Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

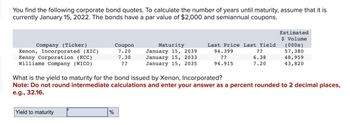

Transcribed Image Text:You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is

currently January 15, 2022. The bonds have a par value of $2,000 and semiannual coupons.

Company (Ticker)

Xenon, Incorporated (XIC)

Kenny Corporation (KCC)

Williams Company (WICO)

Yield to maturity

Coupon

7.20

7.30

??

%

Maturity

January 15, 2039

January 15, 2033

January 15, 2035

Last Price Last Yield

??

6.38

7.20

94.399

??

94.915

What is the yield to maturity for the bond issued by Xenon, Incorporated?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places,

e.g., 32.16.

Estimated

$ Volume

(000s)

57,380

48,959

43,820

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investor sold a bond issued by PQR Corporation with nominal yield of 2% and maturity of June 30, 2027 on June 30, 2020. If the yield on US Treasury Bonds was 1.5210% and the spread for PQR was 200 basis points, the trading price was ? (round to two decimal points).arrow_forwardAssume today is November 1, 2023 and that all bonds pay interest semi-annually with a face value of $1,000. YTM = Current yield + Capital Gains yield; CY = Annual Interest/Current Price Apple is AA rated; AAA Treasuries yield 3-year is 5.25%, 10-year 5.50% 2 Years ago, Apple issued 3.0% coupon paying bonds with a face value of $1000 set to mature on November 1, 2033. The bonds are callable in 1 year at 1050. Concerns over higher inflation have pushed interest rates higher globally. Calculate the yield to call.arrow_forwardplease answer urgent!!!arrow_forward

- Company I issues a $40,000,000 bond on January 1, 2020 with a coupon rate of 7%. The present value of the bond is $37,282,062 and the market rate of interest was 8%. The bond has a 10-year life and will make semiannual interest payments and will use the straight line amortization method. A) Is the bond issued at a face value, a discount, or premium? B) What is the amount of the semi-annual interest payments? C) What is the amount that will be recorded to interest expense each time an interest payment is made? D) What is the carrying value of the bond on December 31, 2021?arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardi need the answer quicklyarrow_forward

- IS - Sampoerna. O Dashboard VitalSource Booksh. O Spotify - Web Player Company XYZ's bonds have 12 years remaining to maturity, interest is paid annually, the bonds have $1,000 par value, and the coupon rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds?* a. 828.78 b. 968.39 c. 1,000,00 d. 1,075.36 O e. none of the above Which of the following statement is (are) correct? a zero coupon bend means the bond does not give (pay) coupon until maturity O b. the price of zero coupon bond is always at discount until its maturity O c. the price of bond will be at discount when the coupon is lower than its interest ra da and b e. a, b and carrow_forwardMansukhbhaiarrow_forwardFinancearrow_forward

- You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2022. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Xenon, Incorporated (XIC) Kenny Corporation (KCC) Williams Company (WICO) Coupon rate Coupon 7.000 7.280 ?? % Maturity January 15, 2041 January 15, 2035 January 15, 2037 Last Price Last Yield 94.375 ?? 94.895 ?? 6.34 7.16 Estimated $ Volume (000s) 57,378 What is the coupon rate for the Williams Company bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 48,957 43,818arrow_forwardOn January 31, 2022 you purchased a newly issued 5.6% coupon bond issued by the Dana Corporation for $1,023.56. The bond is noncallable and matures January 31, 2048. You decide to sell the bond April 30, 2023 when the bond’s yield to maturity was 4.82 percent. Based on a 30/360 day-count method, how much will you receive from the sale of the bond (including accrued interest)? Consider the December 31, 2022 and 2021 balance sheet for the Jasper Company and the income statement for the year ended December 31, 2022: JASPER COMPANY Balance Sheets as of December 31, 2022 and 2021 Assets 2022 2021 Cash $ 405 $310 Accounts receivable 3,055 2,640 Inventory 3,850 3,275 Property, plant, and equipment (net) 10,670 10,960 Total $17,980 $17,185 Liabilities and Stockholder’s Equity 2022 2021 Accounts payable $ 2,570 $ 2,720 Current portion of long-term debt payable 0 100…arrow_forwardTo calculate the number of years until maturity, assume that it is currently January 15, 2022. All of the bonds have a $2,000 par value and pay semiannual coupons. Estimated $ Volume Company (Ticker). Coupon Xenon, Incorporated (XIC) 5.400 Maturity January 15, 2034 Kenny Corporation (KCC) 4.125 Williams Company (WICO) ??? January 15, 2029 January 15, 2031 Last Price 92.685 ?? Last Yield (000s) PP 57,362 3.84 48,941 104.310 4.12 43,802 a. What price would you expect to pay for the Kenny Corporation bond? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What is the bond's current yield? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Price b. Current yield %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education