FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

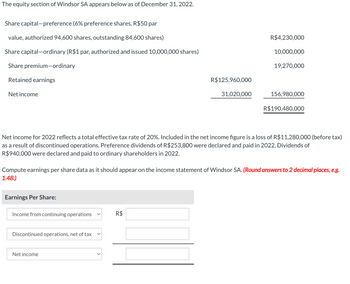

Transcribed Image Text:The equity section of Windsor SA appears below as of December 31, 2022.

Share capital-preference (6% preference shares, R$50 par

value, authorized 94,600 shares, outstanding 84,600 shares)

Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares)

Share premium-ordinary

Retained earnings

Net income

Earnings Per Share:

Income from continuing operations

Discontinued operations, net of tax

R$125,960,000

Net income

31,020,000

R$

R$4,230,000

Net income for 2022 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of R$11,280,000 (before tax)

as a result of discontinued operations. Preference dividends of R$253,800 were declared and paid in 2022. Dividends of

R$ 940,000 were declared and paid to ordinary shareholders in 2022.

10,000,000

Compute earnings per share data as it should appear on the income statement of Windsor SA. (Round answers to 2 decimal places, e.g.

1.48.)

19,270,000

156,980,000

R$190,480,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Required: 1. Complete the following columns for each item in the comparative financial statements (Negative answers shoul be indicated by a minus sign. Round percentage answers to 2 decimal places, i.e., 0.1243 should be entered as 12.43.): Increase (Decrease) Year 2 over Year 1 Amount Percentage Statement of earnings: Sales revenue Cost of sales Gross margin Operating expenses and interest expense Earnings before income taxes Income tax expense Net earnings $ 45,770 38,650 7,120 4,020 3,100 1,050 $ 2,050 Statement of financial position: Cash (4,720) Accounts receivable (net) (4,220) Inventory 6,200 Property, plant, and equipment (net) 6,380 $ 3,640 Current liabilities (3,840) Long-term debt 3,530 Common shares 0 Retained earnings 3,950 $ 3,640arrow_forwardIndicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. Federal income tax due for the previous year is paid.arrow_forwardVertical Analysis of Income Statement Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Previous Year Sales Cost of goods sold Selling expenses Administrative expenses Income tax expense Current Year $447,000 272,670 71,520 71,520 13,410 $384,000 215,040 69,120 57,600 15,360arrow_forward

- Selected data for a segment of a business enterprise are to be reported separately when the revenue ofthe segment exceeds 10% of the ____________________________________________________.A. Combined net income of all segments reporting profitsB. Total revenue obtained in transactions with outsidersC. Total revenue of all the enterprise’s segmentsD. Total combined revenue of all segments reporting profitsarrow_forwardExpress the following comparative income statements in common-size percents. C esponsible for the decline in net income? Complete this question by entering your answers in the tabs below. Income Statement Reason for Decline in Net Income Express the following comparative income statements in common-size percents. Note: Round your percentage answers to 1 decimal place. Sales Cost of goods sold Gross profit Operating expenses Net Income GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year % 100.0 Current Year S $ $ 740,000 568,100 171,900 128,000 43,900 Prior Year $ $ $ 690,000 291,000 399,000 226,400 172,600 Prior Year % Reason for Decline in Not Ingarrow_forwardReturn on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $661,910Interest expense 116,810Average total assets 6,280,000Determine the return on total assets. If required, round the answer to one decimal place.fill in the blank 1 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education