International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

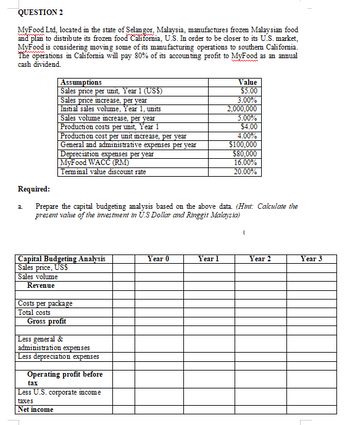

Transcribed Image Text:QUESTION 2

MyFood Ltd, located in the state of Selangor, Malaysia, manufactures frozen Malaysian food

and plan to distribute its frozen food California, U.S. In order to be closer to its U.S. market,

MyFood is considering moving some of its manufacturing operations to southern California.

The operations in California will pay 80% of its accounting profit to MyFood as an annual

cash dividend.

Assumptions

Sales price per unit, Year 1 (USS)

Sales price increase, per year

Initial sales volume, Year 1, units

Sales volume increase, per year

Production costs per unit, Year 1

General and administrative expenses per year

Production cost per unit increase, per year

Depreciation expenses per year

Terminal value discount rate

MyFood WACC (RM)

Value

$5.00

3.00%

2,000,000

5.00%

$4.00

4.00%

$100,000

$80,000

16.00%

20.00%

Required:

а.

Prepare the capital budgeting analysis based on the above data. (Hint: Calculate the

present value of the investment in US Dollar and Ringgit Malaysia)

Capital Budgeting Analysis

Year 0

Year 1

Year 2

Year 3

Sales price, USS

Sales volume

Revenue

Costs per package

Total costs

Gross profit

Less general &

administration expenses

Less depreciation expenses

Operating profit before

tax

Less U.S. corporate income

taxes

Net income

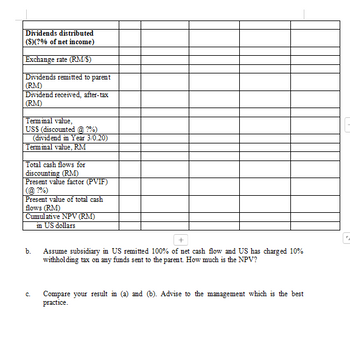

Transcribed Image Text:Dividends distributed

(S)(?% of net income)

Exchange rate (RM/S)

Dividends remitted to parent

(RM)

Dividend received, after-tax

(RM)

Terminal value,

US$ (discounted @?%)

(dividend in Year 3/0.20)

Terminal value, RM

Total cash flows for

discounting (RM)

Present value factor (PVIF)

(@?%)

Present value of total cash

flows (RM)

Cumulative NPV (RM)

in US dollars

b.

+

Assume subsidiary in US remitted 100% of net cash flow and US has charged 10%

withholding tax on any funds sent to the parent. How much is the NPV?

C. Compare your result in (a) and (b). Advise to the management which is the best

practice.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute the increase or decrease in net incomearrow_forwardGlobal Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forwardCalifornia orange Grove produces solve this general accounting questionarrow_forward

- Assume the U.S. corporate income tax rate is 40 percentand the Mexican corporate income tax rate is 30 percent.Jacques International Apparel Company has subsidiaries inboth the U.S. and Mexico. Jacques is trying to decide whattransfer price to use for its famous French frock, whichis being transferred from the U.S. subsidiary to theMexican subsidiary. It could ship the frock at the marketprice of $75 or at cost plus 20 percent. The cost of the frockis $40. Which transfer price would minimize Jacques’s taxburden?a. $75.b. $48.c. $90.d. $75 $40 $35.arrow_forwardCurrent Attempt in Progress Your answer is partially correct. Cullumber Company incurs a cost of $35 per unit, of which $19 is variable, to make a product that normally sells for $58. A foreign wholesaler offers to buy 5,600 units at $30 each. Cullumber will incur additional costs of $1 per unit to imprint a logo and to pay for shipping. Compute the increase or decrease in net income Cullumber will realize by accepting the special order, assuming Cullumber has sufficient excess operating capacity. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Costs $ Net income $ Reject $ $ Should Cullumber Company accept the special order? Cullumber company should accept V the special order. Accept 168000 112000 i 56000 $ $ Net Income Increase (Decrease) 168000 112000 56000arrow_forwardDo fast answer of this accounting questionsarrow_forward

- Question 3:salalah Company's financial information is given in the table below. Year 2020 Sales (OMR) Fixed Costs 445000 Variable Costs: 105000 245000 2021 500000 150000 280000 You are required to calculate the following values for each year. The years are independent of each other. a) P/V ratio, b) В.Е.Р. c) Sales required to earn a profit of OMR 45000. d) Margin of safety at a profit of OMR 50000 e) Profit when sales are OMR. 300000.arrow_forwardQuestion Content Area Airflow Company sells a product in a competitive marketplace. Market analysis indicates that the product would probably sell at $28.00 per unit. Airflow management desires a profit equal to a 20% rate of return on invested assets of $1,400,000. Airflow anticipates selling 50,000 units. The current full cost per unit for the product is $25.00 per unit. Round your answer to two decimal places, if necessary. a. What is the amount of profit per unit?$fill in the blank 1 per unit b. What is the target cost per unit if Airflow meets the market dictated price and management's desired profit?$fill in the blank 2 per unitarrow_forwardQuestion 3: Oman Company's financial information is given in the table below. Year Sales (OMR) Fixed Costs 445000 Variable Costs : 2020 105000 245000 2021 500000 150000 280000 You are required to calculate the following values for each year. The years are independent of each other. a) P/V ratio, b) В.Е.P. c) Sales required to earn a profit of OMR 45000. d) Margin of safety at a profit of OMR 50000 e) Profit when sales are OMR. 300000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub