Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

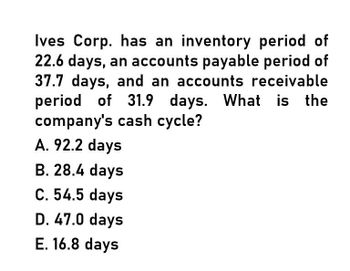

Give company's cash cycle

Transcribed Image Text:Ives Corp. has an inventory period of

22.6 days, an accounts payable period of

37.7 days, and an accounts receivable

period of 31.9 days. What is the

company's cash cycle?

A. 92.2 days

B. 28.4 days

C. 54.5 days

D. 47.0 days

E. 16.8 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Whalen Company had net sales of 125,500,250,000. Whalen had the following balances: Required: Note: Round answers to two decimal places. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardMontalcino Company had net sales of 54,000,000. Montalcino had the following balances: Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardIf the average age of the inventory is 90 days, the average age of accountspayable is 60 days, and the average age of accounts receivables is 65 days, the number of days in the cash flow cycle isa. 95 daysb. 125 daysc. 215 daysd. 85 daysarrow_forward

- Ives Corporation has an inventory period of 21.5 days, an accounts payable period of 31.4 days, and an accounts receivable period of 28.7 days. What is the company's cash cycle?Question 4 options:18.8 days24.2 days81.6 days50.2 days38.6 daysarrow_forwardABC Inc. has the following data. What is the firm's cash (conversion) cycle? Inventory Conversion Period = 38 days Receivables Collection Period = 19 days Payables Deferral Period = 26 daysarrow_forwardGeneral Accountingarrow_forward

- MCQarrow_forwardCash Cycle?arrow_forwardConsidering the financial statement information below for the The C’mon Cam! Co., how long is the cash cycle? Item Beginning EndingInventory $9,338 $11,550Accounts Receivable 5,670 6,947Accounts Payable 7,689 9,625 Net Sales $82,544Cost of Goods Sold $58,638 a. 28 daysb. 39 daysc. 65 daysd. 93 daysarrow_forward

- Twin peaks cash conversion cycle is how many days? General accountingarrow_forwardеВook Zane Corporation has an inventory conversion period of 90 days, an average collection period of 34 days, and a payables deferral period of 48 days. Assume 365 days in year for your calculations. a. What is the length of the cash conversion cycle? Round your answer to two decimal places. days b. If Zane's annual sales are $3,454,540 and all sales are on credit, what is the investment in accounts receivable? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. How many times per year does Zane turn over its inventory? Assume that the cost of goods sold is 75% of sales. Use sales in the numerator to calculate the turnover ratio. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardIf the average age of inventory is 90 days, the average age of accounts payable is 60 days, and the average age of accounts receivable is 65 days, the number of days in the cash flow cycle is__ days. Right Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning