Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

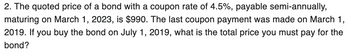

Transcribed Image Text:2. The quoted price of a bond with a coupon rate of 4.5%, payable semi-annually,

maturing on March 1, 2023, is $990. The last coupon payment was made on March 1,

2019. If you buy the bond on July 1, 2019, what is the total price you must pay for the

bond?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- It is now January 1, 2018, and you are considering the purchase of an outstanding bond that was issued on January 1, 2016. It has a 9% annual coupon and had a 20-year original maturity. (It matures on December 31, 2035.) There is 5 years of call protection (until December 31, 2020), after which time it can be called at 109-that is, at 109% of par, or $1,090. Interest rates have declined since it was issued, and it is now selling at 114.12% of par, or $1,141.20. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. %What is the yield to call? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardCommonstealth Bank issued a bond that pays a 7.20% coupon quarterly and matures at the end of September 2036. If the current market rate for similar bonds is 6.50%, what is the bond price at the end of October 2021? Show your workings and round your final answers to two decimal places.arrow_forwardWhat is the calculated quoted futures price for a September 2022 Treasury bond futures contract given that the date is July 30, 2022? The associated bond is a 13% coupon bond set for delivery on September 30, 2022. The bond makes coupon payments twice a year, specifically on February 4 and August 4. The interest rate, compounded semiannually, is a steady 12% annually. The bond's conversion factor is 1.5, and the current quoted price for the bond stands at $110.arrow_forward

- You bought a newly issued 10-year, $1,000 par value, 5.50% coupon bond (with semiannual coupon payments) on May 1, 2023. You decided to check the value and yields on the bond annually, so that you can keep track of your wealth. Your first check was to be done on May 1, 2024. On April 15, 2024, the yield to maturity for the bond changed to 5.20%. For your two year anniversary of owning the bond (May 1, 2025), calculate the bond's total yield for the second year of ownershiparrow_forwardIt is now January 1, 2021, and you are considering the purchase of an outstanding bond that was issued on January 1, 2019. It has a 9.5% annual coupon and had a 20-year original maturity. (It matures on December 31, 2038.) There is 5 years of call protection (until December 31, 2023), after which time it can be called at 108—that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 120.08% of par, or $1,200.80. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. _____ % What is the yield to call? Do not round intermediate calculations. Round your answer to two decimal places. ____ %arrow_forwardA bond that settles on June 7, 2019, matures on July 1, 2039, and may be called at any time after July 1, 2029, at a price of 156. The coupon rate on the bond is 7.2 percent and the price is 169.00. What are the yield to maturity and yield to call on this bond? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Yield to maturity Yield to call % %arrow_forward

- It is now January 1, 2021, and you are considering the purchase of an outstanding bond that was issued on January 1, 2019. It has a 9% annual coupon and had a 20-year original maturity. (It matures on December 31, 2038.) There is 5 years of call protection (until December 31, 2023), after which time it can be called at 108—that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 114.12% of par, or $1,141.20. What is the yield to maturity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the yield to call? Do not round intermediate calculations. Round your answer to two decimal places. % If you bought this bond, which return would you actually earn? Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. Investors would not…arrow_forwardLoïc is planning to purchase a Treasury bond paying a (j2) coupon rate of 4.94% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loïc purchased this bond on 8 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 9.32% p.a., compounded half-yearly. Loïc needs to pay 11.1% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year.arrow_forwardToday is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 1.8% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j2 = 11.9% p.a. Assume that this corporate bond has a 5% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer to three decimal places. O a. O b. $79.790 O c. $61.241 O d. $55.718 a. $78.509arrow_forward

- You bought a newly issued 10-year, $1,000 par value, 5.50% coupon bond (with semiannual coupon payments) on May 1, 2023. You decided to check the value and yields on the bond annually, so that you can keep track of your wealth. Your first check was to be done on May 1, 2024. On April 15, 2024, the yield to maturity for the bond changed to 5.20%. For your one year anniversary of owning the bond, calculate the bond's total yield for the first year of ownership. Report the percentage to two decimal places (3.126% = 3.13).arrow_forward9arrow_forwardIt is now January 1, 2021, and you are considering the purchase of an outstanding bond that was issued on January 1, 2019. It has an 8.5% annual coupon and had a 15-year original maturity. (It matures on December 31, 2033.) There is 5 years of call protection (until December 31, 2023), after which time it can be called at 108-that is, at 108 % of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 111.55% of par, or $1,115.50. a. What is the yield to maturity? Do not round Intermediate calculations. Round your answer to two decimal places. What is the yield to call? Do not round Intermediate calculations. Round your answer to two decimal places. % b. If you bought this bond, which return would you actually earn? I. Investors would expect the bonds to be called and earn the YTC because the YTC is less than the YTM. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. III. Investors would not…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education