Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

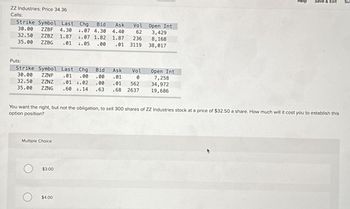

Transcribed Image Text:ZZ Industries: Price 34.36

Calls:

Strike Symbol Last Chg Bid

Ask Vol

30.00 ZZBF 4.30 1.07 4.30 4.40 62

32.50 ZZBZ 1.87 1.07 1.82 1.87 236

35.00

ZZBG .01 1.05 .00 .01

3119

Puts:

Strike Symbol Last Chg Bid Ask

30.00 ZZNF

32.50 ZZNZ

.01 .00 .00

.01 1.02 .00

35.00 ZZNG .60 1.14

.63

Multiple Choice

$3.00

Vol

0

$4.00

.01

.01

.68 2637

562

Open Int

3,429

8,168

38,017

You want the right, but not the obligation, to sell 300 shares of ZZ Industries stock at a price of $32.50 a share. How much will it cost you to establish this

option position?

Open Int

7,258

34,972

19,686

Help Save & Exit Su

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Bullish price spread: Short the high exercise price call and long the low exercise price call IBM Call Expiration July Strike Last 90 13.44 July 95 9.8 July 100 7.35 1 contract for each Stock price/share 80 87.5 90 92.5 96.06 100 105 107.35 110 115 120 Call premium (Long low) Call premium (Short high) Payoff (low) Payoff (high) Profitarrow_forwardUse the following corn futures quotes: Contract Month March May July September Open 455.125 467.000 477.000 475.000 Dollar profit Corn 5,000 bushels Low Settle 452.000 451.750 463.000 463.250 High 457.000 468.000 477.500 472.500 471.750 475.500 473.000 472.250 Change -2.750 -2.750 -2.000 -2.000 Open Interest 597,913 137,547 153,164 29,258 Suppose you buy 18 of the September corn futures contracts at the last price of the day. One month from now, the futures price of this contract is 462.500, and you close out your position. Calculate your dollar profit on this investment. Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forward1. If you had bought the January put with exercise price $105, will you exercise your put? 2. What is the profit (loss) on your position?arrow_forward

- Underlying Microsoft (MSFT) Price: 295.71 Expiration Strike Call Put 1-Oct-2021 290 9.43 3.63 1-Oct-2021 300 3.60 7.82 1-Oct-2021 310 1.08 15.28 17-Dec-2021 290 17.25 11.72 17-Dec-2021 300 11.75 16.25 17-Dec-2021 310 7.62 22.05arrow_forwardCalls Puts Close Hendreeks Strike Price Expiration Vol. Last Vol. Last 103 100 Feb 72 5.20 50 2.40 103 100 Mar 41 8.40 29 4.90 103 100 Apr 16 103 100 Jul 8 10.68 14.30 10 6.60 2 10.10 Suppose you buy 40 July 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $86.40 per share. How much is your options investment worth? What is your net gain? (Do not round intermediate calculations.) Maximum gain Terminal value Net gainarrow_forwardClose Hend reeks 103 103 103 103 Maximum gain Terminal value Net gain Calls Strike Price Expiration Volume Last 5.20 February March 72 41 8.40 April 16 July 8 100 100 100 100 10.68 14.30 Puts Volume Last 50 29 10 2 2.40 4.90 6.60 10.10 Suppose you buy 30 March 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $84.60 per share. How much is your options investment worth? What is your net gain? Note: Do not round intermediate calculations.arrow_forward

- Straddle problem Given a stock with a current strike price of $25 and the following information; Write 1 ABC September 25 Calls @ 1Write 1 ABC September 25 puts @ 3 What is the total premium paid? (assume 1 contract = 100 shares) What is the maximum investor return? What is the maximum investor loss? Why do investors use straddles? If an investor buys a derivative position, are they long or short?arrow_forwardam. 140.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education