Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

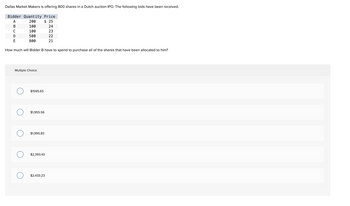

Transcribed Image Text:Dallas Market Makers is offering 800 shares in a Dutch auction IPO. The following bids have been received.

Bidder Quantity Price

A

200

$ 25

100

24

100

23

500

22

800

21

B

C

D

E

How much will Bidder B have to spend to purchase all of the shares that have been allocated to him?

Multiple Choice

O

$1595.65

$1,955.56

$1,995.83

$2,393.43

$2,433.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Jaleel is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Jaleel wishes to protect the value of his investments. He seeks your advice on using option contracts and presents a list of options for you to choose from. Assume the number of underlying shares per contract is 100 shares. Strike Call premium Moneyness Put premium Moneyness $975 $10.01 $0.01 $980 $4.45 $0.04 $985 $0.63 $0.99 $1005 $0.05 $20.48 (i) Please specify the moneyness of the above options. Are they in the money, at the money or out of the money? (ii) Identify what kind of risk that Jaleel is facing and to hedge this risk, which option would you suggest that Jaleel should purchase? Why?arrow_forwardi need the answer quicklyarrow_forwardABC would like to repurchase 50,000 of its ordinary shares. Investor X offered to sell his 20,000 shares at P20 per share. Investor Y offered to sell his 30,000 shares at P21 per share. Lastly, Investor Z offered to sell his 50,000 shares at P22 per share. ABC eventually paid Investors X and Y P21 per share to complete the repurchase. This is a/an *A. Fixed price tender offerB. Dutch auction self-tender repurchaseC. Open market operationD. Selective buy-backarrow_forward

- Hassinah, Incorporated, is proposing a rights offering. Presently, there are 800,000 shares outstanding at $48 each. There will be 160,000 new shares offered at $40 each. a. What is the new market value of the company? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. How many rights are associated with one of the new shares? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. What is the ex-rights price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the value of a right? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. New market value b. Number of rights needed c. Ex-rights price d. Value of a rightarrow_forwardOne year ago you entered a margin trade involving 200 shares of stock at a price of £35 a share and an initial margin of 60%. Now you sell the stock for £32 a share. What is the initial Dollar margin that you need for the trade? Group of answer choices 8400 3840 4200 2800arrow_forwardProblem 2. You open a 1000 share short position in Happy Bunny Inc. common stock at the bid-ask price spread of $32.00 - $32.50. When you close your position the bid-ask prices are $30.25 – $30.50. Happy Bunny Inc. common stock paid a cash dividend in the amoount of $0.20 per share while you held the short position. If you pay a commission of $10 per trade, and interest rates are zero, calculate your profit or loss on the investment position?arrow_forward

- Consider company Macrosoft, whose current stock price is 542. The board of directors of Macrosoft has decided to engage a spin-off. Each shareholder of Macrosoft will receive 3.50232 shares of Coco Colo, whose stock price is 8.34, for each share of Macrosoft owned. Consider an investor who currently owns 152 shares of Macrosoft. What is the amount of cash that this investor will receive after that spin-off? A) 4436.88 B) 2.941 C) 4439.821 D) 636.781arrow_forwardHaving heard about IPO underpricing, I put in an order to my broker for 1, 120 shares of every IPO he can get for me. After 3 months, my investment record is as follows: IPO Shares Allocated to Me Price per Share Initial Return A 620 $ 10 6 % В 320 20 14 C 1, 1208-3D0 12 23 a. What is the average underpricing in dollars of this sample of IPOs? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What is the average initial return on my "portfolio" of shares purchased from the four IPOs that I bid on? When calculating this average initial return, remember to weight by the amount of money invested in each issue.arrow_forwardYou submitted an 1OC (immediate-or-cancel), buy order for 200 shares at a limit price of $30 per share. Currently there is a sell limit order for 160 shares at $30 per share in the trading system. How many of your shares will get filled: O A. 40 O B. 160 O C. Zero, order will be cancelledarrow_forward

- The bids and bidders in a Dutch auction to sell 20,000 shares are as follows: At what price are the shares sold? How many shares does each bidder get?arrow_forwardYou would like to sell 220 shares of Echo Global Logistics, Inc. (ECHO). The current ask and bid quotes are $15.44 and $15.39, respectively. You place a limit sell order at $15.43.If the trade executes, how much money do you receive from the buyer?arrow_forwardJohn wants to invest in shares and is trying to decide between two companies(Company A and Company B) in the same industry. After doing his research henotes the following about the two companies:Measure Company A Company BShare Price $10 $15Earnings Per Share $1 $1Dividend $0.50 $1PE Ratio 10 15Dividend Yield 5% 7% Having critically examined the five measures, John decided to purchase 1.5mshares in Company B. At the time when John purchased the shares, the value ofthe equity shares was $3m and the par value was $0.40.Required:a. Explain how each of the measures identified by John could help him in decidingon which company’s shares to buy.b. How did the stock market help John to purchase the shares in Company Bc. Calculate John’s shareholding in Company B and the cost on his investment?d.. What are the benefits John obtains by being a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education