy May Futures @ ? What is the futures price on May 1? What is the gain or loss on futures market result? = What is the gain or loss on cash market result? = What is the realized price (or net selling price)? = What is the overall profit? = What is the break-even price?arrow_forwardThe following table lists prices of Amazon options in January 2018 when Amazon stock was selling for $1,200. Exercise Price Expiration Date April 2018 Call Price Put Price $ 31.10 $1,200 1,300 1,400 $1,200 1,300 1,400 $1,200 1,300 1,400 $132.70 73.20 70.10 134.20 $ 53.55 96.00 33.00 July 2018 $161.70 104.00 62.55 156.05 January 2019 $210.00 $ 88.05 155.35 133.25 112.00 190.00 Suppose that by January 2019, the price of Amazon could either rise from its January 2018 level to $1,200 × 1.25 = $1,500.00 or fall to $1,200/1.25 = $960.00. a. What would be your percentage return on a January expiration call option with an exercise price of $1,200 if the stock price rose? (Round your answer to 2 decimal places.) b. What would be your percentage return if the stock price fell? (Negative value should be indicated by a minus sign.) c. Which is riskier: the stock or the option? a. Percentage return b. Percentage return Which is riskier: the stock or the option? % (100) % Option C.arrow_forwardWhich of the following is NOT traded by the CBOE? Group of answer choices: Weeklys Monthlys Binary options DOOM optionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education