Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

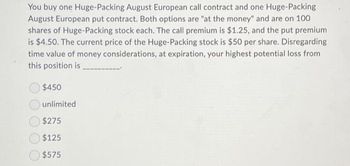

Transcribed Image Text:You buy one Huge-Packing August European call contract and one Huge-Packing

August European put contract. Both options are "at the money" and are on 100

shares of Huge-Packing stock each. The call premium is $1.25, and the put premium

is $4.50. The current price of the Huge-Packing stock is $50 per share. Disregarding

time value of money considerations, at expiration, your highest potential loss from

this position is

$450

unlimited

$275

$125

$575

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Vijayarrow_forwardWith formulas, no tables Exploring six-month call and put options for a stock with an exercise price of $20 and a call premium of $4 per contract, your consideration involves the potential purchase of 20 call options. Let's analyze the following scenarios: a) In the context of contemplating the acquisition of 20 call options, visualize the profit and losses at the expiration date of your position, disregarding any transaction costs. Calculate the potential gain if the stock price stands at $20 in six months. Determine the break-even point and assess the potential gain if the stock price rises to $27 in six months. b) Examine the profit and losses for the writer (seller) of the call option. What constitutes the maximum profit for the call writer, and what represents the maximum loss for the call writer? c) Shift attention to a put option for the same stock, sharing the same strike price and maturity, traded on the market at a price of $3. Present the profit and losses at the expiration…arrow_forwardSuppose you think company Y’s share is going to appreciate substantially in value next year. The current share of company Y is $150. One call option of this company’s share expiring in one year is currently available at $15 with an exercise price of $150. With $150,000 to invest, you are considering three investment strategies: a. Invest all $150,000 b. Invest all $150,000 in options c. Buy 5,000 options and invest the remaining amount in treasury bills paying 5% annually What is the value of your portfolio and your rate of return for each strategy for the following share prices one year from now? Summarise your results in a table and draw a graph showing return for each alternative (Hint: show return on Y axis and share price on X axis). Share prices $130, $140, $150, $160 and $170arrow_forward

- ← A 8-month call option contract on 100 shares of Home Depot common stock with a strike price of $50.05 can be purchased for $512. Assuming that the market price of Home Depot stock rises to $65 11 per share by the expiration date of the option, what is the call holder's profit? What is the holding period return? The profit this option would generate over the 8-month holding period is $ (Round to the nearest cent.) Correcarrow_forward$80. The call premium is $6 and the put premium is $8. To keep thìngs simple, you can assume each contract allows the holder to buy or sell 13) You buy one call contract and also buy one put contract, both with the strike price of one (rather than the typical 100) share of the underlying stock. a. Compute the payoff to your option position if the stock price is $92 when the options expire. b. Compute the profit you made if the stock price is $92 when the options еxpire. c. What would happen to the value of your position if the volatility of returns for the underlying stock increases a day after you bought the call and the put? Please explain your answer for full credit. E FC MacBook Pro I A !!!arrow_forwardYou buy 1 put contract with a strike price of $60 on a stock which you own 100 shares. What are the expiration total values for this position (100 stock shares plus 1 put contract) for prices of $50 and $60 if the put premium is $1.80?arrow_forward

- Please show the steps and calculationsarrow_forward6. An investor took a long position on an American style call option on Tesla in June with an expiration date at the end of December in the same year. The premium is 38$/contract and the strike price is 1030$/share. One contract is 100 shares. Following the purchase, the price rose and in August the investor decided to exercise the option before the expiration date. How much did the investor with the short position in this option lose/win if the price of Tesla was in August 1073$/share? Draw the payoff diagram.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education