ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

e) The crude oil market can be described as a Nash-Cournot market, in which Saudi Arabia acts as Stackelberg leader. Do you agree with this statement?

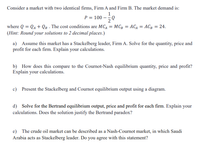

Transcribed Image Text:Consider a market with two identical firms, Firm A and Firm B. The market demand is:

1

P = 100

where Q = Qa + QB . The cost conditions are MCA = MC; = AC4 = ACg = 24.

(Hint: Round your solutions to 2 decimal places.)

a) Assume this market has a Stackelberg leader, Firm A. Solve for the quantity, price and

profit for each firm. Explain your calculations.

b) How does this compare to the Cournot-Nash equilibrium quantity, price and profit?

Explain your calculations.

c) Present the Stackelberg and Cournot equilibrium output using a diagram.

d) Solve for the Bertrand equilibrium output, price and profit for each firm. Explain your

calculations. Does the solution justify the Bertrand paradox?

e) The crude oil market can be described as a Nash-Cournot market, in which Saudi

Arabia acts as Stackelberg leader. Do you agree with this statement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Which one of the following statements about the (modified) Stackleberg model is incorrect? A. Firm 1's move is a strategic move. B. Firm 2's move is a strategic move. C. It is can be solved by backward induction. D. It is a dynamic game.arrow_forwardAt a busy intersection on Route 309 in Quakertown, Pennsylvania, the convenience store and gasoline station, Wawa, competes with the service and gasoline station, Fred's Sunoco. In the Nash-Bertrand equilibrium with product differentiation competition for gasoline sales, the demand for Wawa's gas is qw=740-400pw + 400ps and the demand for Fred's gas is as = 740-400ps + 400pw. Assume that the marginal cost of each gallon of gasoline is m = $6. The gasoline retailers simultaneously set their prices. What is the Bertrand-Nash equilibrium? The Bertrand-Nash equilibrium is where pw = $ 7.85 and Ps =$7.85. (Enter your responses rounded to two decimal places.) Suppose that for each gallon of gasoline sold, Wawa earns a profit of $1.00 from its sale of salty snacks to its gasoline customers. Fred sells no products that are related to the consumption of his gasoline. What is the Nash equilibrium? The Bertrand-Nash equilibrium is where Pw = $ and Ps = $ (Enter your responses rounded to…arrow_forwardA Prisoner's Dilemma occurs in military disputes when two countries use valuable resources to harm each other. True O Falsearrow_forward

- Time remaining: 00:09:51 Economics The market demand function is Q=10,000-1,000p. Each firm has a marginal cost of m=$0.16. Firm 1, the leader, acts before Firm 2, the follower. Solve for the Stackelberg-Nash equilibrium quantities, prices, and profits. Compare your solution to the Cournot-Nash equilibrium. The Stackelberg-Nash equilibrium quantities are: q1=___________ units and q2=____________units The Stackelberg-Nash equilibrium price is: p=$_____________ Profits for the firms are profit1=$_______________ and profit2=$_______________ The Cournot-Nash equilibrium quantities are: q1=______________units and q2=______________units The Cournot-Nash equilibrium price is: p=$______________ Profits for the firms are profit1=$_____________ and profit2=$_______________arrow_forwardWhy does Manuel Velasquez think that multinational corporations are in a situation akin to a prisoner’s dilemma?arrow_forwardQUESTION 4 Consider the decision tree below. This tree illustrates hypothetical payoffs to General Mills (GM) and Quaker Oats (Q) if they engage in a price war. GM Cut price No price cut Cut price No price cut GM₁ = $3 million/year Q = $3 million/year GM = $10 million/year Q = $2 million/year GM = $5 million/year Q = $5 million/year If GM cuts prices, the greatest potential gain is: a. $5 million per year b. $10 million per year c. $2 million per year Od. $3 million per year e. none of the abovearrow_forward

- QUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forwardAnswer to the image?arrow_forwardUsing the Surplus Approach, describe how tendencies for concentration emerge from the regular functioning of competition between capitalist firms.arrow_forward

- I have attracted a picture of my question because I don't know how to insert a table, if possible, can you please answer the question in typing because I fell hard to understand hand written works, thanksarrow_forwardThere are two oil producers, Saudi Arabia and Iran (these are countries which we are treating as players in this example). The market price will be $60/barrel if the total volume of sales is 9 million barrels daily, $50 if the total volume of sales is 11 million barrels daily, and $35 if the total volume of sales is 13 million barrels daily. Saudi Arabia has two strategies; either produce 8 million barrels daily or 6 million. Iran has two strategies; either produce 3 million barrels daily or 5 million. Assume for simplicity that marginal cost of production is zero for both countries. Here is the normal form representation of this game (where Saudi Arabia and Iran are players, they can choose strategies over what quantity to produce and they face payoffs in terms of profits). Note that the following paragraph is simply an explanation of this representation of the game. If you are already comfortable with the structure, feel free to skip to the questions below the horizontal line…arrow_forward5. Given that excess demands are continuous and satisfy Walras' law, use Brouwer's Fixed Point Theorem to establish the existence of competitive equilibrium in a simple exchange economy. Suppose that an apple orchard is located next to a bee keeper. If the orchard produces x apples and the bee keeper produces y honey and the cost functions of the two are as follows: C(x) = x² + 10x +9 C(y) = y² - 8x What will be the socially optimal amount of apples that can be produced? How does this compare to privately optimal amount?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education